Good Windows Machine?

The wife’s iBook is on its very last legs — she uses it for email and NYT crossword puzzles — since I always feel the...

By James Montier In my previous missive I concluded that investors should stay true to the principles that have always guided (and should...

By James Montier In my previous missive I concluded that investors should stay true to the principles that have always guided (and should...

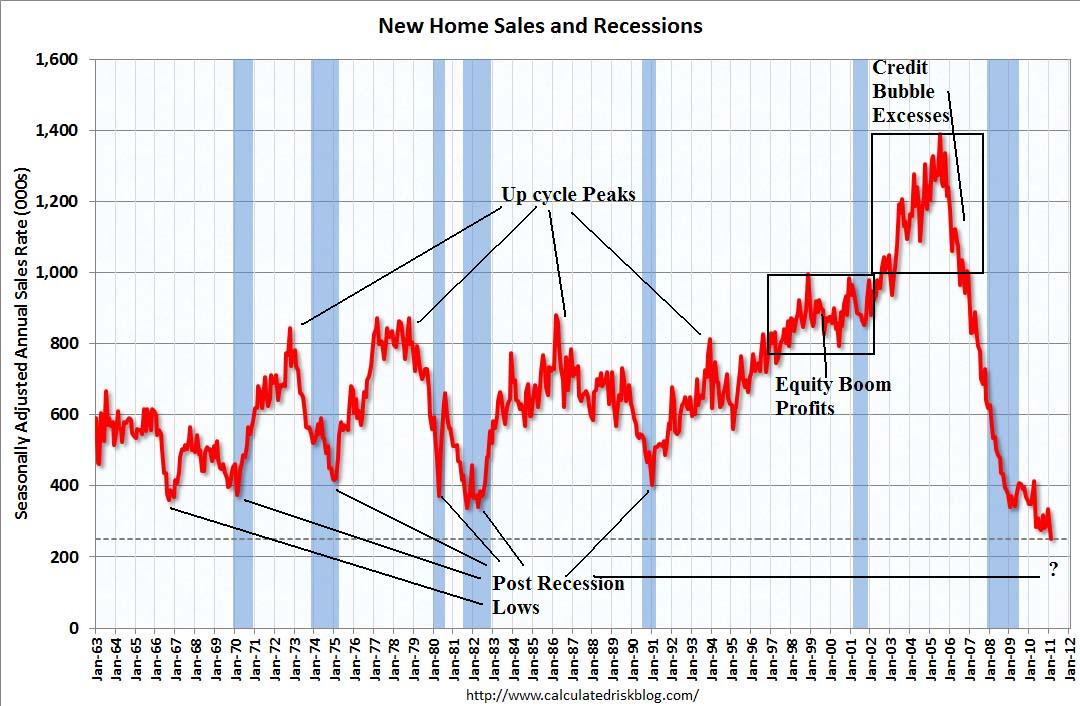

I want to direct your attention at two items related to New Home Sales: The chart below, and a post from 2005: First, the post: New Home...

I want to direct your attention at two items related to New Home Sales: The chart below, and a post from 2005: First, the post: New Home...

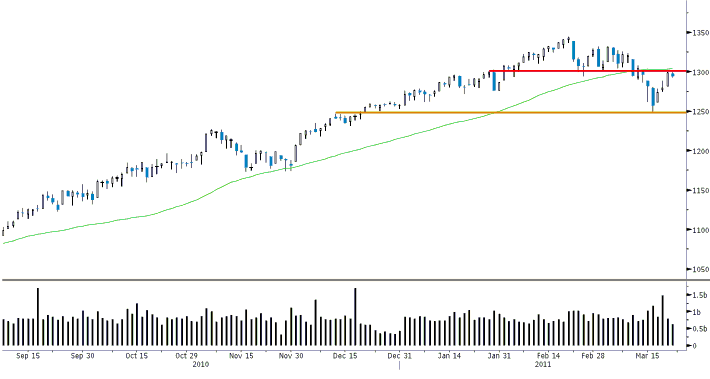

Chart courtesy of FusionIQ > Kevin Lane of Fusion Analytics makes the observation: As seen in the chart above the S&P 500 stalled...

Chart courtesy of FusionIQ > Kevin Lane of Fusion Analytics makes the observation: As seen in the chart above the S&P 500 stalled...

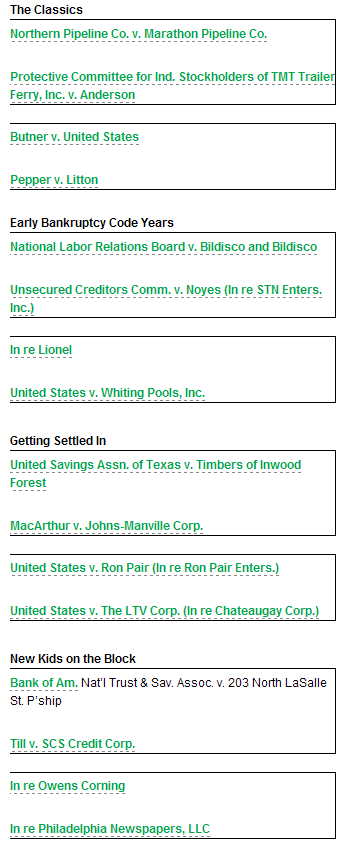

Warning: Legal wonkery ahead: Powerhouse law firm Weill Gotshal published a “Sweet 16” of most influential, transformative,...

Warning: Legal wonkery ahead: Powerhouse law firm Weill Gotshal published a “Sweet 16” of most influential, transformative,...

Get subscriber-only insights and news delivered by Barry every two weeks.