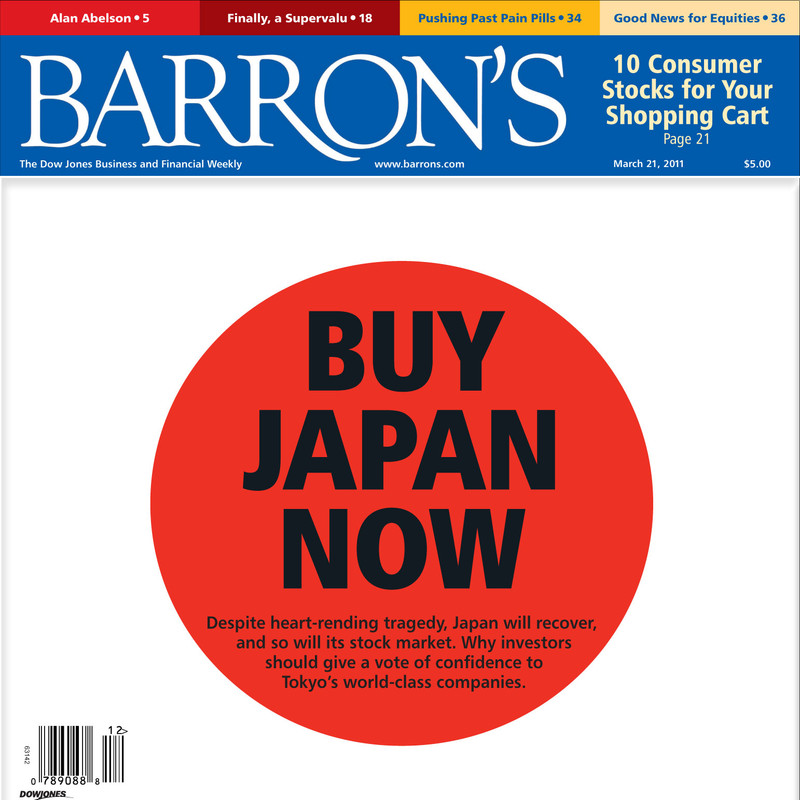

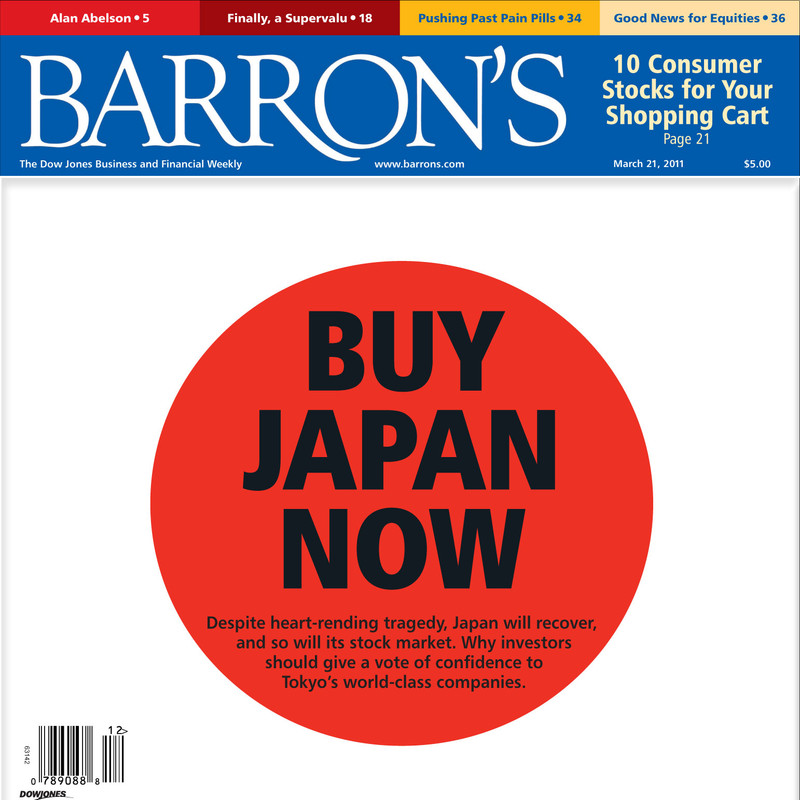

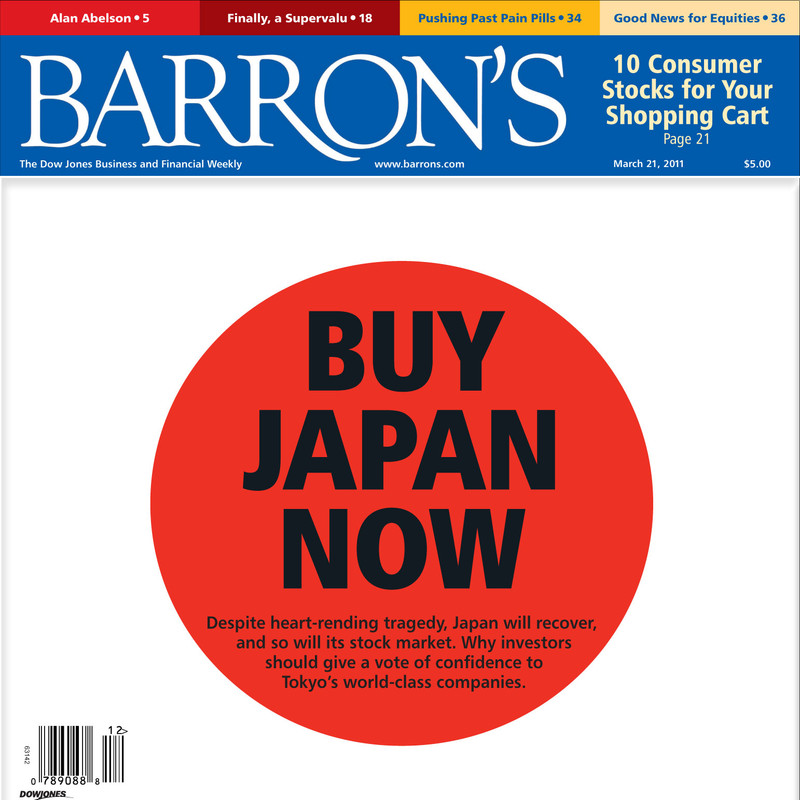

Interesting cover on Barron’s this week: This is hardly a contrary view — I’ve heard from lots of people saying they...

Interesting cover on Barron’s this week: This is hardly a contrary view — I’ve heard from lots of people saying they...

Read More

Succinct summation of week’s events: Positives: 1) Bilateral intervention halts yen spike 2) China and India continue to tighten...

Read More

By Joey Tosi The film features interviews with Brad Plunkett, the inventor of the pedal, plus many other musical luminaries such as Ben...

