$100 Oil!

$100 Oil! David R. Kotok February 28, 2011 www.cumber.com > ~~~ Some folks look at the $100 oil price and conclude that it has...

Bruce Bartlett pings me with this free eBook: What a Federal Consumption Tax Would Mean for America (click for free eBook): > >

Bruce Bartlett pings me with this free eBook: What a Federal Consumption Tax Would Mean for America (click for free eBook): > >

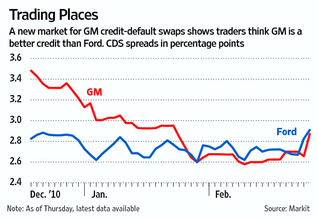

A mere technicality, my good man! WSJ: “Banks and hedge funds are trading credit-default swaps, which make payments to holders of...

A mere technicality, my good man! WSJ: “Banks and hedge funds are trading credit-default swaps, which make payments to holders of...

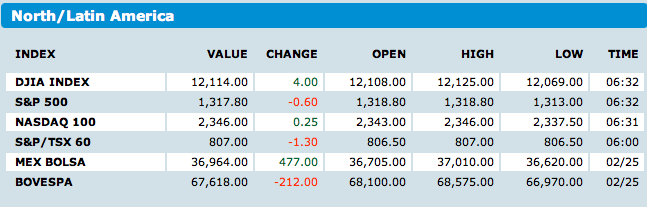

Its good to be back home. We have a busy week coming up — lots of economic data culminating in NFP on Friday. Before then, there...

Its good to be back home. We have a busy week coming up — lots of economic data culminating in NFP on Friday. Before then, there...

Get subscriber-only insights and news delivered by Barry every two weeks.