“We are just plagued today with the lack of long-term trends, and it’s because of people reacting to the issues of the day....

“We are just plagued today with the lack of long-term trends, and it’s because of people reacting to the issues of the day....

Read More

This week we look at another except from Ed Easterling’s gonzo book on stock market return projections, called Probable Outcomes. This...

This week we look at another except from Ed Easterling’s gonzo book on stock market return projections, called Probable Outcomes. This...

Read More

Instead of ‘shock and awe’, it seems what we’re seeing in Libya is more ‘hit and run.’ I say this because...

Read More

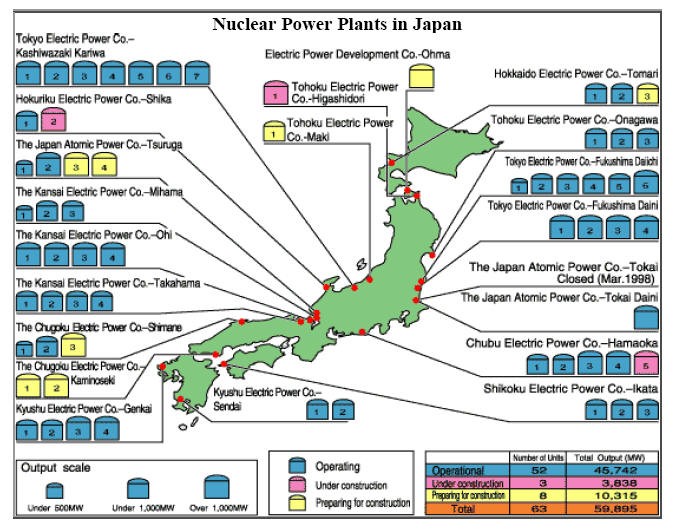

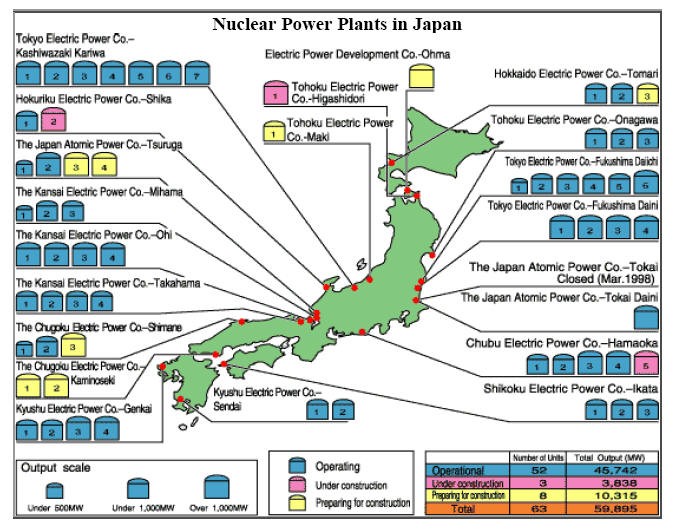

“In the 40 years that Japan had been building nuclear plants, seismic activity was, fortunately or unfortunately, relatively quiet....

“In the 40 years that Japan had been building nuclear plants, seismic activity was, fortunately or unfortunately, relatively quiet....

Read More

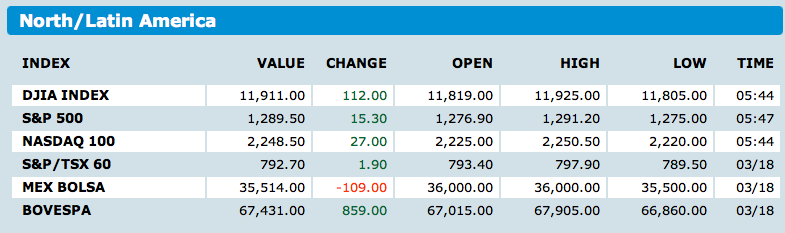

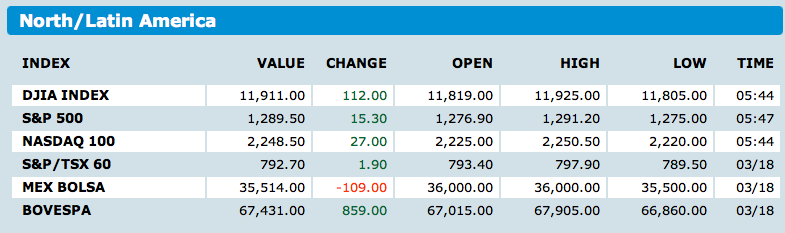

click for updated futures > We managed to make it through the weekend without a meltdown of other nuclear catastrophe. Asian markets...

click for updated futures > We managed to make it through the weekend without a meltdown of other nuclear catastrophe. Asian markets...