Read More

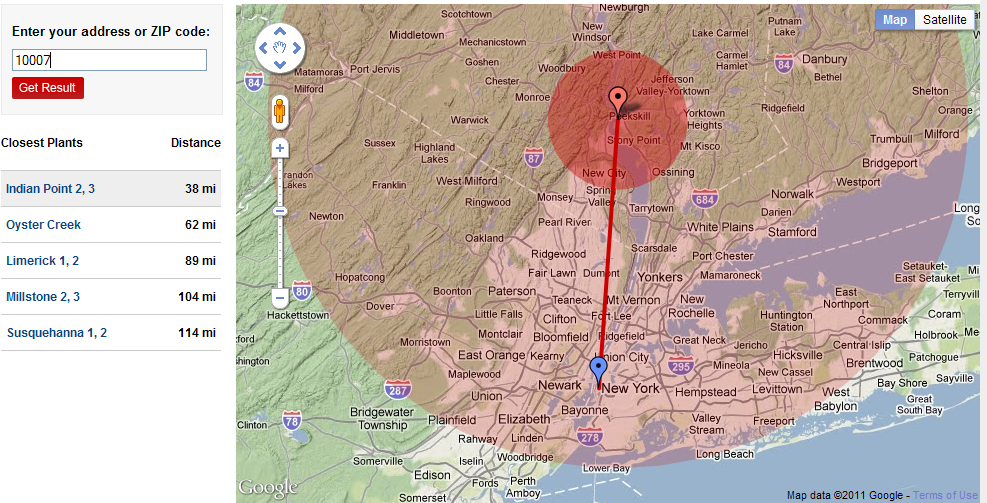

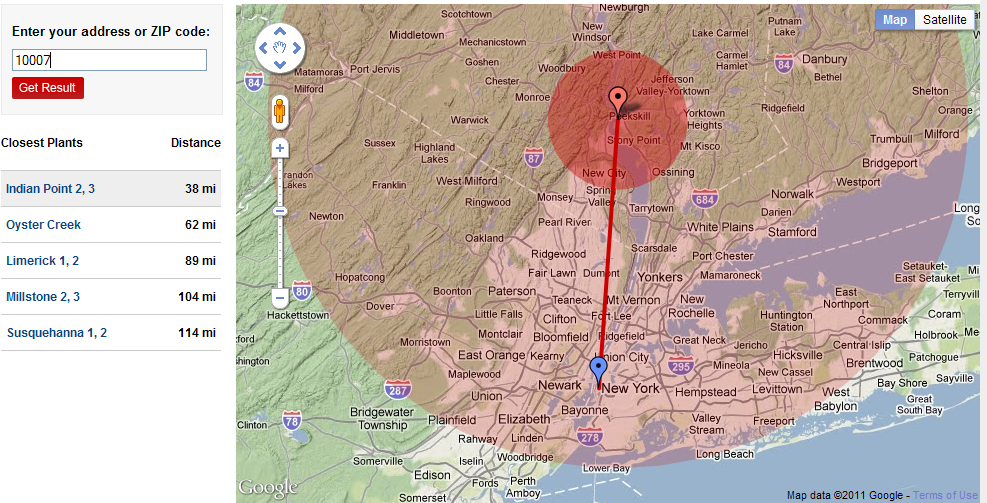

CNN/Money jumps on the fear bandwagon with this interactive graphic: > click to see how soon you will die of radiation poisoning Hey,...

CNN/Money jumps on the fear bandwagon with this interactive graphic: > click to see how soon you will die of radiation poisoning Hey,...

Read More

The Fed is giving the green light to banks to resume paying divvies. I guess this means things are okay, everything is getting back to...

