> A quick note on Oil futures in the US: They are showing $96 on mideastern unrest. In the Us, rising gas prices, and increasing...

> A quick note on Oil futures in the US: They are showing $96 on mideastern unrest. In the Us, rising gas prices, and increasing...

Read More

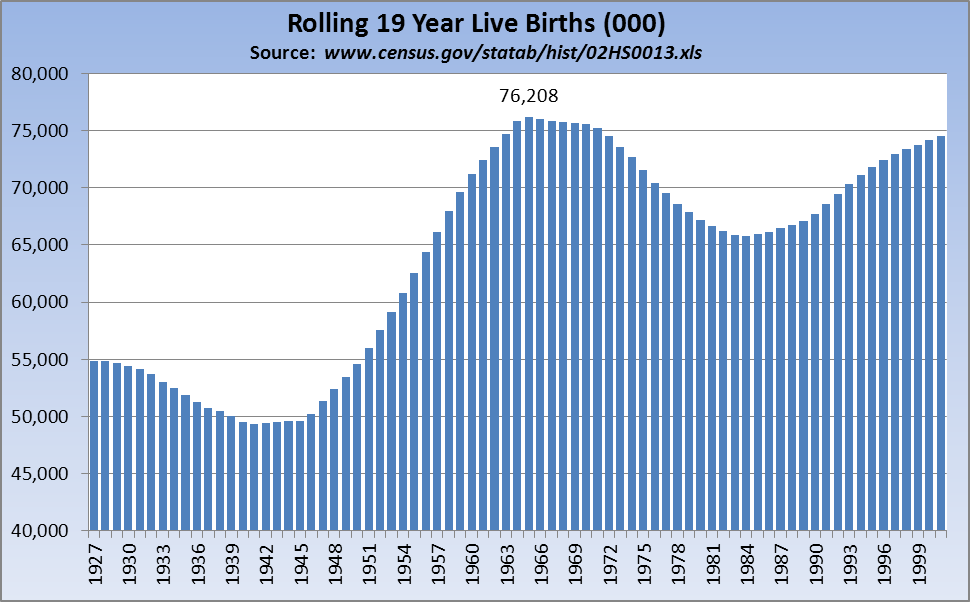

SEMINAR: Understanding Today’s Housing Market, 1Q11 April 4, 2011 – 4:00 pm-7:15 pm Scandinavia House, 58 Park Avenue (at 38th...

SEMINAR: Understanding Today’s Housing Market, 1Q11 April 4, 2011 – 4:00 pm-7:15 pm Scandinavia House, 58 Park Avenue (at 38th...

Read More

While the story of the collapse of the Celtic Tiger is not a new story, I did enjoy Theodore Dalrymple’s recent piece in City...

Read More

by William K. Black Originally published December 4th, 2008, cato-unbound.org > Our different views prove that hindsight is often...

Read More

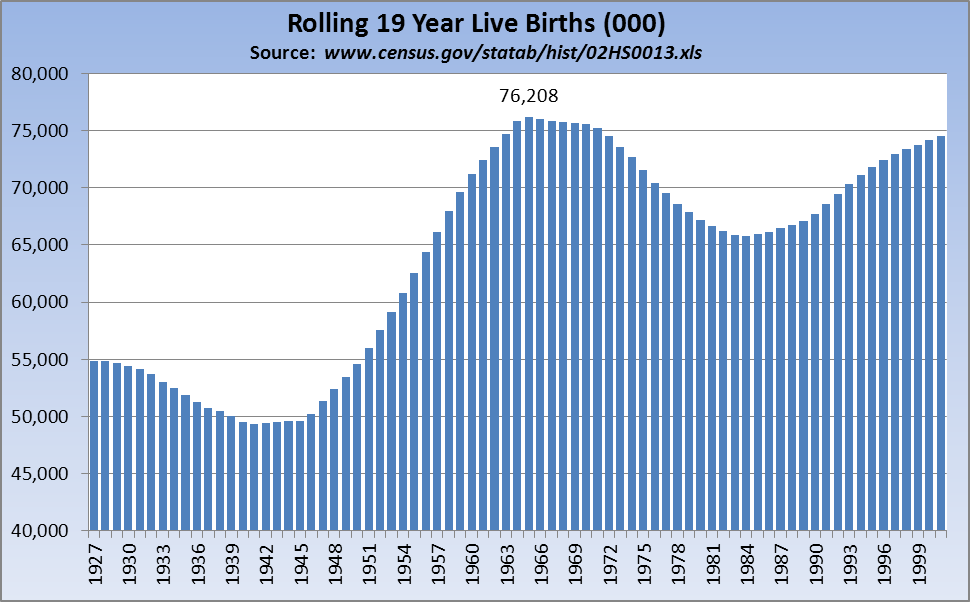

Chart Store week continues at the Big Picture. Today’s TCS table looks at rolling 102 week returns (previously reviewed as Another Look...

Chart Store week continues at the Big Picture. Today’s TCS table looks at rolling 102 week returns (previously reviewed as Another Look...

Read More

The Maestro: “Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for...

Read More

A video honoring Ronaldo Luís Nazário de Lima, the greatest pure striker to ever grace the game. He has been an icon and a star of the...

Read More

With the recent passing of what would have been Ronald Reagan’s 100th birthday — and with President Obama having invoked...

With the recent passing of what would have been Ronald Reagan’s 100th birthday — and with President Obama having invoked...

Read More

Barry is taking a well needed break but I’m certain he’s never far from his laptop. He asked me to drop in occasionally so...

Read More

Bill Black is the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of...

Read More

> A quick note on Oil futures in the US: They are showing $96 on mideastern unrest. In the Us, rising gas prices, and increasing...

> A quick note on Oil futures in the US: They are showing $96 on mideastern unrest. In the Us, rising gas prices, and increasing...

> A quick note on Oil futures in the US: They are showing $96 on mideastern unrest. In the Us, rising gas prices, and increasing...

> A quick note on Oil futures in the US: They are showing $96 on mideastern unrest. In the Us, rising gas prices, and increasing...