Your Preview to Next Week’s Saudi ‘Day of Rage’

All eyes are on Saudi Arabia right now, especially on Wall Street, as an upcoming planned protest there could send shockwaves through...

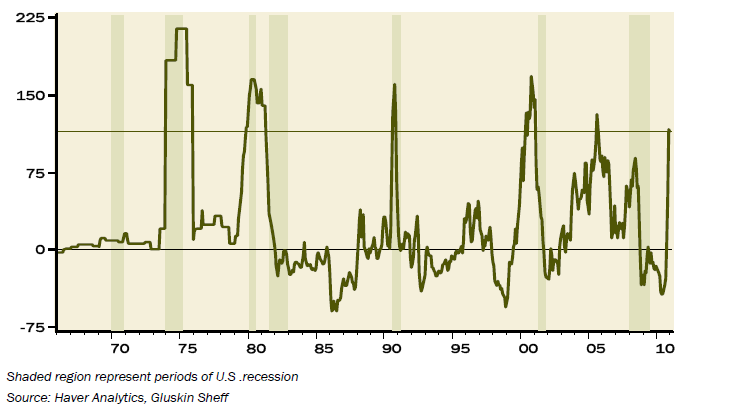

David Rosenberg of Gluskin Sheff calls the current doubling in the spot price of oil a “game changer: “There have been only...

David Rosenberg of Gluskin Sheff calls the current doubling in the spot price of oil a “game changer: “There have been only...

Traveling in California today we witnessed $4.00 gas and prompted us to think what makes up the price. We constructed the following...

Traveling in California today we witnessed $4.00 gas and prompted us to think what makes up the price. We constructed the following...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Get subscriber-only insights and news delivered by Barry every two weeks.