Monday Reading

• Kessler: Raise Rates to Boost the Economy (WSJ) • James Surowiecki: Creative Destruction? (New Yorker) • Dan Gross: 3 Things...

Please visit the KeithRichards.com Store now to order a very special limited edition t-shirt Keith is making available. The Japan Relief...

Please visit the KeithRichards.com Store now to order a very special limited edition t-shirt Keith is making available. The Japan Relief...

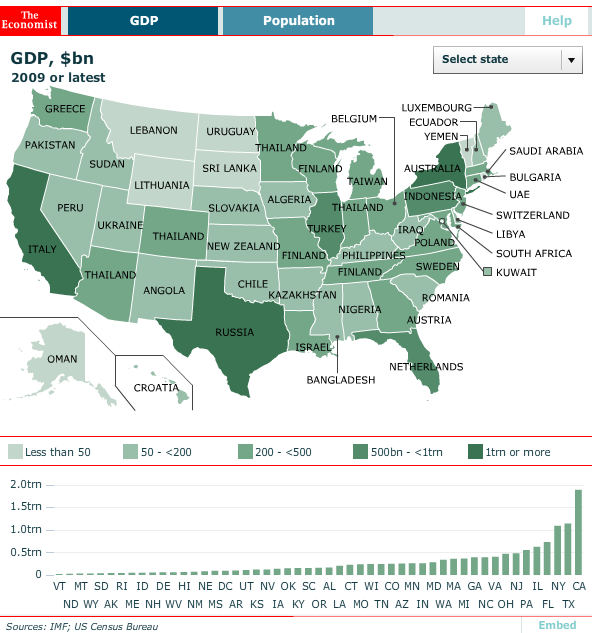

Way back in 2007, I found this obscure chart from The York Group on a Norwegian blog, posted previously as Countries GDP as US States....

Way back in 2007, I found this obscure chart from The York Group on a Norwegian blog, posted previously as Countries GDP as US States....

I read an interesting NYT article (No Hero in 1811, Street Grid’s Father Was Showered With Produce, Not Praise) this morning about John...

I read an interesting NYT article (No Hero in 1811, Street Grid’s Father Was Showered With Produce, Not Praise) this morning about John...

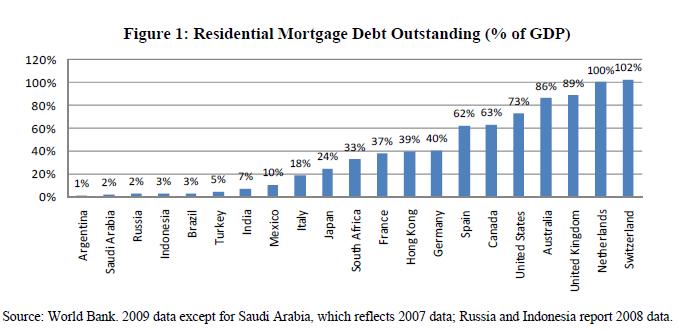

> Interesting observations from Merrill Lynch’s Sheryl King and Ryan Bohren. They believe Canadian housing is “in bubble...

> Interesting observations from Merrill Lynch’s Sheryl King and Ryan Bohren. They believe Canadian housing is “in bubble...

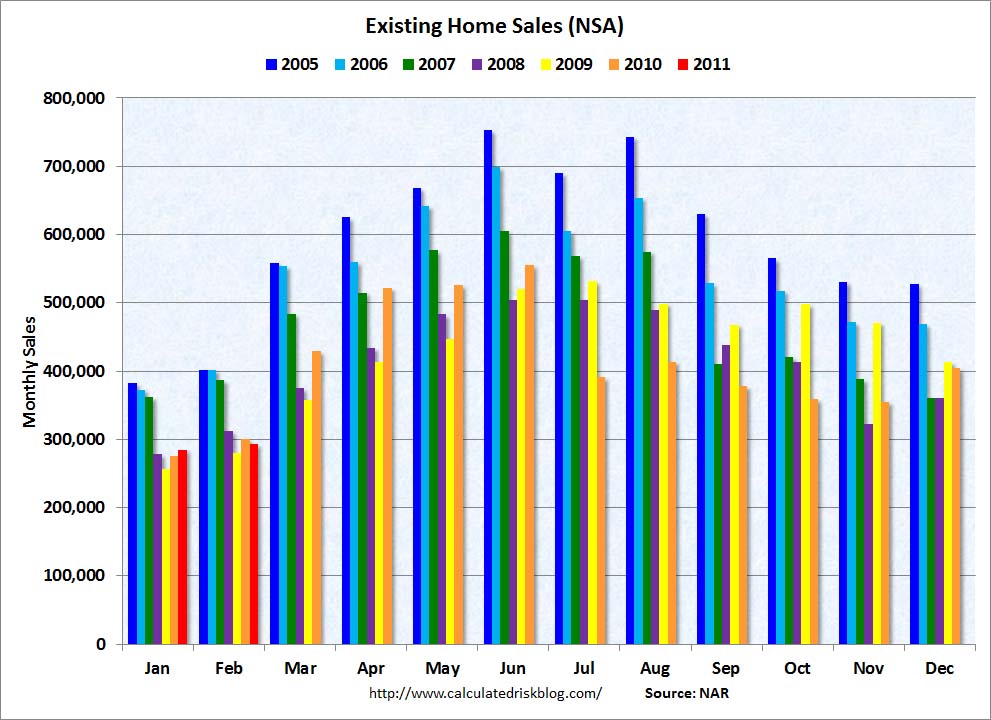

I have a few favorite Housing charts: Median Income to Median Home Price, Housing Value as % of GDP. This one may very well be my...

I have a few favorite Housing charts: Median Income to Median Home Price, Housing Value as % of GDP. This one may very well be my...

Get subscriber-only insights and news delivered by Barry every two weeks.