Earthquake-Tsunami-Reactor

Earthquake-Tsunami-Reactor David R. Kotok March 13, 2011 www.cumber.com > “We are assuming that a meltdown has occurred.”...

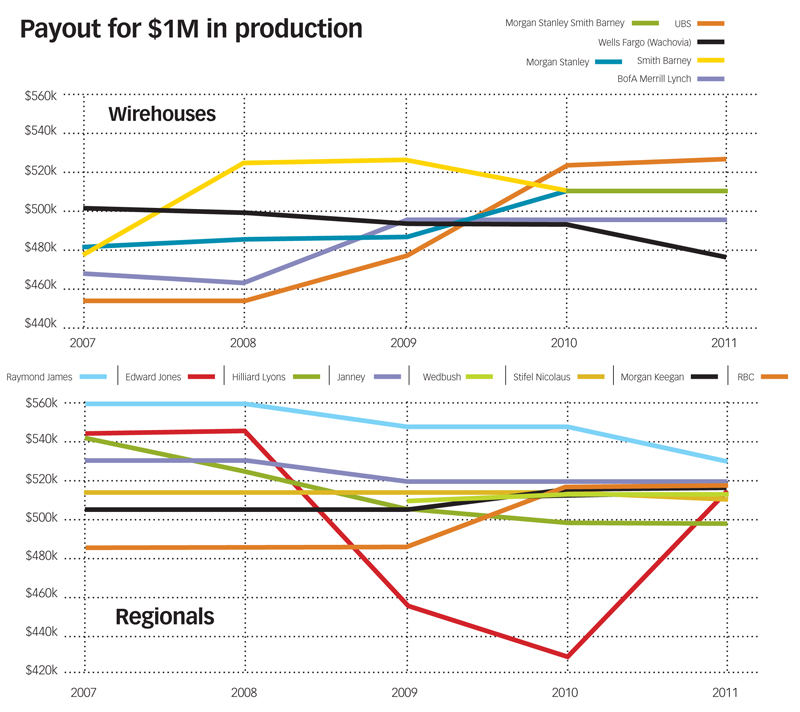

I was working on a column for the Washington Post on the IBGYBG Wall Street bonuses, when my partner Kevin Lane (the wizard behind the...

I was working on a column for the Washington Post on the IBGYBG Wall Street bonuses, when my partner Kevin Lane (the wizard behind the...

Fantastic interactive graphic at the NYT reviewing how the shifting tectonic plates in the earth’s crust caused the earthquake and...

Fantastic interactive graphic at the NYT reviewing how the shifting tectonic plates in the earth’s crust caused the earthquake and...

> If you would like to help out those suffering from the effects of the Earthquake/Tsunami, feel free to donate to the Red Cross.

> If you would like to help out those suffering from the effects of the Earthquake/Tsunami, feel free to donate to the Red Cross.

Get subscriber-only insights and news delivered by Barry every two weeks.