Japan and Bahrain. Oh, My!

Japan and Bahrain. Oh, My! David R. Kotok March 14, 2011 www.cumber.com > Risk management means sell now and then hope you are wrong....

The Verizon letter arrived at home, exhorting us to “Renew now and save $100 on a new phone.” Mrs. Big Picture was in no...

The Verizon letter arrived at home, exhorting us to “Renew now and save $100 on a new phone.” Mrs. Big Picture was in no...

The following table is a detailed analysis of Japan’s international investment position from the Ministry of Finance. Using the...

The following table is a detailed analysis of Japan’s international investment position from the Ministry of Finance. Using the...

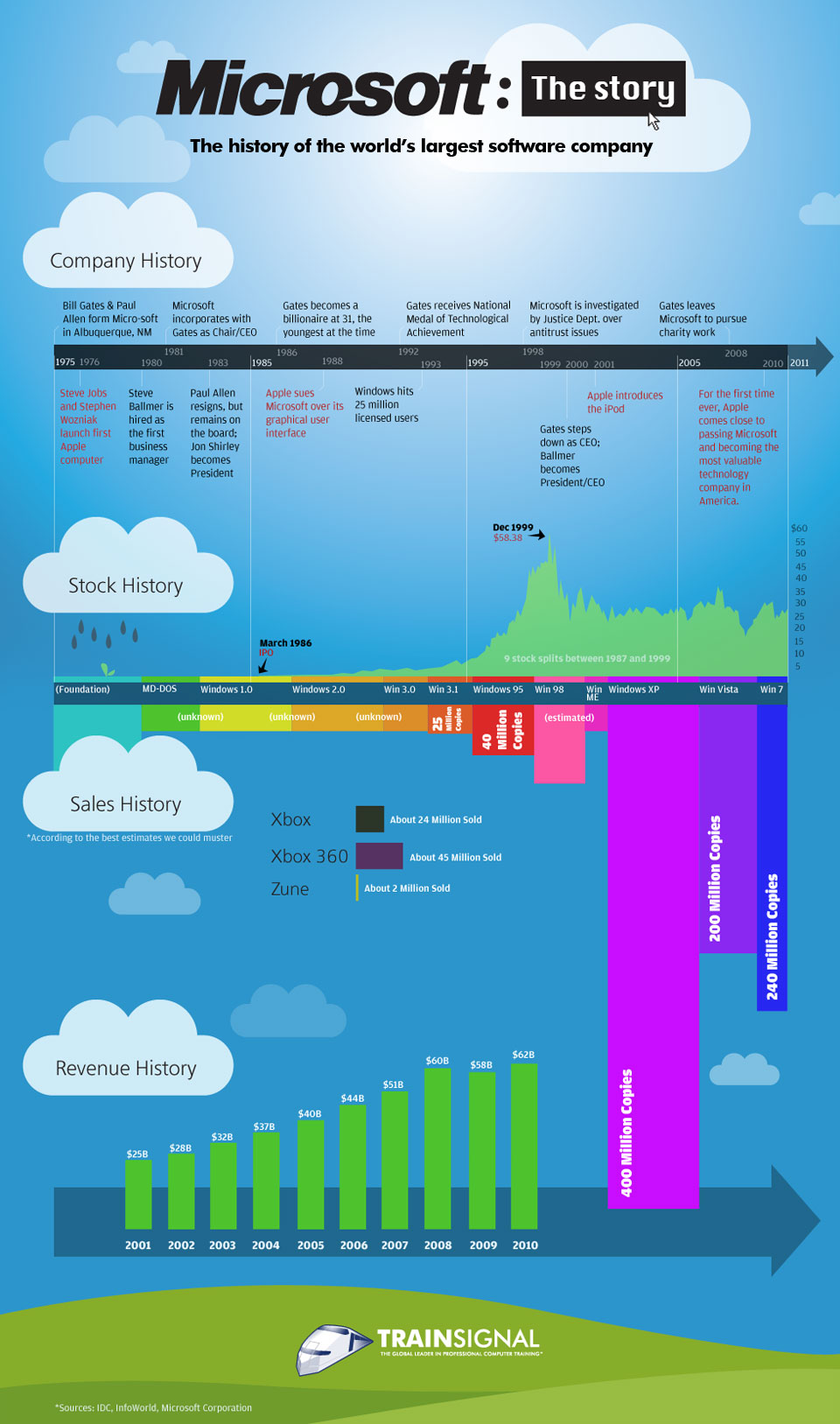

We interrupt our usual Apple fanboy ‘tude for this cool chart porn via social media graphic: > click for ginormous graphic

We interrupt our usual Apple fanboy ‘tude for this cool chart porn via social media graphic: > click for ginormous graphic

Fabulous set of charts looking at inflation adjusted S&P composite during major secular bear markets, via The Chart Store: >...

Fabulous set of charts looking at inflation adjusted S&P composite during major secular bear markets, via The Chart Store: >...

Get subscriber-only insights and news delivered by Barry every two weeks.