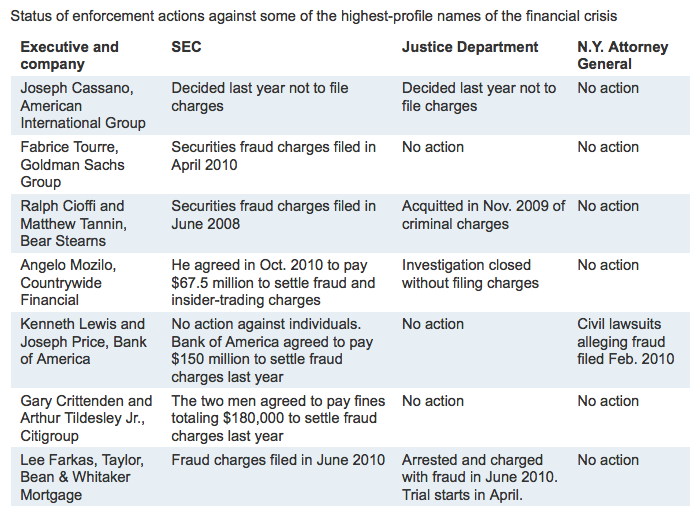

My Sunday Washington Post column discusses the lack of accountability of the Wall Street execs smashed and grabbed, destroyed their own...

My Sunday Washington Post column discusses the lack of accountability of the Wall Street execs smashed and grabbed, destroyed their own...

Read More

Mark Hanson March, 8 2011 http://mhanson.com/ > The Multi-Agency Mortgage Servicer Settlement, Principal Balance Reductions, Effective...

Read More

Attention Accountants: You are on the hook for what CEOs/CFOs do if their aggressive accounting tactics bring the firm down and you...

Read More

Taking a step back from the awful tragedy that Japan is dealing with, the economic/market reaction will be characterized by a few common...

Read More

Japans’ system detects P-waves, and then alerts you on your computer before the bigger S-waves arrive. They also do this on...

Read More

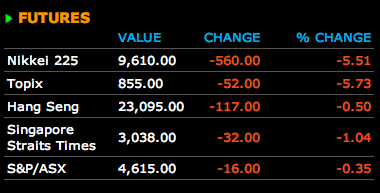

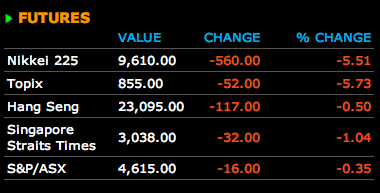

Japan is getting shellacked — earthquake, tsunami, partial nuclear meltdown, and now stock market whackage. Here’s Bloomberg:...

Japan is getting shellacked — earthquake, tsunami, partial nuclear meltdown, and now stock market whackage. Here’s Bloomberg:...

Read More

Another few takeover the past week: > ~~~

Another few takeover the past week: > ~~~

Read More

March 13, 2011 In this video, compiled by “60 Minutes Overtime,” you’ll hear the back-stories of our favorite walk-offs...

Read More

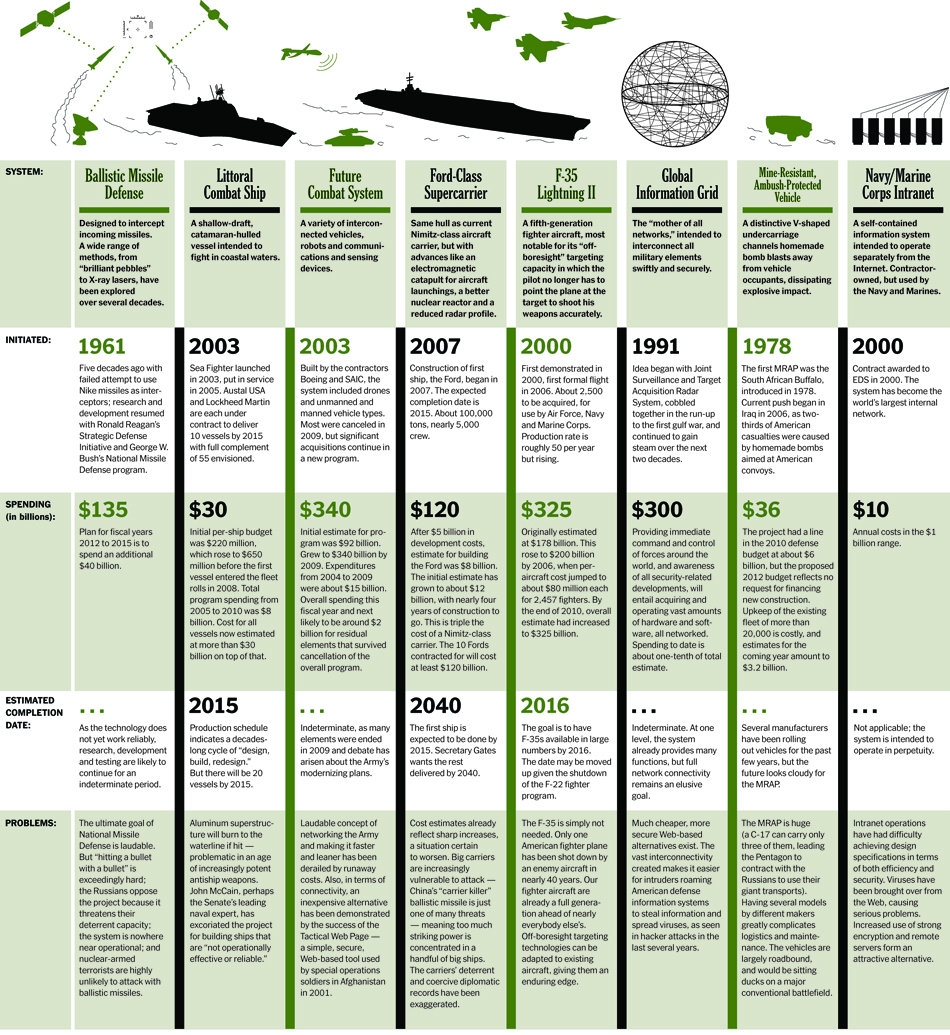

Wanna get serious about the deficit? Consider these issues: 1) Eliminate agricultural subsidies 2) Slash corporate giveaways/welfare 3)...

