Barney Frank: “Re-Deregulating the Economy”

How far off the rails has the GOP gone? Barney Frank is now the voice of reason in the House. (Insane!) ~~~ Source: Barney Frank: GOP...

We have decided to change our stock ranking to reflect current sensibilities more closely. Rankings formerly known as “Buy”...

We have decided to change our stock ranking to reflect current sensibilities more closely. Rankings formerly known as “Buy”...

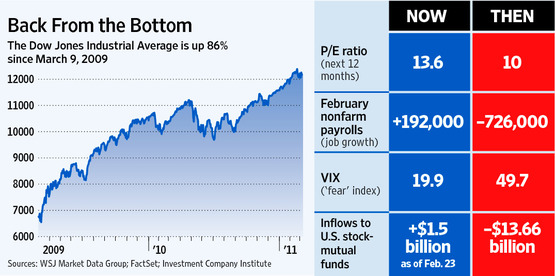

Two seemingly contradictory articles are in the WSJ today: • Dow’s Big Rebound Can’t Erase Doubts • A Serving of Doubt on...

Two seemingly contradictory articles are in the WSJ today: • Dow’s Big Rebound Can’t Erase Doubts • A Serving of Doubt on...

The following was co-authored a former UST employee, now working at another bulge bracket firm and Barry Ritholtz. It is a little inside...

The following was co-authored a former UST employee, now working at another bulge bracket firm and Barry Ritholtz. It is a little inside...

The phrase I was looking for in the last post was “I’ll be gone. You’ll be gone.” Iain Bryson was the first who...

The phrase I was looking for in the last post was “I’ll be gone. You’ll be gone.” Iain Bryson was the first who...

Get subscriber-only insights and news delivered by Barry every two weeks.