Read More

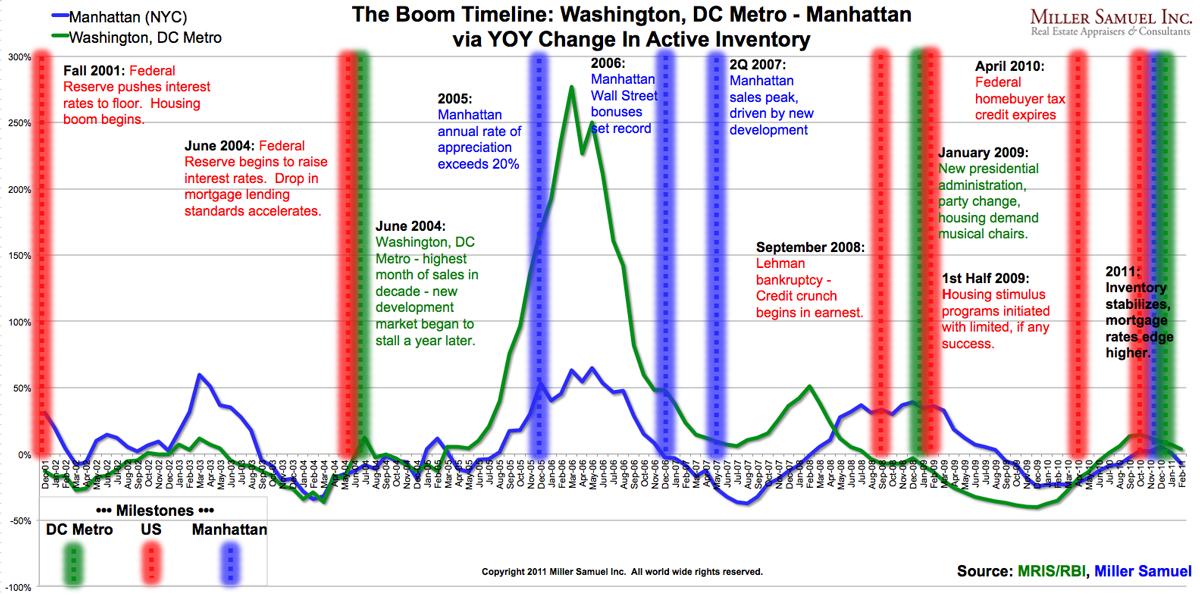

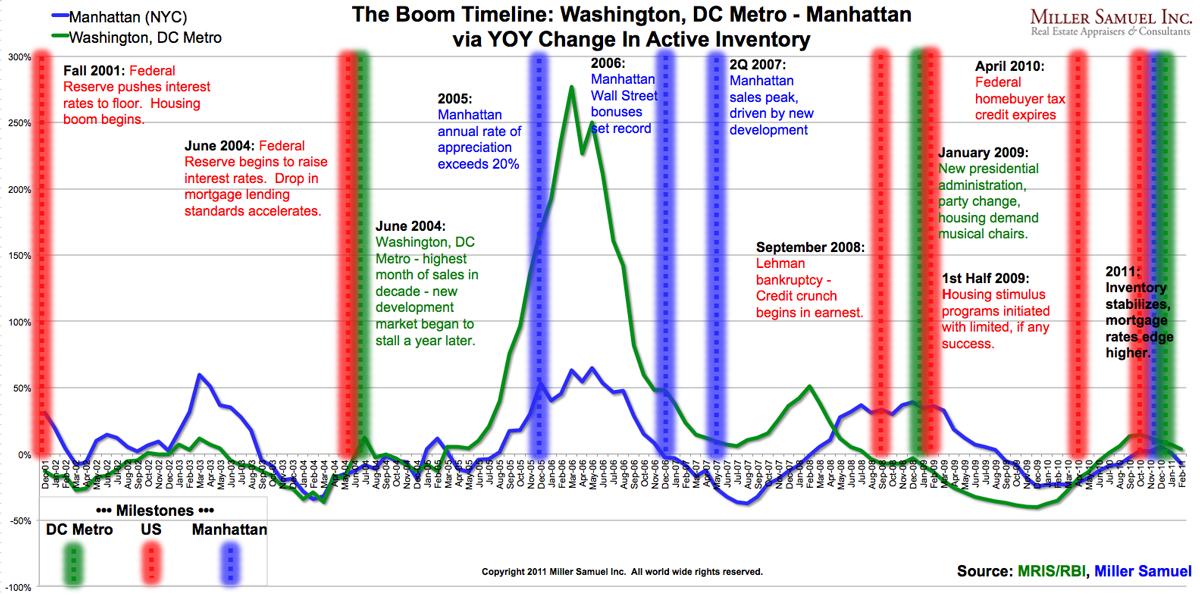

> Over at Curbed, Jonthan Miller (of Miller Matrix) looks at who has the more resilient RE market, New York or Washington DC. The...

> Over at Curbed, Jonthan Miller (of Miller Matrix) looks at who has the more resilient RE market, New York or Washington DC. The...

Read More

In light of yesterday’s charts on US debt (Who Does the US Owe Money To?), let’s take a quick look at two more, via Ron...

In light of yesterday’s charts on US debt (Who Does the US Owe Money To?), let’s take a quick look at two more, via Ron...

Read More

Here I am in Central Park in Tokyo. The park is situated on reclaimed ground. It’s filled in harbor from what I’m told. Here...

Read More

click for larger chart > No, we are not profitable on the bailouts. TARP has $123B to go before breakeven, and the GSEs are $133B in...

click for larger chart > No, we are not profitable on the bailouts. TARP has $123B to go before breakeven, and the GSEs are $133B in...

Read More

The G7 is Not Permanent Manna from Heaven! March 18, 2011 David R. Kotok http://www.cumber.com > “We need to be sure to note in any...

Read More

Interesting cover on Barron’s this week: This is hardly a contrary view — I’ve heard from lots of people saying they...

Interesting cover on Barron’s this week: This is hardly a contrary view — I’ve heard from lots of people saying they...

Interesting cover on Barron’s this week: This is hardly a contrary view — I’ve heard from lots of people saying they...

Interesting cover on Barron’s this week: This is hardly a contrary view — I’ve heard from lots of people saying they...