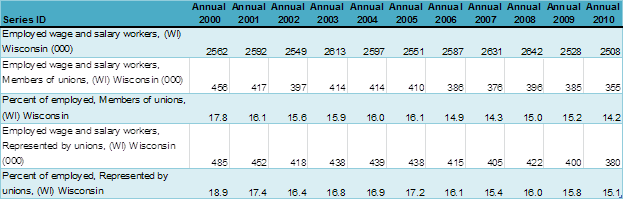

Having gotten curious about the situation in Wisconsin, I decided to see what data I could pull to get a feel for the size and scope of...

Having gotten curious about the situation in Wisconsin, I decided to see what data I could pull to get a feel for the size and scope of...

Read More

Richard W. Arms, Jr., is one of the world’s most respected Stock Market personalities. His technical work is used worldwide and he has...

Read More

First the Fed, now the B of E: Spencer Dale, the Bank of England’s Chief Economist, is joining hawkish bankers Andrew Sentance and...

Read More

Gaddafi’s Rule Appears in Jeopardy Libyan leader Muammar Gaddafi’s four-decade-old rule appeared in increasing jeopardy on...

Read More

Its likely a coincidence, but my travel history has the markets doing odd things when I roam. The 2000 top and 2003 bottom, the October...

Its likely a coincidence, but my travel history has the markets doing odd things when I roam. The 2000 top and 2003 bottom, the October...

Read More

Tim du Toit is the editor and founder of Eurosharelab. He has more than 20 year of institutional and personal investing experience in...

Read More

While I am traveling, its going to be The Chart Store week here at the Big Picture. I will feature a different TCS graph every day. If...

While I am traveling, its going to be The Chart Store week here at the Big Picture. I will feature a different TCS graph every day. If...

Read More

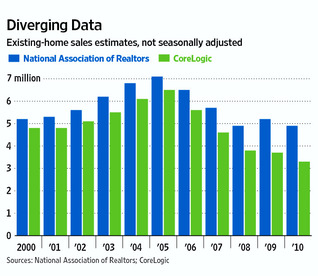

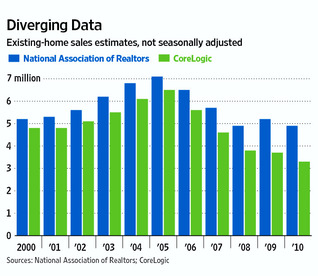

Last week, we discussed data that suggested the NAR has been dramatically overstating home sales and understating stating inventory. I...

Last week, we discussed data that suggested the NAR has been dramatically overstating home sales and understating stating inventory. I...

Read More

Mike Konczal is a fellow with the Roosevelt Institute, and is a blogger at the Rortybomb Blog and New Deal 2.0. Originally posted here...

Read More

Check out William Worthington Fowler’s description of Wall Street, circa 1870: “To the merchant and banker it is a financial...

Check out William Worthington Fowler’s description of Wall Street, circa 1870: “To the merchant and banker it is a financial...

Read More

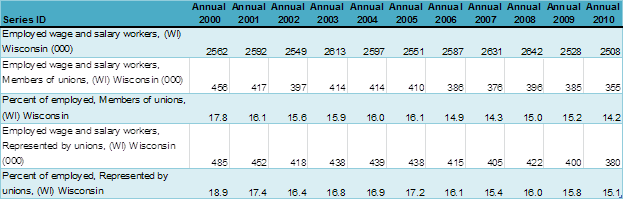

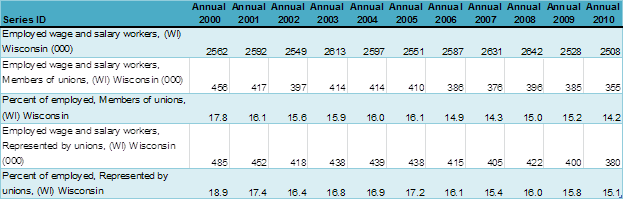

Having gotten curious about the situation in Wisconsin, I decided to see what data I could pull to get a feel for the size and scope of...

Having gotten curious about the situation in Wisconsin, I decided to see what data I could pull to get a feel for the size and scope of...

Having gotten curious about the situation in Wisconsin, I decided to see what data I could pull to get a feel for the size and scope of...

Having gotten curious about the situation in Wisconsin, I decided to see what data I could pull to get a feel for the size and scope of...