FOMC speaks

The FOMC said the “economic recovery is on a firmer footing and overall conditions in the labor market appear to be improving...

Finding the Lost City of Atlantis

I have to set the Tivo to record this tonite: Could the fabled lost city of Atlantis have been located? Using satellite photography,...

Nuclear Physicist on Japan Crisis

Nuclear physicist Kirby Kemper gives us his assessment of the Japan nuclear crisis, including the likelihood of a meltdown and radiation...

Allocation Shift: Closing Shorts, Adding Longs

A quick update as to our trading posture: -For the past quarter, we have been about 50% cash with a handful (20%) of longs (HSY, MTZ,...

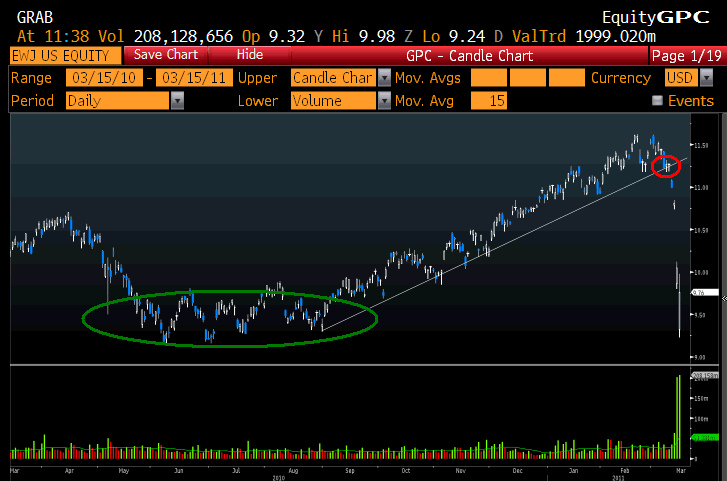

Trading Japan’s EWJ

click for larger chart Chart courtesy of FusionIQ, Bloomberg > I wanted to follow up a post from last year about EWJ. Back in December...

click for larger chart Chart courtesy of FusionIQ, Bloomberg > I wanted to follow up a post from last year about EWJ. Back in December...

Sherffius on Japan

John Sherffius, who did the brilliant cover and cartoons for Bailout Nation, has these two sad graphics on Japan: ~~~

John Sherffius, who did the brilliant cover and cartoons for Bailout Nation, has these two sad graphics on Japan: ~~~

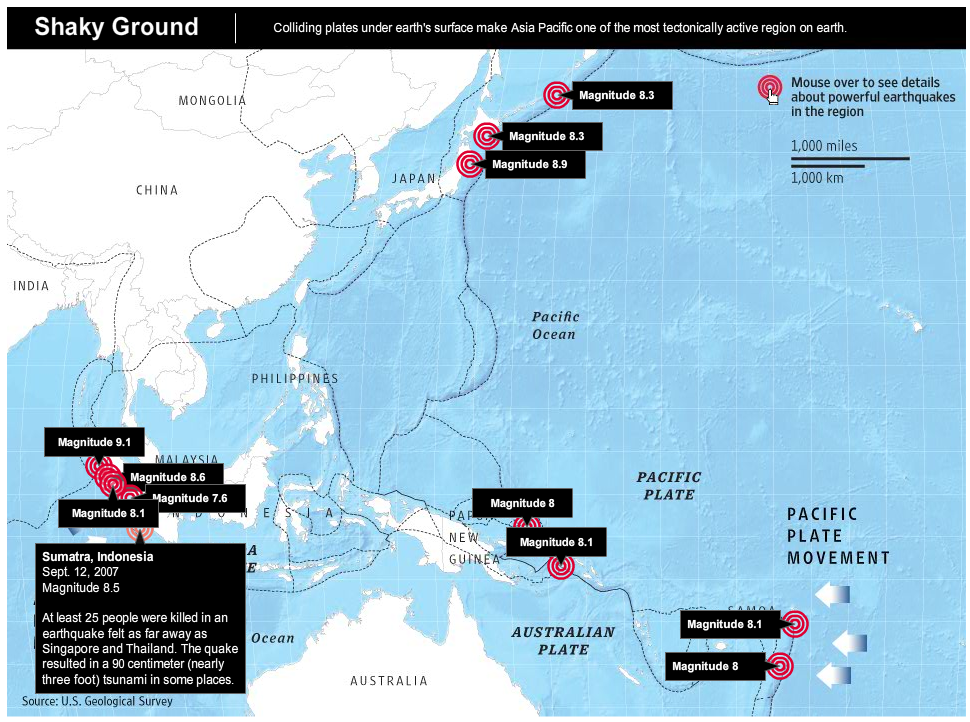

Interactive Graphics on Earthquakes, Nuclear Accident

The MSM has a series of terrific interactive charts, maps and animations: Let’s start with the WSJ‘s Pacific/Australian...

The MSM has a series of terrific interactive charts, maps and animations: Let’s start with the WSJ‘s Pacific/Australian...

The Assault on the Already Crippled SEC and CFTC Will Increase...

Bill Black is an Associate Professor of Economics and Law at the University of Missouri – Kansas City (UMKC). He was the Executive...

Economic data old news but…

Because of the tragedy in Japan, all the economic data we now see should be viewed as old news in that it hasn’t captured what...