Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Read More

CNBC’s Herb Greenberg explains why some companies shy away from their adoring public, with Frank Aquila, Sullivan & Cromwell,...

Read More

Succinct summation of week’s events: Positives: 1) Payrolls reflect job growth, particularly in private sector 2) ISM mfr’g...

Read More

> Special IPO Edition! I will be on Power Lunch on CNBC at 1:30 pm debating the IPO market with Herb Greenberg, (whose take is here),...

> Special IPO Edition! I will be on Power Lunch on CNBC at 1:30 pm debating the IPO market with Herb Greenberg, (whose take is here),...

Read More

All eyes are on Saudi Arabia right now, especially on Wall Street, as an upcoming planned protest there could send shockwaves through...

Read More

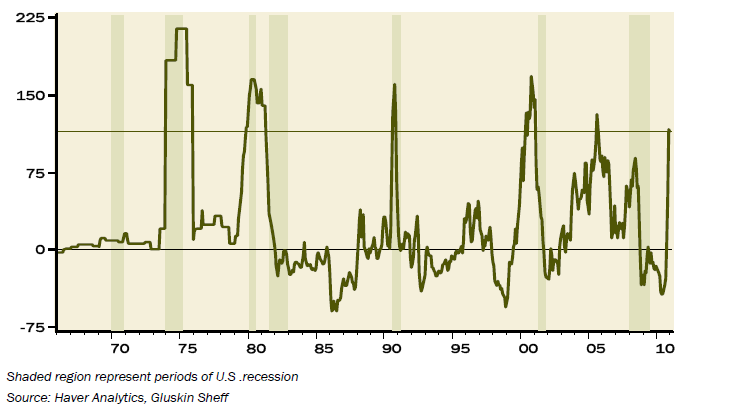

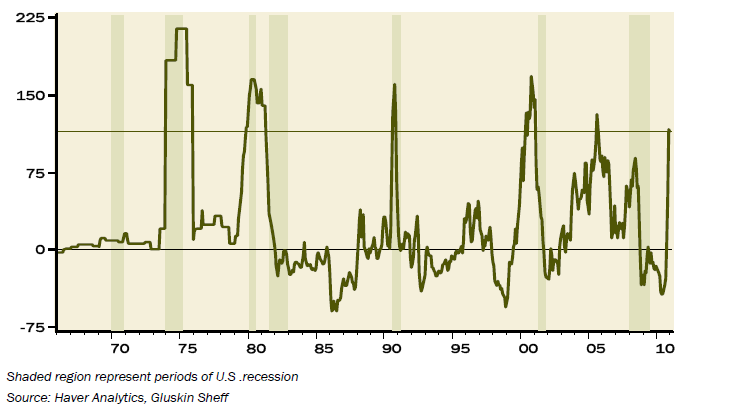

David Rosenberg of Gluskin Sheff calls the current doubling in the spot price of oil a “game changer: “There have been only...

David Rosenberg of Gluskin Sheff calls the current doubling in the spot price of oil a “game changer: “There have been only...

Read More

As a democratic revolution led by tech-empowered young people sweeps the Arab world, Wadah Khanfar, the head of Al Jazeera, shares a...

Read More

BLS: Nonfarm payroll employment increased by 192,000 in February, and the unemployment rate was little changed at 8.9 percent, the U.S....

Read More

Via Wordspy, we learn today’s new phrase: precariat n. People whose lives are precarious because they have little or no job...

Read More

Feb Payrolls rose by 192k, 4k less than expected but private sector job gains totaled 222k, 22k above forecasts. To smooth the influence...

Read More

> Special IPO Edition! I will be on Power Lunch on CNBC at 1:30 pm debating the IPO market with Herb Greenberg, (whose take is here),...

> Special IPO Edition! I will be on Power Lunch on CNBC at 1:30 pm debating the IPO market with Herb Greenberg, (whose take is here),...

David Rosenberg of Gluskin Sheff calls the current doubling in the spot price of oil a “game changer: “There have been only...

David Rosenberg of Gluskin Sheff calls the current doubling in the spot price of oil a “game changer: “There have been only...