I read an interesting NYT article (No Hero in 1811, Street Grid’s Father Was Showered With Produce, Not Praise) this morning about John...

I read an interesting NYT article (No Hero in 1811, Street Grid’s Father Was Showered With Produce, Not Praise) this morning about John...

Read More

March 11 eyewitness video: In under 10 minutes, a harbor in Oirase Town, Aomori Prefecture is wiped out. A huge dry area that completely...

Read More

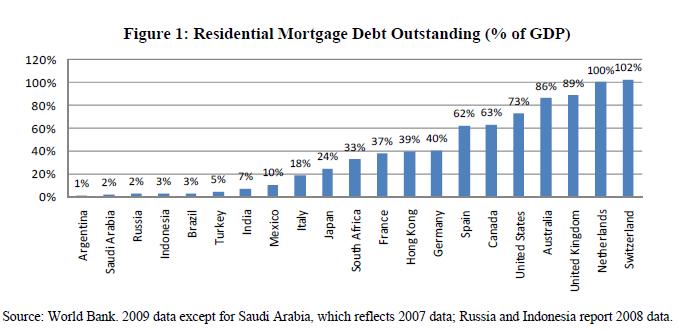

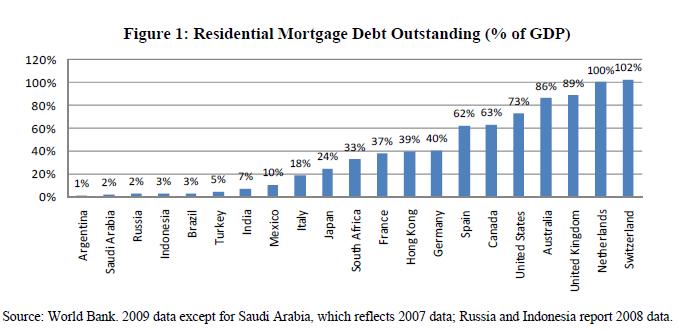

> Interesting observations from Merrill Lynch’s Sheryl King and Ryan Bohren. They believe Canadian housing is “in bubble...

> Interesting observations from Merrill Lynch’s Sheryl King and Ryan Bohren. They believe Canadian housing is “in bubble...

