Hey, I almost forgot these Chart Store specials: >

Hey, I almost forgot these Chart Store specials: >

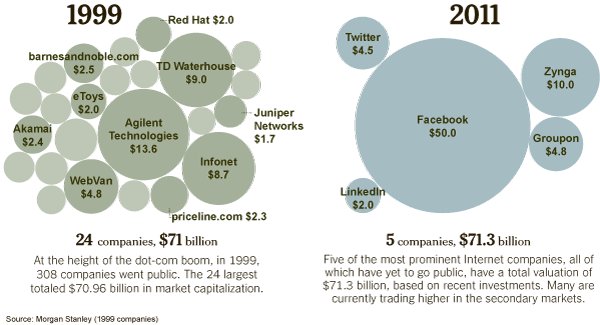

New Tech Bubble?

Cool graphic from tomorrow’s NYT: > > Source: Is It a New Tech Bubble? Let’s See if It Pops EVELYN M. RUSLI and VERNE G....

Cool graphic from tomorrow’s NYT: > > Source: Is It a New Tech Bubble? Let’s See if It Pops EVELYN M. RUSLI and VERNE G....

Bloomberg Game Changers: Twitter

“Bloomberg Game Changers” profiles Twitter co-founders Jack Dorsey, Evan Williams and Biz Stone. This program features...

No, the Amount of Radiation Released from the Japanese Nuclear...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Abelson on “Immunity to Bad News,” Margin Debt

Alan Abelson in this weekend’s Barron’s: “THE BULLS SEEMINGLY HAVE DEVELOPED an immunity to bad news. We’re...

Matt Haughey & Metafilter: Lessons from 11 years of community

This is Matt’s SXSW 2011 talk: Lessons from 11 years of community (my SXSW 2011 talk) from Matt Haughey on Vimeo.

Housing Market Cycle: Much Worse This Time

Floyd Norris gives us the no nonsense take on Housing: Yes, Housing remains moribund; No, this is not getting better any time soon. The...

Floyd Norris gives us the no nonsense take on Housing: Yes, Housing remains moribund; No, this is not getting better any time soon. The...

Unintended Consequences

Unintended Consequences John Mauldin March 24, 2011 > Loose Monetary Policies and Emerging Markets Bubbles in Emerging Markets...

Unintended Consequences John Mauldin March 24, 2011 > Loose Monetary Policies and Emerging Markets Bubbles in Emerging Markets...

Hindenburg Omen? Put a Fork In It.

Here’s the thing about unproven “technical” tools: They are dangerous to your wealth. Recall this article...

Here’s the thing about unproven “technical” tools: They are dangerous to your wealth. Recall this article...

Parrot AR.Drone Quadricopter

How cool is this? The Parrot AR.Drone Quadricopter: An iPhone controlled quadricopter with a camera in its nose! Here’s...

How cool is this? The Parrot AR.Drone Quadricopter: An iPhone controlled quadricopter with a camera in its nose! Here’s...