Wanna get serious about the deficit? Consider these issues: 1) Eliminate agricultural subsidies 2) Slash corporate giveaways/welfare 3)...

Read More

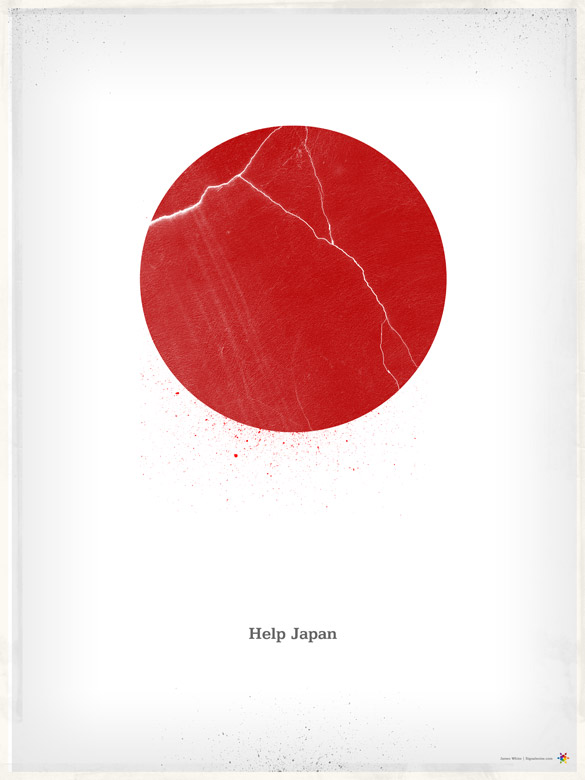

Signal Noise has this poster for sale — all profits will be donated to help Earthquake/Tsunami relief efforts in Japan. In the USA,...

Signal Noise has this poster for sale — all profits will be donated to help Earthquake/Tsunami relief efforts in Japan. In the USA,...

Read More

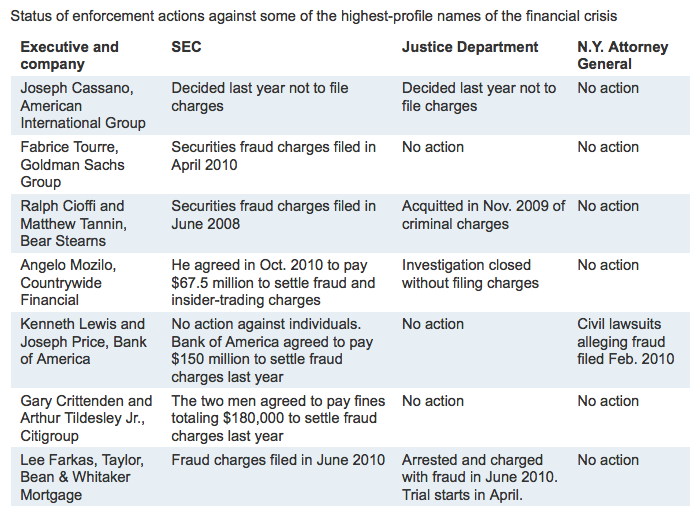

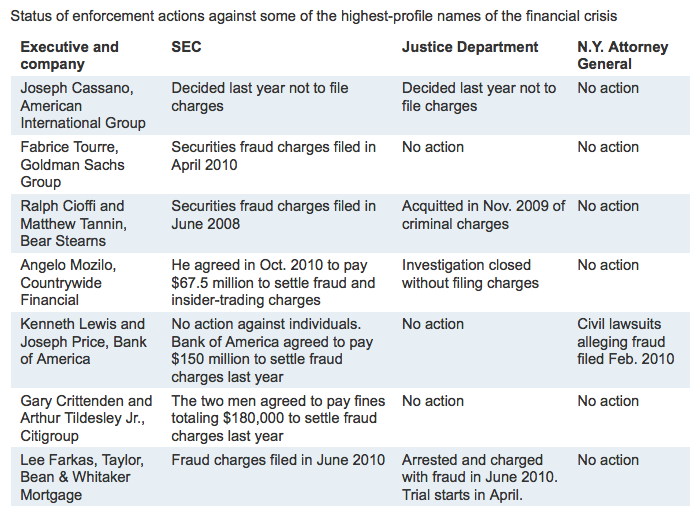

My Sunday Washington Post column discusses the lack of accountability of the Wall Street execs smashed and grabbed, destroyed their own...

My Sunday Washington Post column discusses the lack of accountability of the Wall Street execs smashed and grabbed, destroyed their own...

My Sunday Washington Post column discusses the lack of accountability of the Wall Street execs smashed and grabbed, destroyed their own...

My Sunday Washington Post column discusses the lack of accountability of the Wall Street execs smashed and grabbed, destroyed their own...