Wednesday Reads

My afternoon reading material: • Sexual Economics, Erotic Capital (Slate) • Bernanke Doesn’t Rule Out More Bond Buying to Aid...

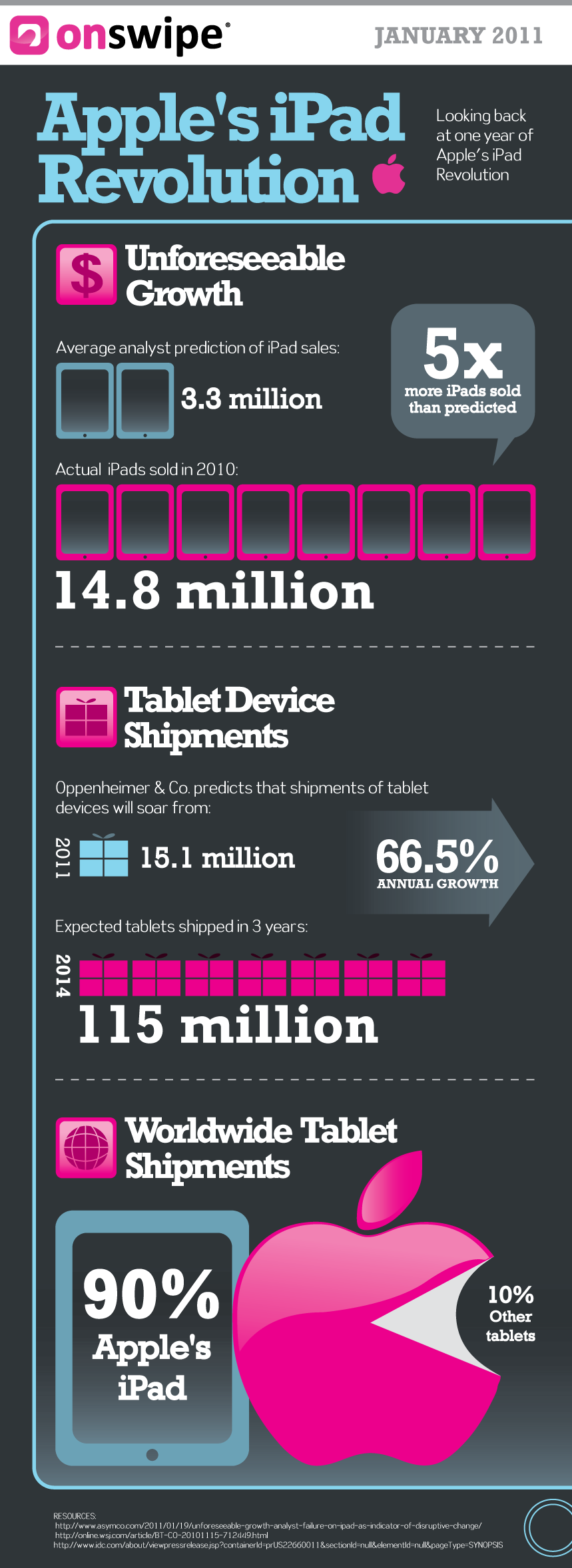

In light of today’s new iPad 2 announcement, let’s have a look at the data via the this handy infographic: > via OnSwipe

In light of today’s new iPad 2 announcement, let’s have a look at the data via the this handy infographic: > via OnSwipe

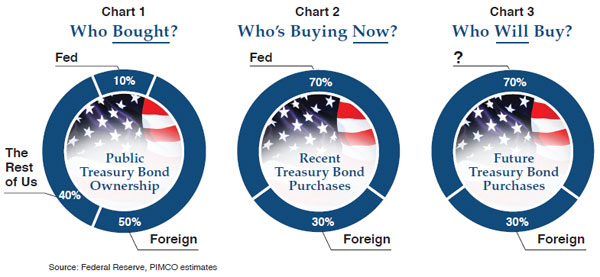

Today’s chart comes to us via PIMCO’s Bill Gross: > Chart via PIMCO > Gross describes the issue thusly: “What an...

Today’s chart comes to us via PIMCO’s Bill Gross: > Chart via PIMCO > Gross describes the issue thusly: “What an...

Get subscriber-only insights and news delivered by Barry every two weeks.