Fed Drawing Up QE3?

Fed Drawing Up QE3? CNBC’s Steve Liesman as the details on what former Federal Reserve vice chairman Donald Kohn has to say about...

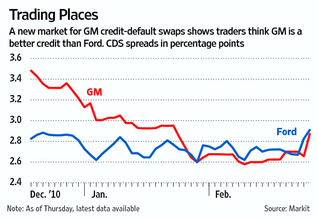

A mere technicality, my good man! WSJ: “Banks and hedge funds are trading credit-default swaps, which make payments to holders of...

A mere technicality, my good man! WSJ: “Banks and hedge funds are trading credit-default swaps, which make payments to holders of...

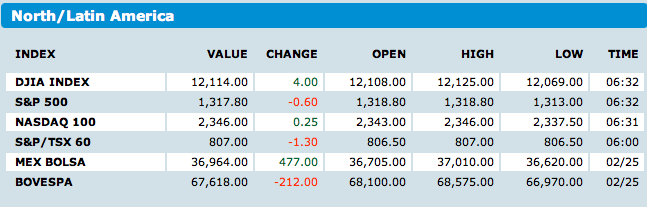

Its good to be back home. We have a busy week coming up — lots of economic data culminating in NFP on Friday. Before then, there...

Its good to be back home. We have a busy week coming up — lots of economic data culminating in NFP on Friday. Before then, there...

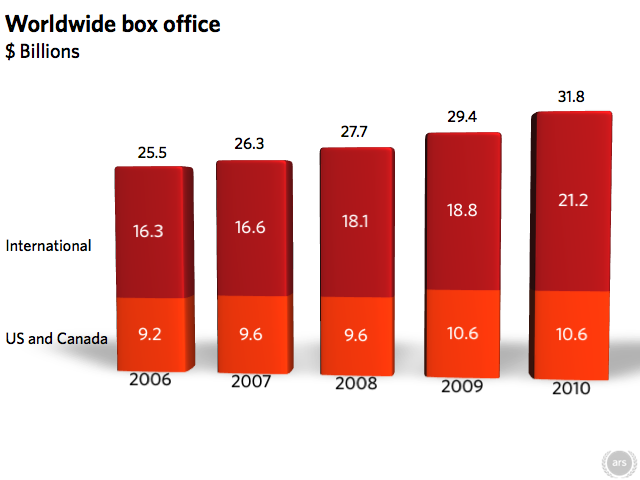

Tonight is the big Oscar show — beforehand, I thought it might be fun to have a look at some data. Let’s start with box...

Tonight is the big Oscar show — beforehand, I thought it might be fun to have a look at some data. Let’s start with box...

The best sellers of fiction and nonfiction titles on a single list. Note the fascinating breakdown of eBook + Print versions of these top...

The best sellers of fiction and nonfiction titles on a single list. Note the fascinating breakdown of eBook + Print versions of these top...

When Irish Eyes Are Voting By John Mauldin February 26, 2011 > When Irish Eyes Are Voting An Extra “15 Million” Homes Some...

When Irish Eyes Are Voting By John Mauldin February 26, 2011 > When Irish Eyes Are Voting An Extra “15 Million” Homes Some...

Get subscriber-only insights and news delivered by Barry every two weeks.