Wall Street’s Biggest Bargain: Office Space

Interesting discussion at Bloomberg: “The best deal on Wall Street might be its office space. Asking rents for buildings at the...

Amazing before and after photos via German news magazine Spiegel of numerous Japanese towns and cities. (Can anyone translate the...

Amazing before and after photos via German news magazine Spiegel of numerous Japanese towns and cities. (Can anyone translate the...

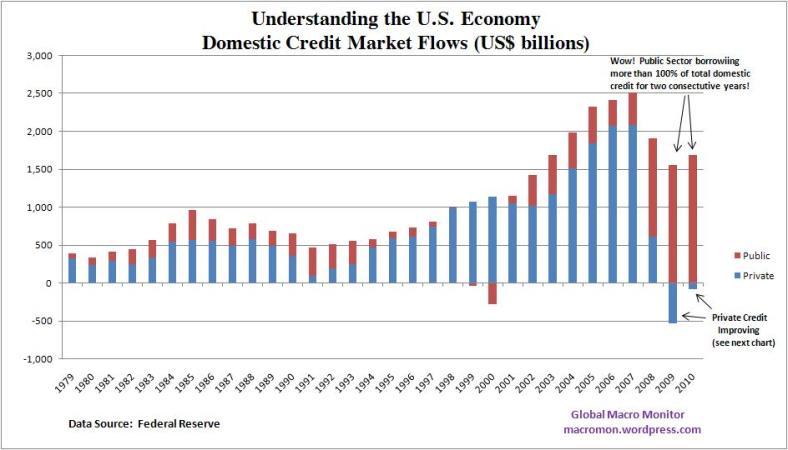

To understand the U.S. economy go no further than the following two charts. In 2009 and 2010, public sector borrowing was more than 100...

To understand the U.S. economy go no further than the following two charts. In 2009 and 2010, public sector borrowing was more than 100...

> Special Japanese Edition! Tonight I will be on Dylan Ratigan (MSNBC at 4pm) and then Fast Money (CNBC at 5:30 pm) discussing...

> Special Japanese Edition! Tonight I will be on Dylan Ratigan (MSNBC at 4pm) and then Fast Money (CNBC at 5:30 pm) discussing...

Get subscriber-only insights and news delivered by Barry every two weeks.