Williams-Sonoma is nowcarrying a selection of specialty brewing equipment and accessories from Hario, a glass-manufacturing giant from...

Williams-Sonoma is nowcarrying a selection of specialty brewing equipment and accessories from Hario, a glass-manufacturing giant from...

Read More

Given the unrest in the Middle East we’re hearing a lot of noise these days about how the U.S. is totally dependent on oil imports from...

Given the unrest in the Middle East we’re hearing a lot of noise these days about how the U.S. is totally dependent on oil imports from...

Read More

Max Gunther set forth basic trading principles called The Zurich Axioms: On Risk: – Worry is not a sickness but a sign of health...

Read More

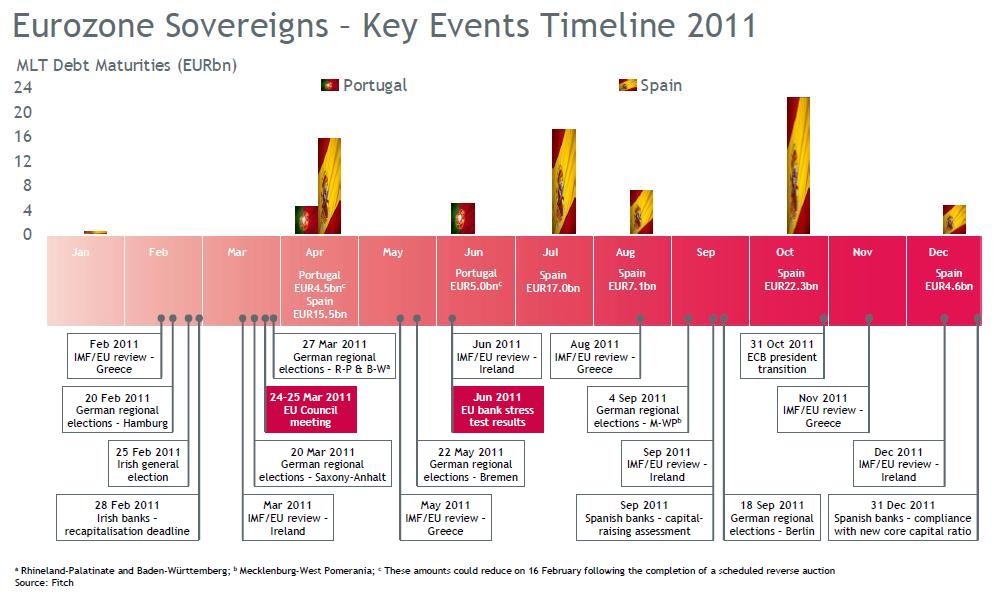

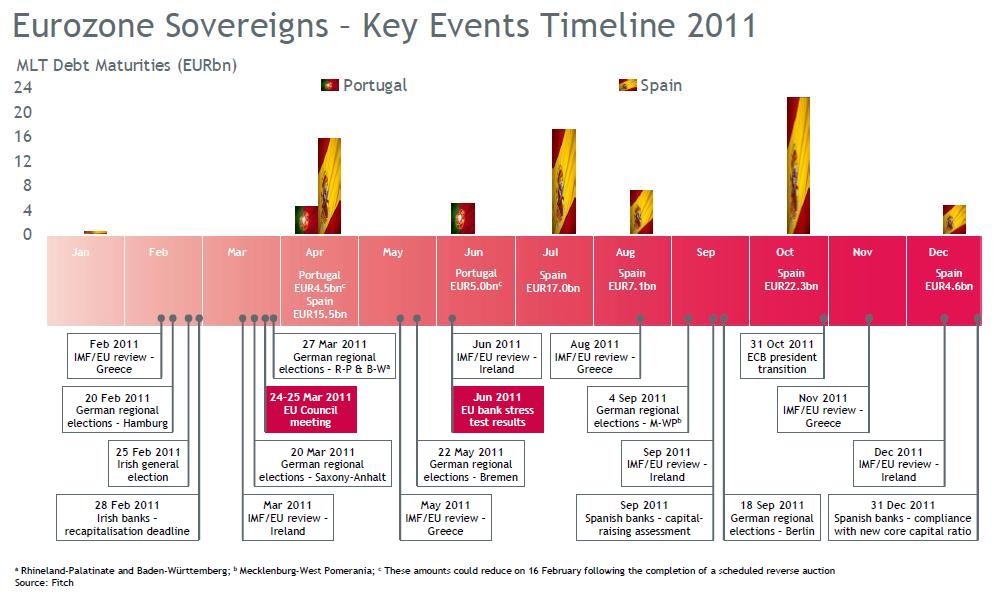

via FT Alphaville, Fitch Ratings has come up with a timeline of upcoming events that they expect will “help shape the direction” of...

via FT Alphaville, Fitch Ratings has come up with a timeline of upcoming events that they expect will “help shape the direction” of...

