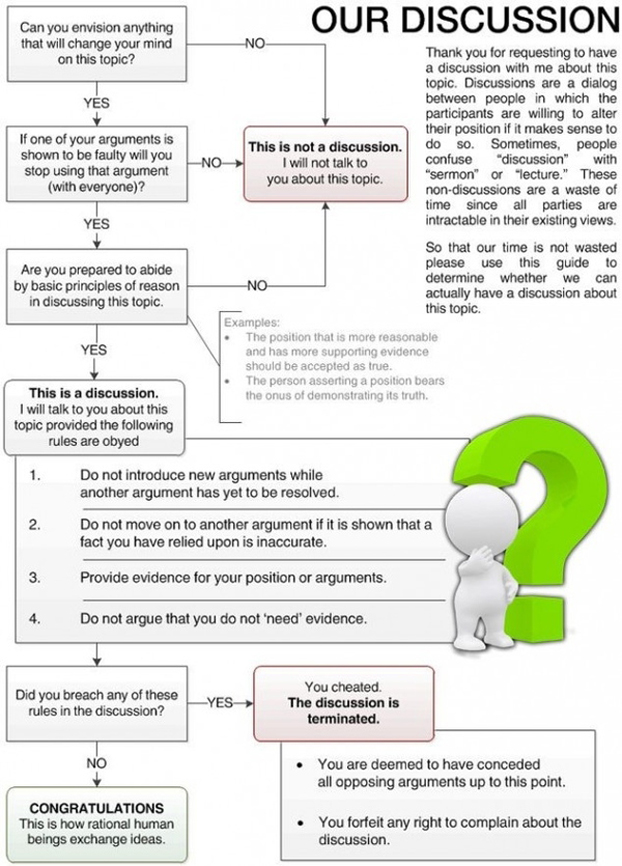

Thought Catalog explains how to have a Rational Discussion: > Hat tip Simolean Sense

Thought Catalog explains how to have a Rational Discussion: > Hat tip Simolean Sense

NYSE = Chad Ridgeway?

Sal Arnuk: Chad Ridgeway is the actual character in the Scottrade commercials, and he makes us laugh almost as hard as “Ghadafi, Martin...

Sal Arnuk: Chad Ridgeway is the actual character in the Scottrade commercials, and he makes us laugh almost as hard as “Ghadafi, Martin...

Earnings the driver, real test though in 2 weeks

Solid earnings from ORCL and ACN are the main drivers of the morning’s market strength. With about two weeks to go before Q1...

Forclosure Fraud Dates to 2006

The spate of Foreclosure Fraud that reared its head in late 2010 dated as far back as 2006, according to an internal Fannie Mae report...

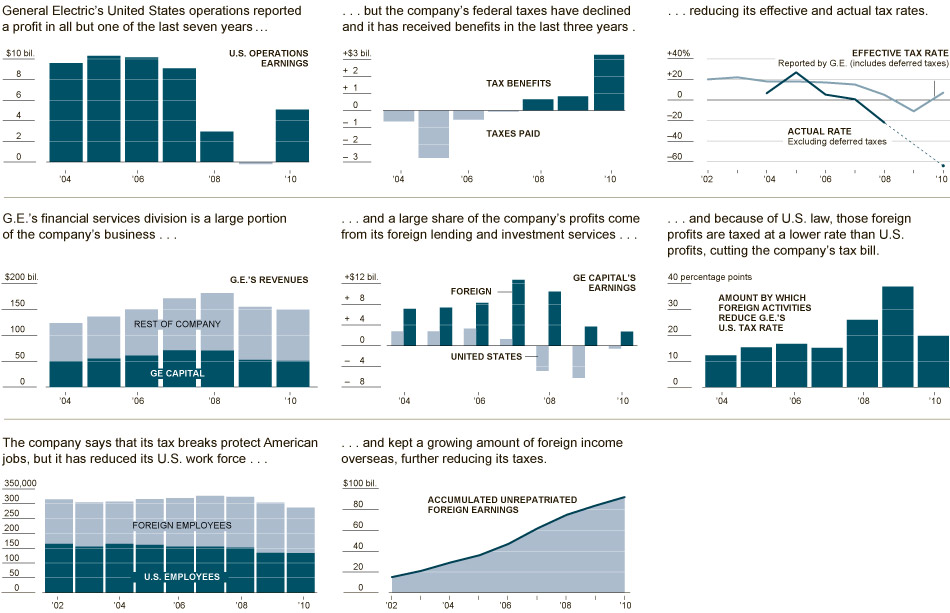

GE: All Profit, No Taxes

Today’s must read article is a NYT piece about the amazing non-profit tax-paying entity known as GE. Yet another reason why you...

Today’s must read article is a NYT piece about the amazing non-profit tax-paying entity known as GE. Yet another reason why you...

Dollar Threat to Prosperity ?

How to save King Dollar, and its impact on oil and food prices, with Steve Forbes, Forbes Media, and David Gilmore, Foreign Exchange...

Thursday Instapaper Reads

Here are some of the more interesting I am reading: • Four States Consider Legislation Barring Distressed Sales as Comparables...

Save the Date: Ben to Hold Regular Pressers

In a move that I think is long overdue, the Fed announced that chairman Ben Bernanke will hold press briefings four times per year:...

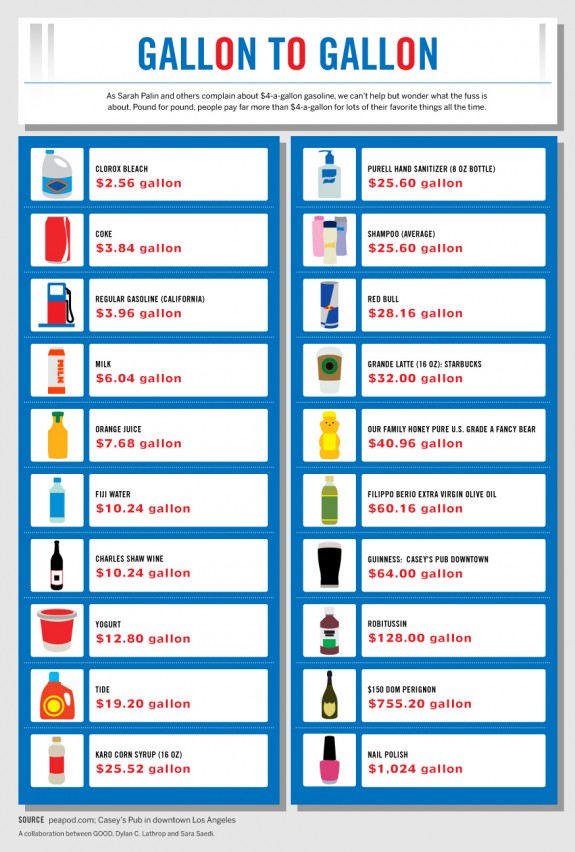

Read it here First: Prices of Gallons

Back in 2005, I posted this table on Cheap Gas vs other items; it contained the following table: > Other “Refined”...

Back in 2005, I posted this table on Cheap Gas vs other items; it contained the following table: > Other “Refined”...

Gold touches record high, nominal vs real gains

On the day gold hits an all time high and with 3 months to go before the Fed ends its latest attempt to help the economy, let’s...