Afternoon Reads

• The situation in Tokyo, a view from the ground (Alphaville) • Simon Johnson: Who’s Afraid of Elizabeth Warren? (Economix) •...

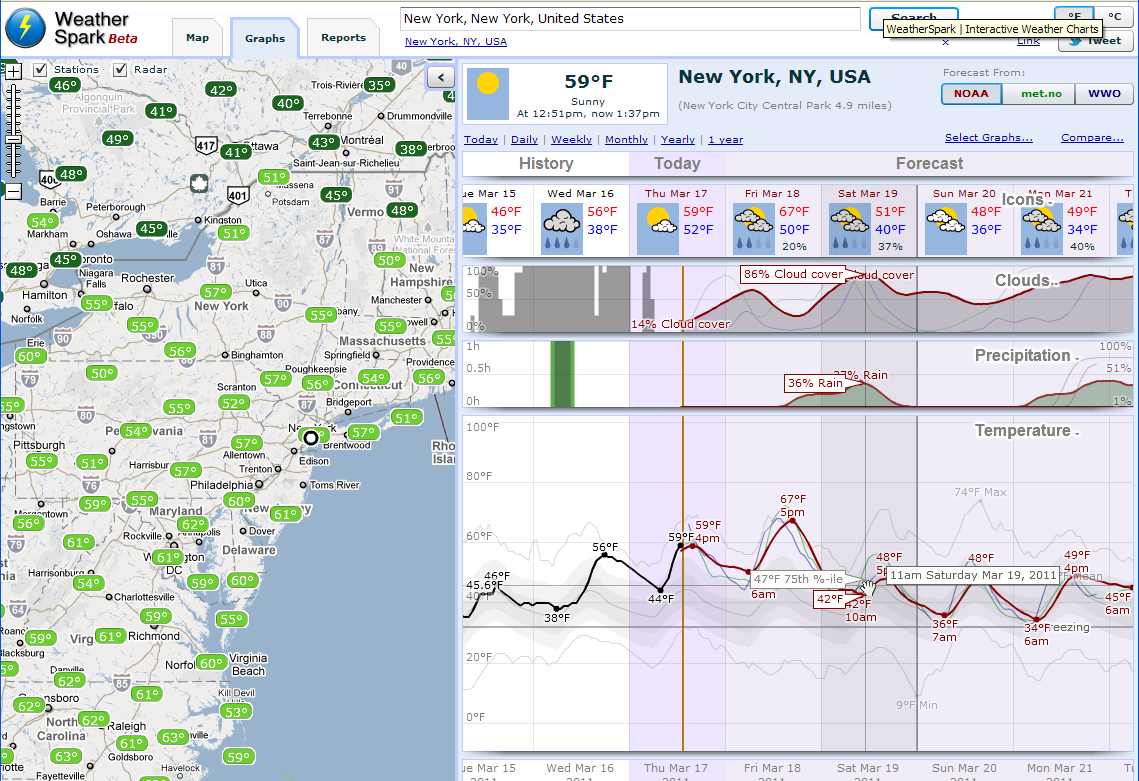

For you hardcore weather bugs, WeatherSpark is sheer chart overload! > click for interactive weather madness! (note the buy and sell...

For you hardcore weather bugs, WeatherSpark is sheer chart overload! > click for interactive weather madness! (note the buy and sell...

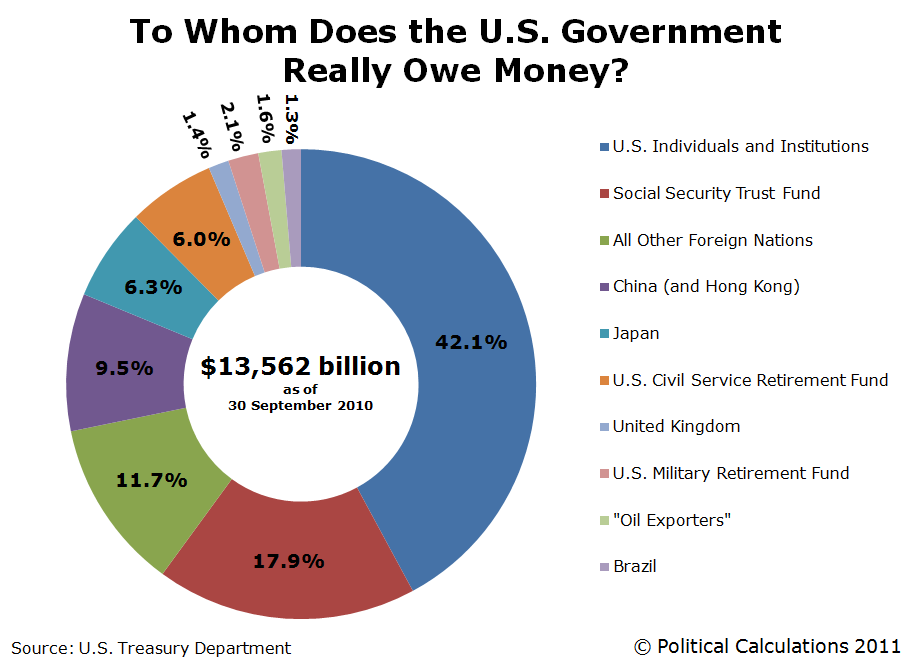

Its been a few months, and its time to update this chart of US Debt Holders from Political Calculations. In the Think Tank this morning,...

Its been a few months, and its time to update this chart of US Debt Holders from Political Calculations. In the Think Tank this morning,...

Lex: Reinsurers and Japan “Investors are right in one sense: the money needed for re-building Japan must come from somewhere. But...

Lex: Reinsurers and Japan “Investors are right in one sense: the money needed for re-building Japan must come from somewhere. But...

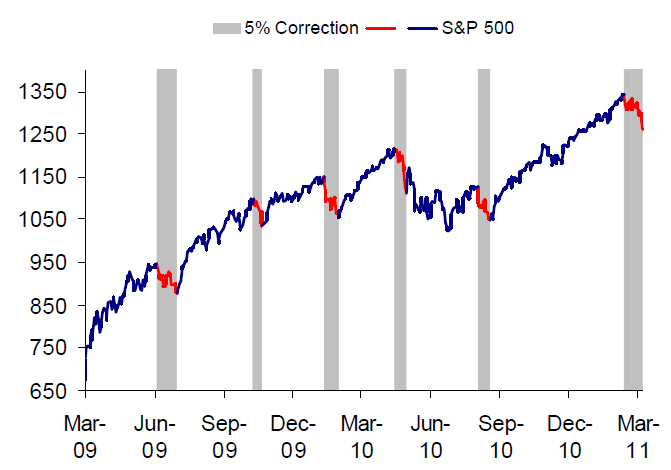

Interesting chart from Birinyi Associates: > S&P 500 5% Pullbacks (3/9/09 – 3/16/11) > They add: “What is perhaps...

Interesting chart from Birinyi Associates: > S&P 500 5% Pullbacks (3/9/09 – 3/16/11) > They add: “What is perhaps...

Get subscriber-only insights and news delivered by Barry every two weeks.