Cool graphic (note this is the 1st 10%): > click for ginormous graphic Via instamerchant

Cool graphic (note this is the 1st 10%): > click for ginormous graphic Via instamerchant

Some Thoughts About the Oil Price?

Some Thoughts About the Oil Price? March 28, 2011 David Kotok http://www.cumber.com > The TV is crammed with industry folks and...

QOTD: As QE II Wraps Up . . .

WJB Technical Analyst John Roque channels his inner imp to deliver these delightfully sarcastic bon mots: “Won’t it be cool if...

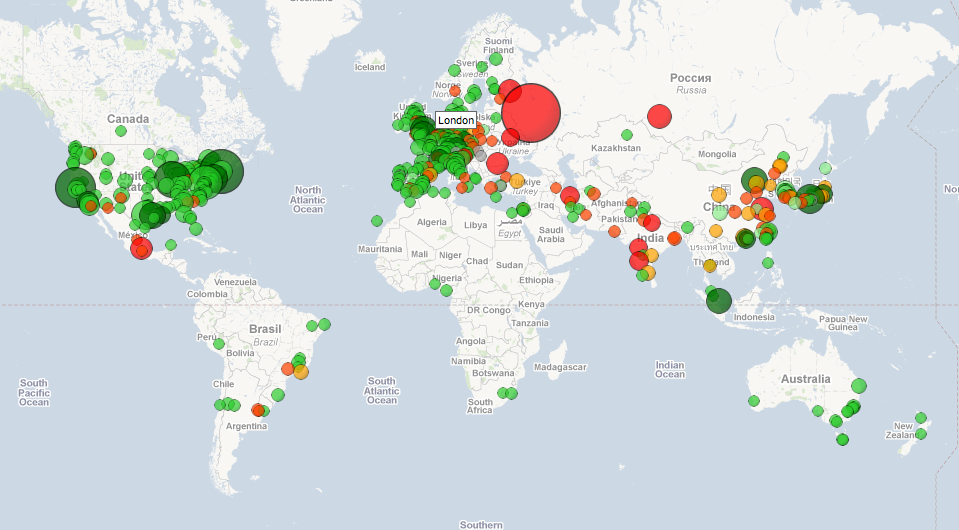

Science: Rising in China, Crashing in Russia

Walter Derzko of Smart Economy gives us the heads up on this interesting map, showing citations in Chemistry papers (below). Thanks to...

Walter Derzko of Smart Economy gives us the heads up on this interesting map, showing citations in Chemistry papers (below). Thanks to...

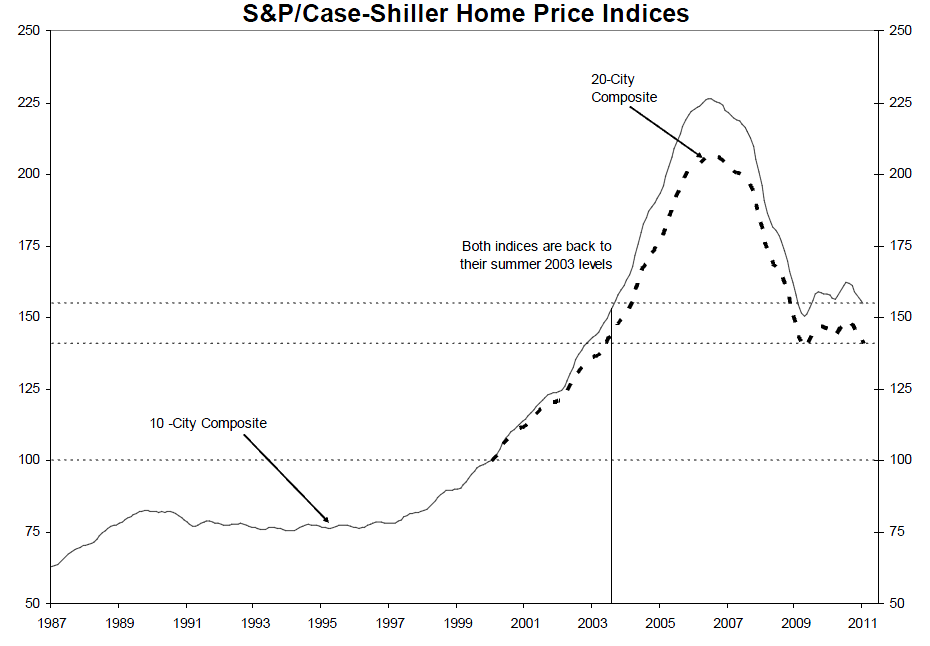

Case Shiller: Dismal Start to Home Prices

Excellent news: Despite the best efforts of misguided government policies (tax credits, mortgage mods, foreclosure abatements) and the...

Excellent news: Despite the best efforts of misguided government policies (tax credits, mortgage mods, foreclosure abatements) and the...

Fukushima Nuclear Accident Radiological Consequences (3.28.11)

Radiological Consequences of the Fukushima Nuclear Accident – 28 March 2011 View more presentations from IAEA

The End of QE2

Joshua Brown, author of “The Reformed Broker,” says he believes there will be no QE3 and that Bernanke deserves some credit...

Economic data

S&P/CaseShiller said home prices in Jan fell 3.06% y/o/y in the top 20 cities, a touch better than expectations of a fall of 3.2%...

Financial Profits

• Real Time Economics (WSJ Blog) – Like The Phoenix, U.S. Finance Profits Soar Not too long ago, during the depths of the global...

• Real Time Economics (WSJ Blog) – Like The Phoenix, U.S. Finance Profits Soar Not too long ago, during the depths of the global...

Time to quantify

Beginning today with the March Conference Board Consumer Confidence figure (key employment questions included), economic data will start...