Understanding the Radioactivity at Fukushima

A physics and engineering perspective Prof. Ben Monreal, UCSB Department of Physics > Understanding the radioactivity at Fukushima ~~~...

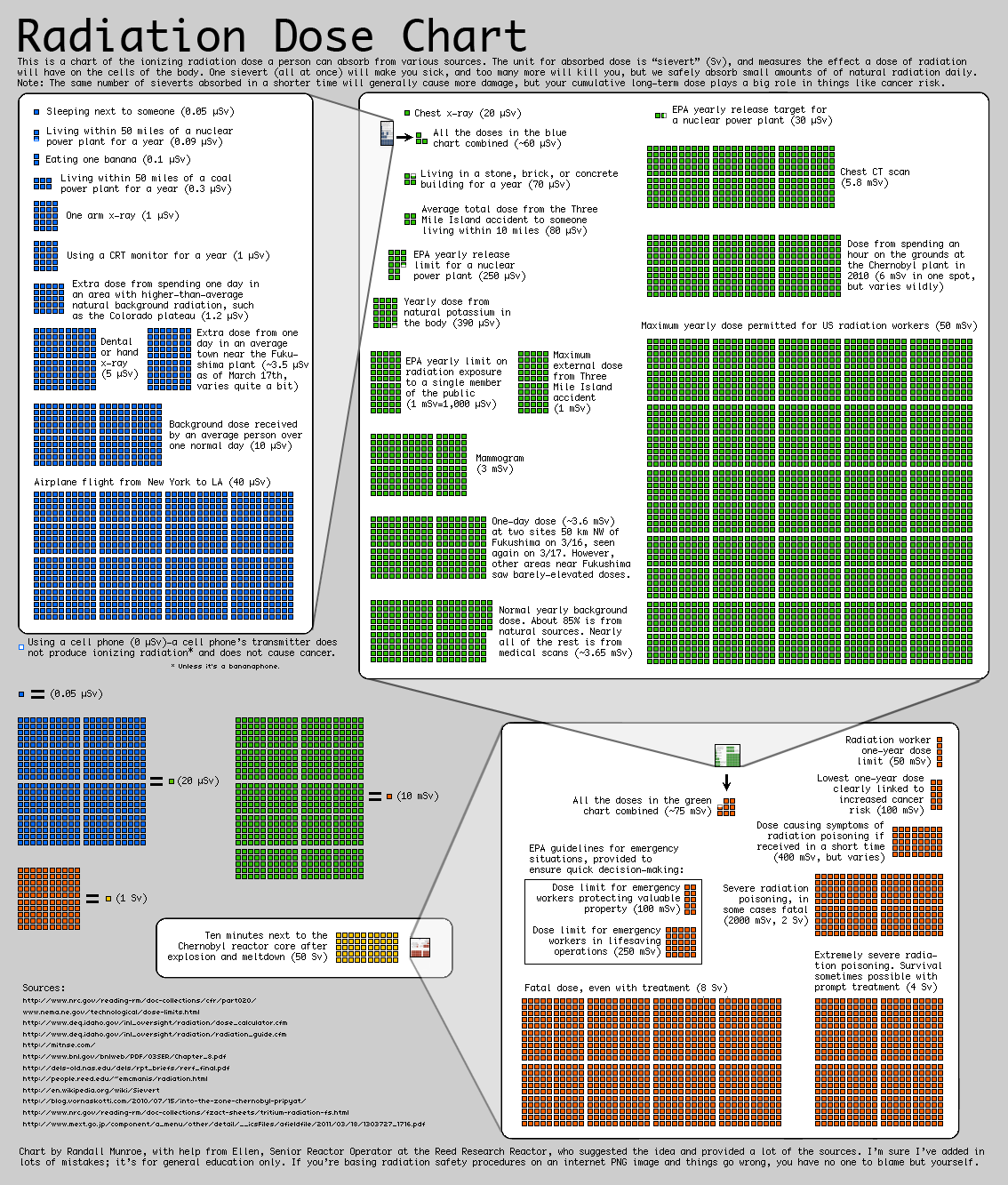

Via xkcd comes this very informative chart on radiation exposure: > click for ginormous graphic > Sources:...

Via xkcd comes this very informative chart on radiation exposure: > click for ginormous graphic > Sources:...

The End of QE2? By John Mauldin March 18, 2011 > New York Times Bestseller The End of QE2? Producer Prices Up 35-40% in the Last Six...

The End of QE2? By John Mauldin March 18, 2011 > New York Times Bestseller The End of QE2? Producer Prices Up 35-40% in the Last Six...

Get subscriber-only insights and news delivered by Barry every two weeks.