Read More

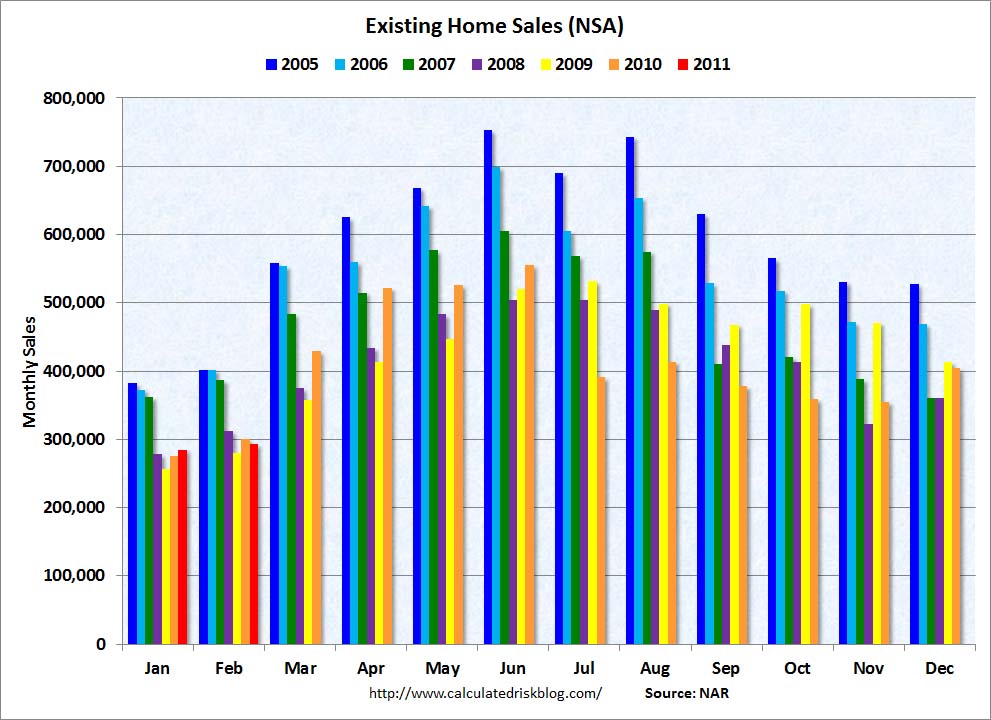

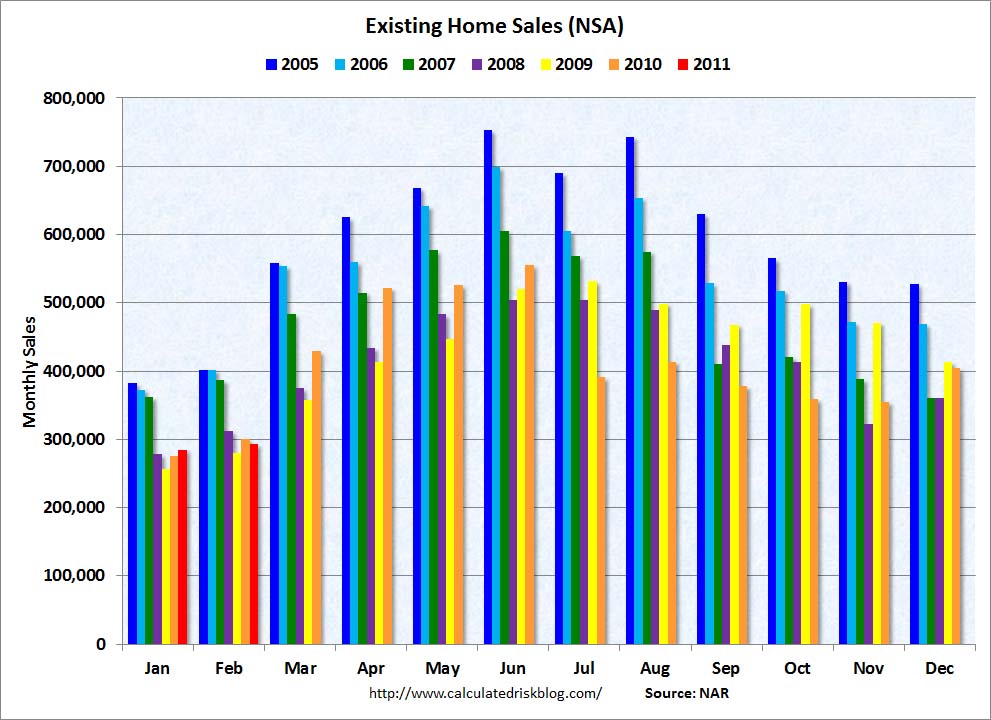

I have a few favorite Housing charts: Median Income to Median Home Price, Housing Value as % of GDP. This one may very well be my...

I have a few favorite Housing charts: Median Income to Median Home Price, Housing Value as % of GDP. This one may very well be my...

Read More

Technical Briefing on the Radiological Situation in Japan, Renate Czarwinski, 18th March 2011 View more presentations from IAEA

Read More

Krugman gives us our QOTD: “Greenspan is an ex-Maestro; his reputation is pushing up the daisies, it’s gone to meet its maker,...

Read More

ECB Pres Trichet speaking in Brussels is basically clinching an April 7th rate hike by repeating that risks to their price outlook are to...

Read More

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Read More

Jeff Macke on the unseemly reality of Wall St reactions to disasters:

Read More

“We are just plagued today with the lack of long-term trends, and it’s because of people reacting to the issues of the day....

“We are just plagued today with the lack of long-term trends, and it’s because of people reacting to the issues of the day....

Read More

I read an interesting NYT article (No Hero in 1811, Street Grid’s Father Was Showered With Produce, Not Praise) this morning about John...

I read an interesting NYT article (No Hero in 1811, Street Grid’s Father Was Showered With Produce, Not Praise) this morning about John...

I read an interesting NYT article (No Hero in 1811, Street Grid’s Father Was Showered With Produce, Not Praise) this morning about John...

I read an interesting NYT article (No Hero in 1811, Street Grid’s Father Was Showered With Produce, Not Praise) this morning about John...