Back Home

Back home after a little R&R — unpacking, relaxing, and thinking about the coming next few months. They should be interesting....

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Last fall I was listening to NPR’s On The Media podcast: Photojournalism and Foreclosure which opened my eyes to the genre....

Last fall I was listening to NPR’s On The Media podcast: Photojournalism and Foreclosure which opened my eyes to the genre....

Williams-Sonoma is nowcarrying a selection of specialty brewing equipment and accessories from Hario, a glass-manufacturing giant from...

Williams-Sonoma is nowcarrying a selection of specialty brewing equipment and accessories from Hario, a glass-manufacturing giant from...

Given the unrest in the Middle East we’re hearing a lot of noise these days about how the U.S. is totally dependent on oil imports from...

Given the unrest in the Middle East we’re hearing a lot of noise these days about how the U.S. is totally dependent on oil imports from...

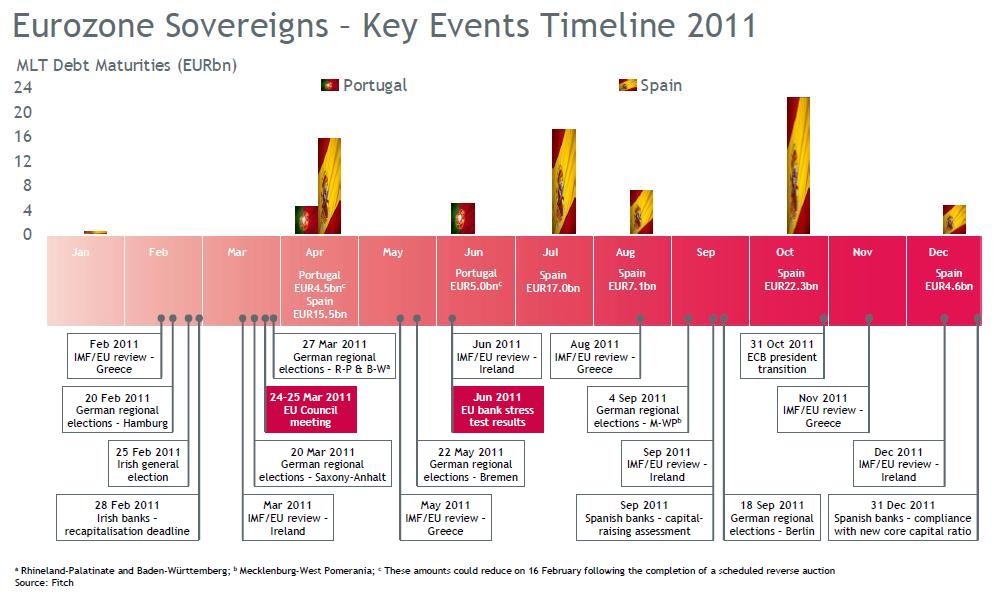

via FT Alphaville, Fitch Ratings has come up with a timeline of upcoming events that they expect will “help shape the direction” of...

via FT Alphaville, Fitch Ratings has come up with a timeline of upcoming events that they expect will “help shape the direction” of...

by Richard Russell Dow Theory Letters Recently by Richard Russell: The Red Arrows MAKING MONEY: The most popular piece I’ve...

by Richard Russell Dow Theory Letters Recently by Richard Russell: The Red Arrows MAKING MONEY: The most popular piece I’ve...

Get subscriber-only insights and news delivered by Barry every two weeks.