Gold touches record high, nominal vs real gains

On the day gold hits an all time high and with 3 months to go before the Fed ends its latest attempt to help the economy, let’s...

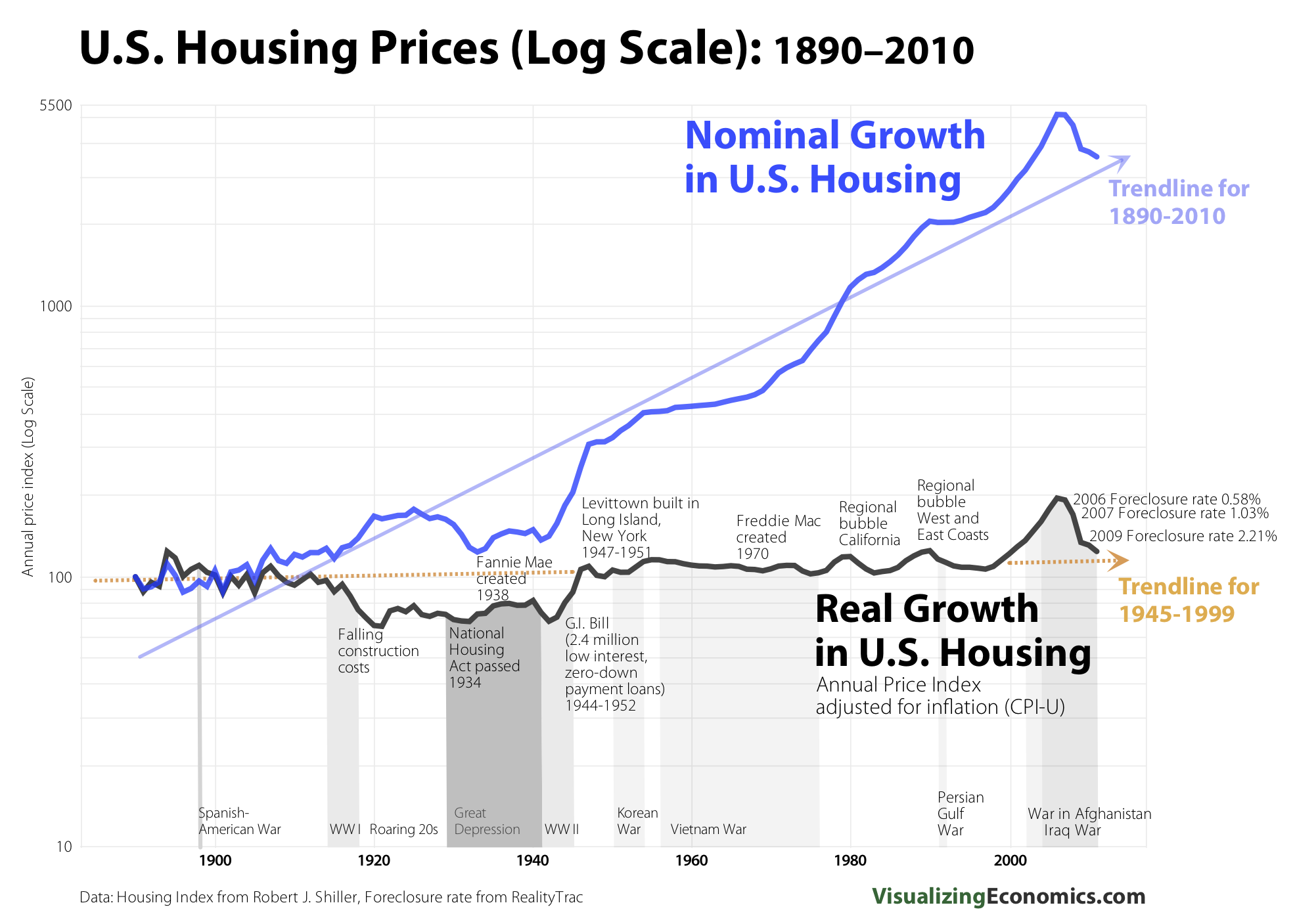

Following the record low data in New Home Sales yesterday, we looked at a 50 year chart of that plumbed the depths of that data series....

Following the record low data in New Home Sales yesterday, we looked at a 50 year chart of that plumbed the depths of that data series....

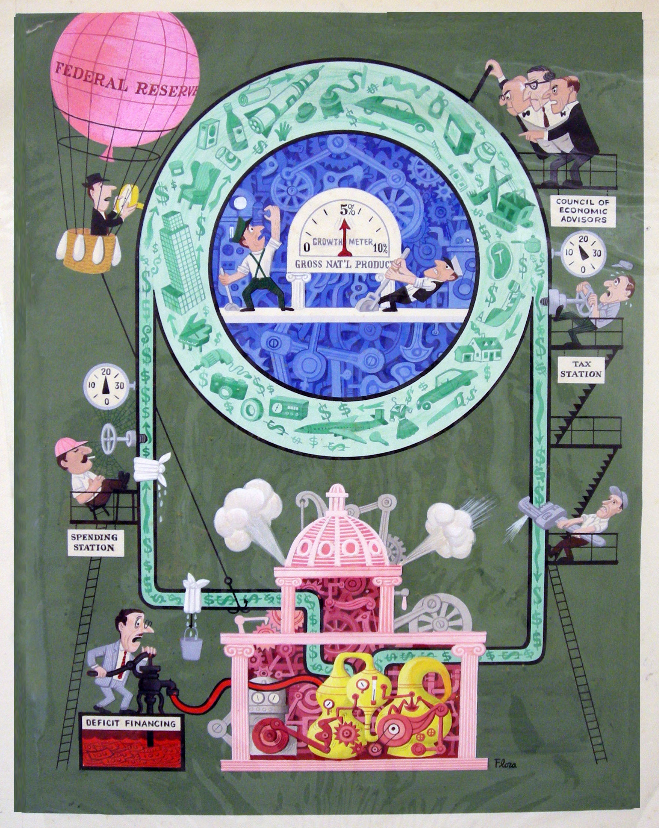

As a longstanding Jazz fan, I have been enamored of Jim Flora’s work for some time (eg, this and this) . His work is bright and...

As a longstanding Jazz fan, I have been enamored of Jim Flora’s work for some time (eg, this and this) . His work is bright and...

> • BusinessWeek – Portugal’s Bonds Slump as Prime Minister Quits Over Budget Cuts Portuguese bonds led a slide by securities...

> • BusinessWeek – Portugal’s Bonds Slump as Prime Minister Quits Over Budget Cuts Portuguese bonds led a slide by securities...

Get subscriber-only insights and news delivered by Barry every two weeks.