Read More

Check out Gretchen Morgenson’s column in the Sunday Times: “The American taxpayer will lose a rare straight shooter when Neil...

Read More

A physics and engineering perspective Prof. Ben Monreal, UCSB Department of Physics > Understanding the radioactivity at Fukushima ~~~...

Read More

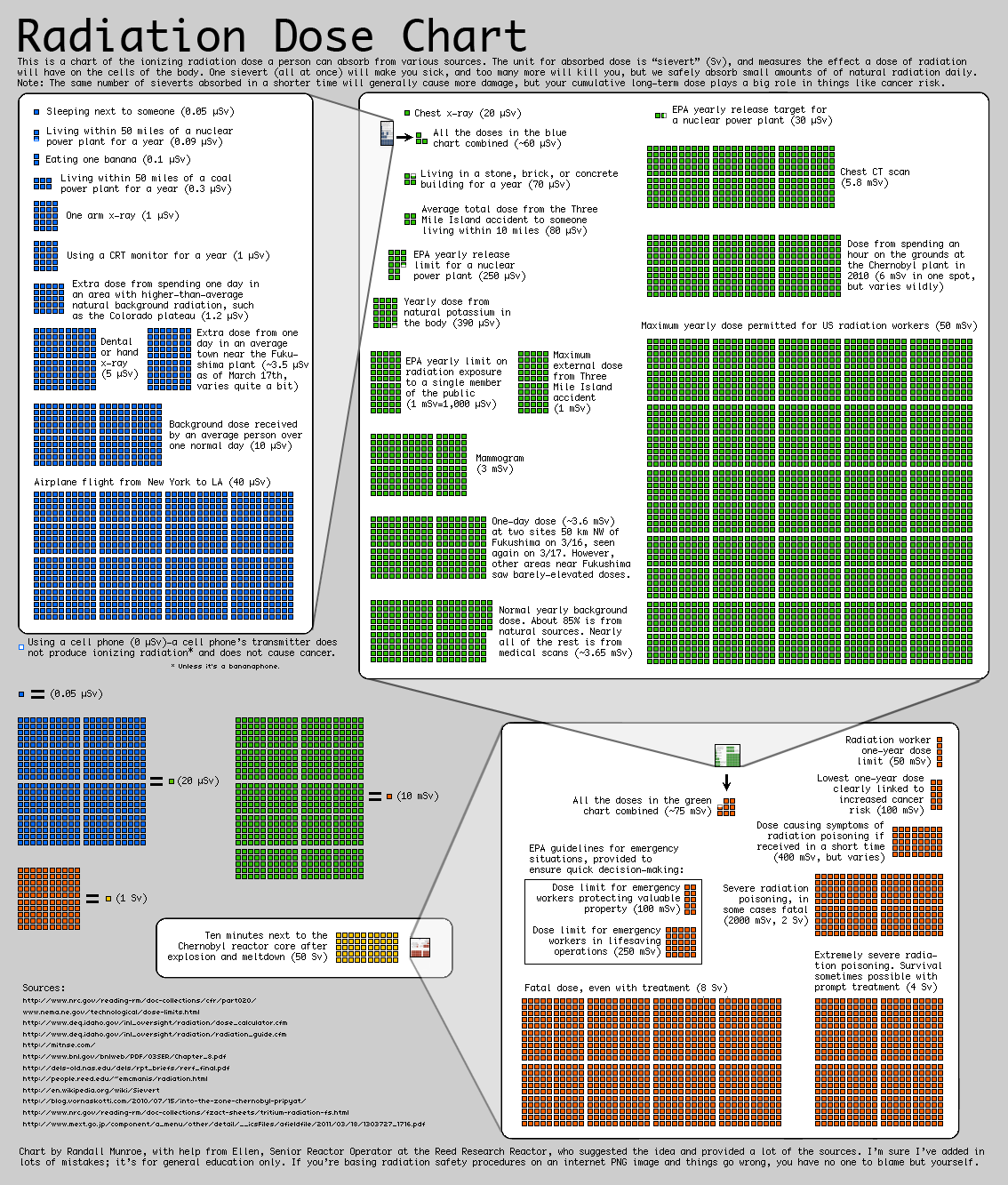

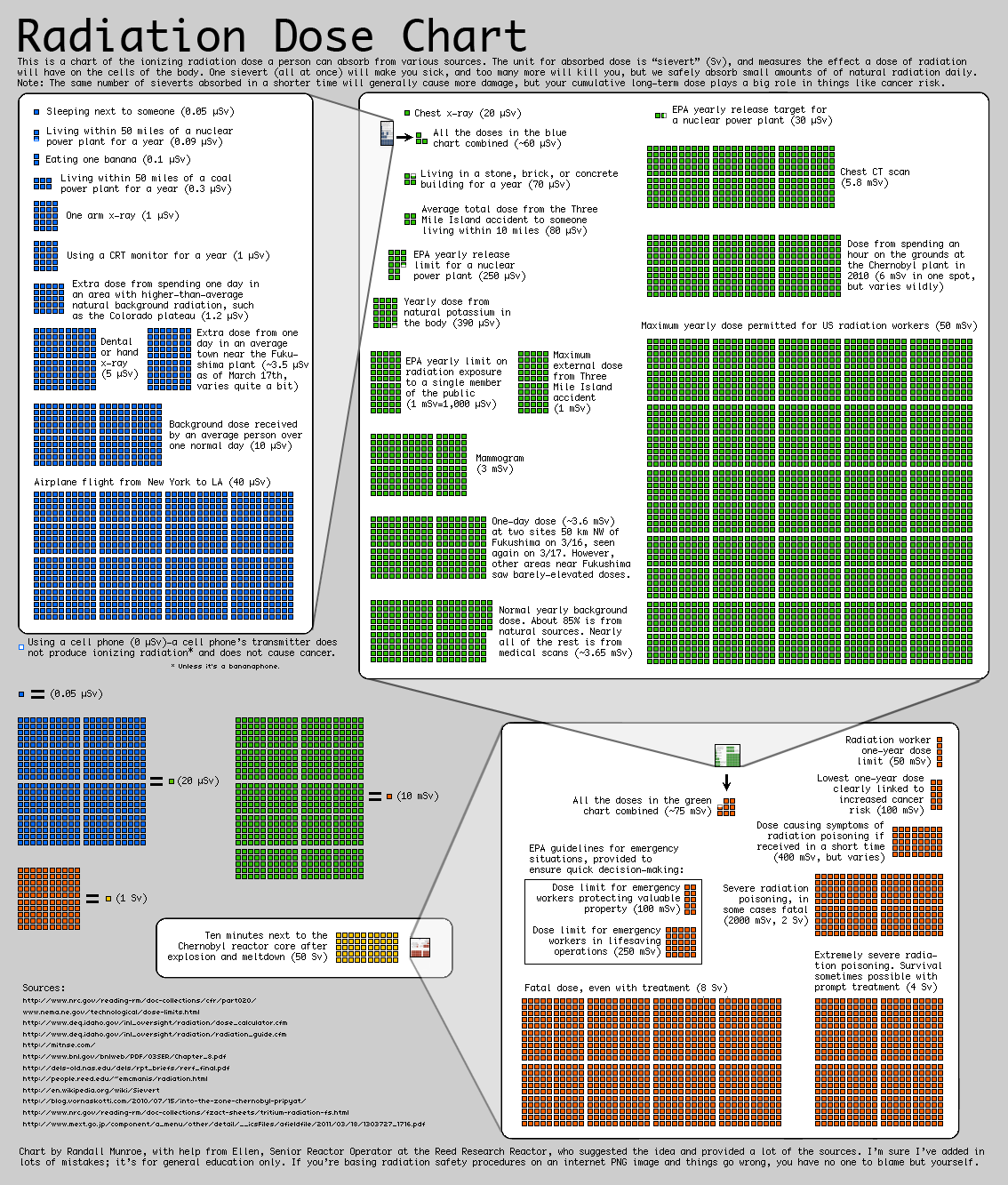

Via xkcd comes this very informative chart on radiation exposure: > click for ginormous graphic > Sources:...

Via xkcd comes this very informative chart on radiation exposure: > click for ginormous graphic > Sources:...

Read More

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Read More

“We are just plagued today with the lack of long-term trends, and it’s because of people reacting to the issues of the day....

“We are just plagued today with the lack of long-term trends, and it’s because of people reacting to the issues of the day....

“We are just plagued today with the lack of long-term trends, and it’s because of people reacting to the issues of the day....

“We are just plagued today with the lack of long-term trends, and it’s because of people reacting to the issues of the day....