Comparing Japan’s Radiation Release to “Background...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

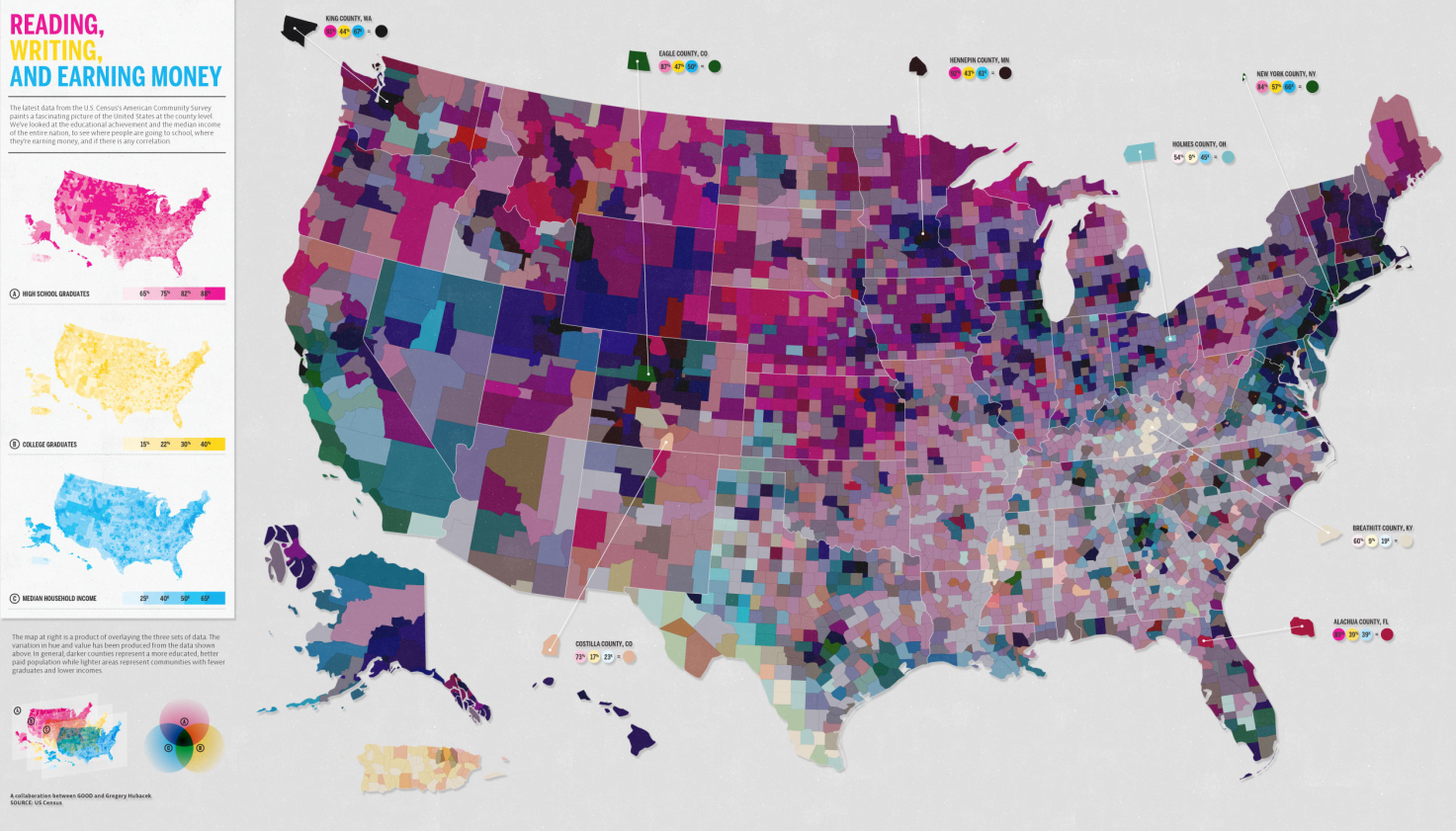

Via Good, comes this graphic looking at the relationship between education and income: > click for larger graphic

Via Good, comes this graphic looking at the relationship between education and income: > click for larger graphic

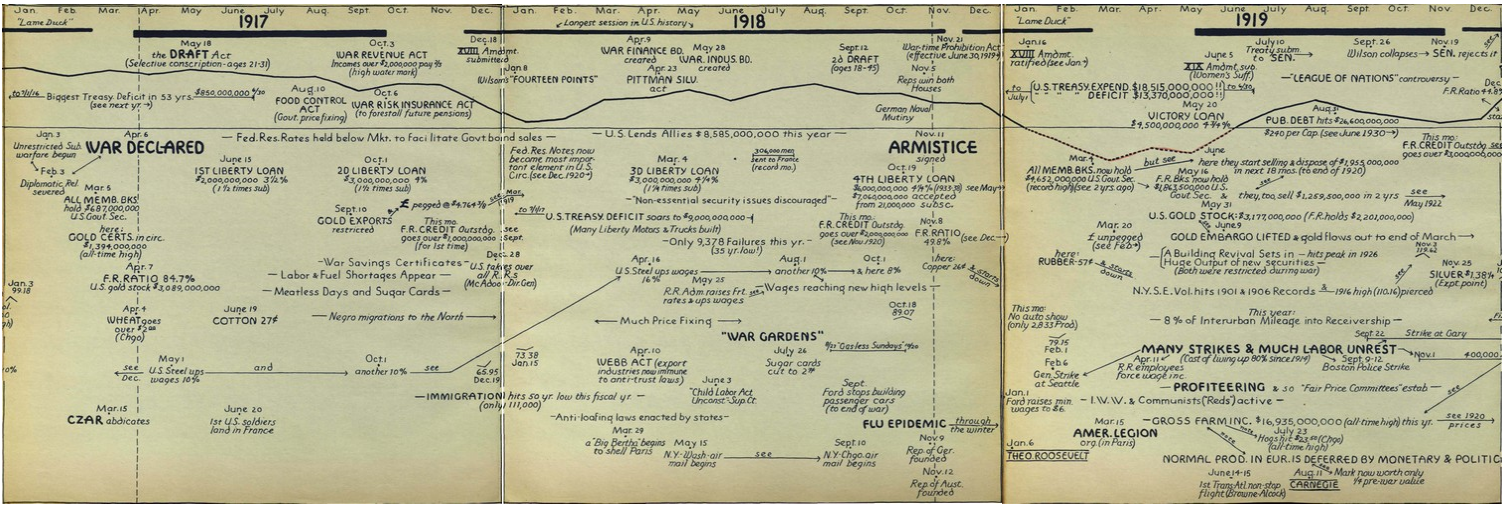

From the St. Louis Fed’s FRASER system, via FT Alphaville, comes this crazy delightful super-big chart porn, showing an enormous...

From the St. Louis Fed’s FRASER system, via FT Alphaville, comes this crazy delightful super-big chart porn, showing an enormous...

Get subscriber-only insights and news delivered by Barry every two weeks.