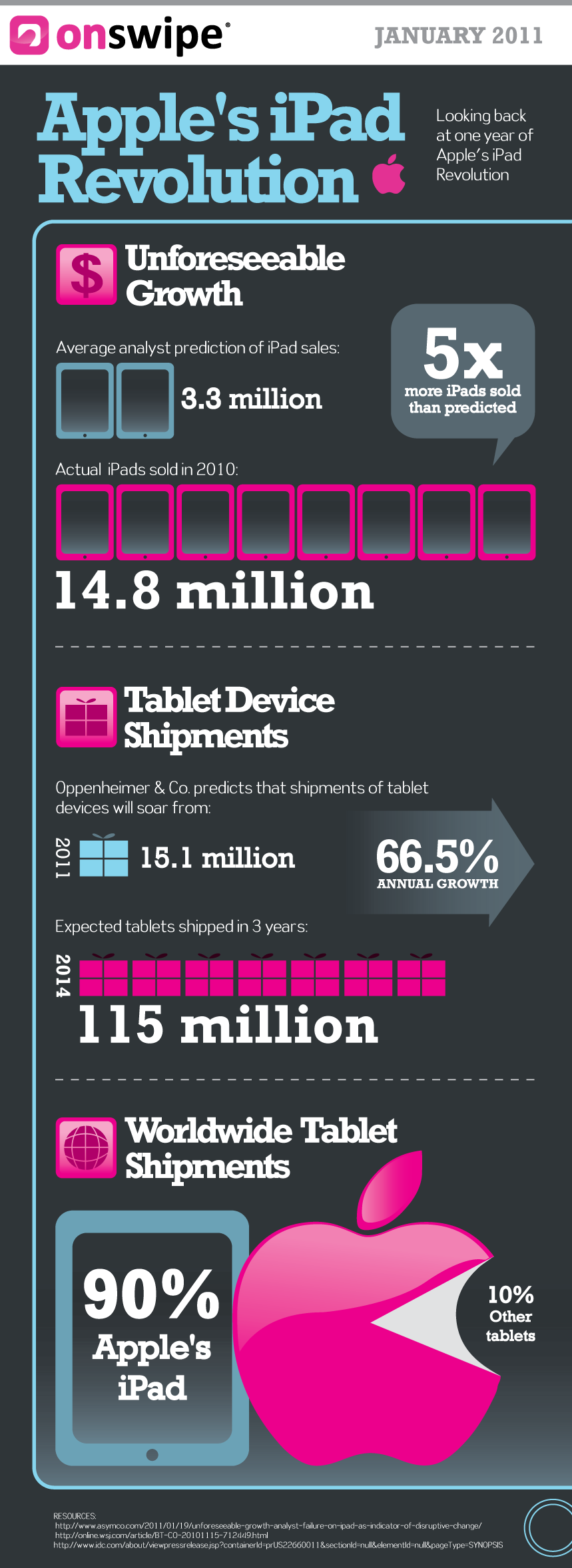

Apple iPad (1.0) Data

In light of today’s new iPad 2 announcement, let’s have a look at the data via the this handy infographic: > via OnSwipe

In light of today’s new iPad 2 announcement, let’s have a look at the data via the this handy infographic: > via OnSwipe

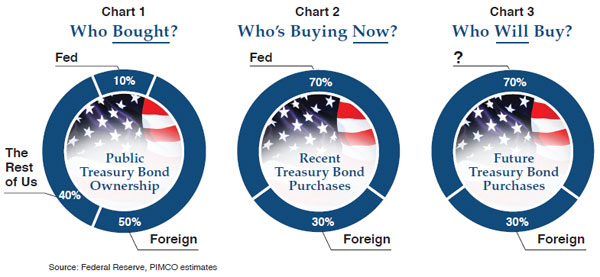

Who Will Buy Treasuries When the Fed Doesn’t?

Today’s chart comes to us via PIMCO’s Bill Gross: > Chart via PIMCO > Gross describes the issue thusly: “What an...

Today’s chart comes to us via PIMCO’s Bill Gross: > Chart via PIMCO > Gross describes the issue thusly: “What an...

Live Blogging iPad 2

My favorite source for these things is John Paczkowski at All Things Digital. If you are interested in the new iPad, thats your best live...

QOTD: Performance-Enhancing Drugs

Today’s quote is a Doozie: > “A lot of national economies are still on performance-enhancing drugs. It will be interesting to...

Warren Buffet on Squawk Box (all 12 videos)

Buffett: Not Worried About Oil Warren Buffett, Berkshire Hathaway CEO, says he doesn’t worry about where oil prices are going....

Roubini: $100 billion of municipal-bond defaults

Alternative title: Chasing Whitney: “A consulting firm founded by economist Nouriel Roubini said there could be close to $100...

Morning news

Saudi stocks are down another 4%, lower by 15% over the past four days and lower by 22% from the peak in Jan. I’ve seen no new news...

Pentagon Tries to Blame Financial Crisis on Foreign Financial...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Street Fight: Political Risks to Markets

Insight on whether investors will see a pullback or end of the rally, with Barry Ritholtz, FusionIQ. Airtime: Tues. Mar. 1 2011 | :15:0...