Read More

by Richard Russell Dow Theory Letters Recently by Richard Russell: The Red Arrows MAKING MONEY: The most popular piece I’ve...

by Richard Russell Dow Theory Letters Recently by Richard Russell: The Red Arrows MAKING MONEY: The most popular piece I’ve...

Read More

These are the articles I have open on my laptop for in-flight reading: • Is this bull market almost over, or will it thrive for years?...

Read More

Work-life balance, says Nigel Marsh, is too important to be left in the hands of your employer. At TEDxSydney, Marsh lays out an ideal...

Read More

Edward Harrison | February 2011 10:00 Here is my mantra regarding so-called ‘unsustainable’ debt levels. I feel strongly about this...

Read More

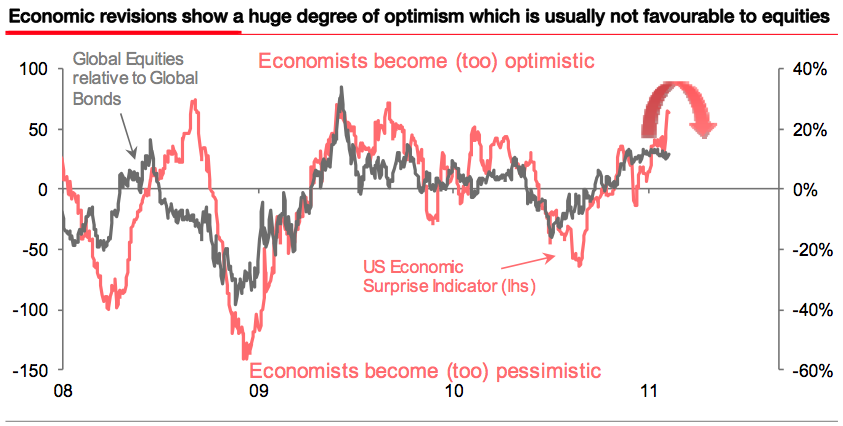

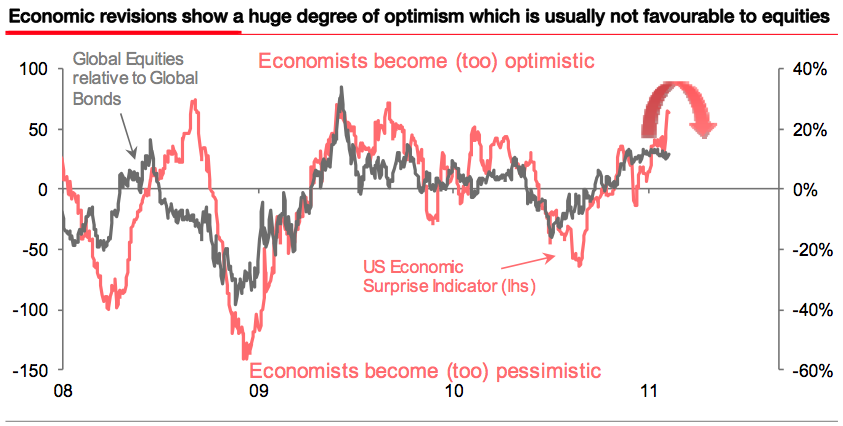

Alain Bokobza of the Société Générale Quant team, writes that their “Economic surprise indicator” suggests risky assets...

Alain Bokobza of the Société Générale Quant team, writes that their “Economic surprise indicator” suggests risky assets...

Read More

> A quick note on Oil futures in the US: They are showing $96 on mideastern unrest. In the Us, rising gas prices, and increasing...

> A quick note on Oil futures in the US: They are showing $96 on mideastern unrest. In the Us, rising gas prices, and increasing...

Read More

Williams-Sonoma is nowcarrying a selection of specialty brewing equipment and accessories from Hario, a glass-manufacturing giant from...

Williams-Sonoma is nowcarrying a selection of specialty brewing equipment and accessories from Hario, a glass-manufacturing giant from...

Williams-Sonoma is nowcarrying a selection of specialty brewing equipment and accessories from Hario, a glass-manufacturing giant from...

Williams-Sonoma is nowcarrying a selection of specialty brewing equipment and accessories from Hario, a glass-manufacturing giant from...