The phrase I was looking for in the last post was “I’ll be gone. You’ll be gone.” Iain Bryson was the first who...

The phrase I was looking for in the last post was “I’ll be gone. You’ll be gone.” Iain Bryson was the first who...

Read More

I am trying to track down an expression and its original source I saw some time ago. It is some variation of: Get Yours and Get Out Get...

Read More

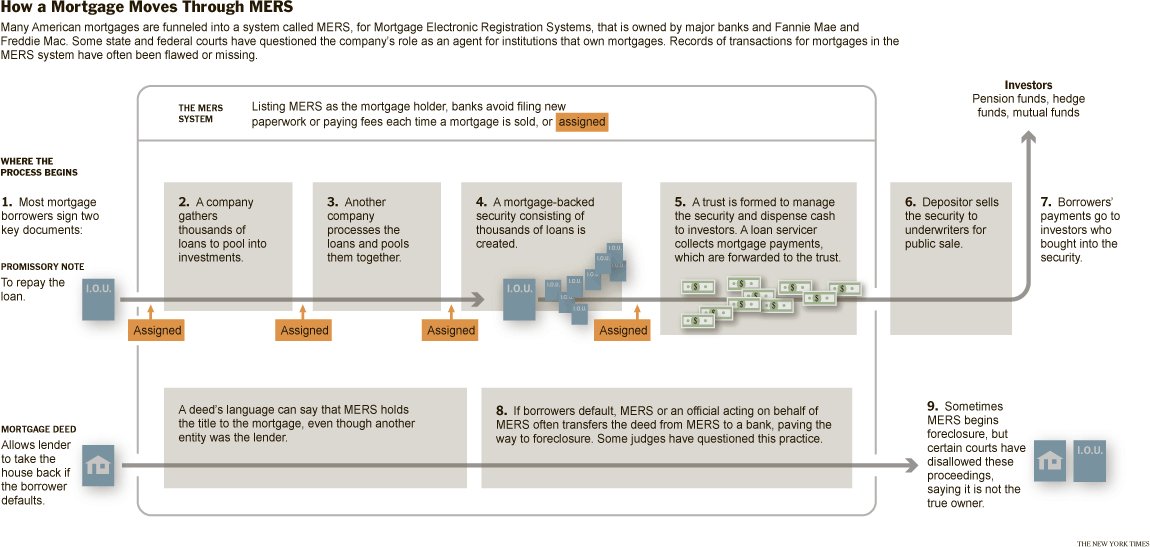

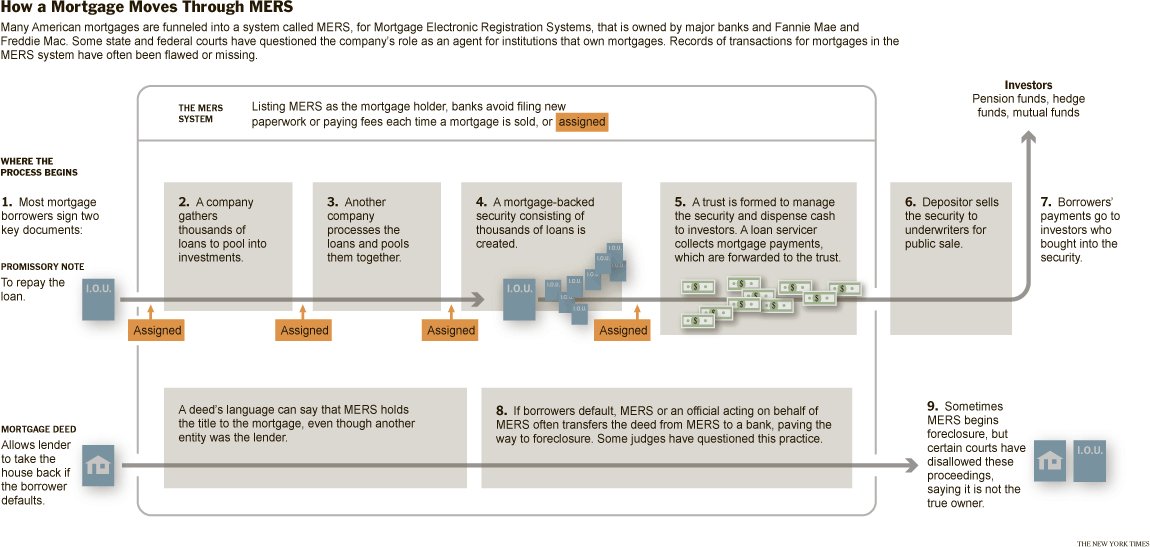

click for larger graphic > Source: MERS? It May Have Swallowed Your Loan MICHAEL POWELL and GRETCHEN MORGENSON NYT, March 5,...

click for larger graphic > Source: MERS? It May Have Swallowed Your Loan MICHAEL POWELL and GRETCHEN MORGENSON NYT, March 5,...

Read More

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Read More

Yosemite Nature Notes – Episode 14 – Horsetail Fall Horsetail Fall is a small, ephemeral waterfall that flows over the...

Read More

Are Booming Economies Good for the Markets? By John Mauldin March 5, 2011 ~~~ The Delusion of Crowds and the Endgame Let the Good Times...

Read More

Here comes some long overdue trouble: “Guilford County Register of Deeds Jeff Thigpen wants an investigation into a service used by...

Read More

I have a ton of errands to get to this weekend (including some WaPo stuff) but before I run out the door, I simply MUST direct your...

Read More

The phrase I was looking for in the last post was “I’ll be gone. You’ll be gone.” Iain Bryson was the first who...

The phrase I was looking for in the last post was “I’ll be gone. You’ll be gone.” Iain Bryson was the first who...

The phrase I was looking for in the last post was “I’ll be gone. You’ll be gone.” Iain Bryson was the first who...

The phrase I was looking for in the last post was “I’ll be gone. You’ll be gone.” Iain Bryson was the first who...