The Investment Answer

“The Investment Answer” is broken down into five main principles: 1. Hire a fee-only, independent financial advisor, not a...

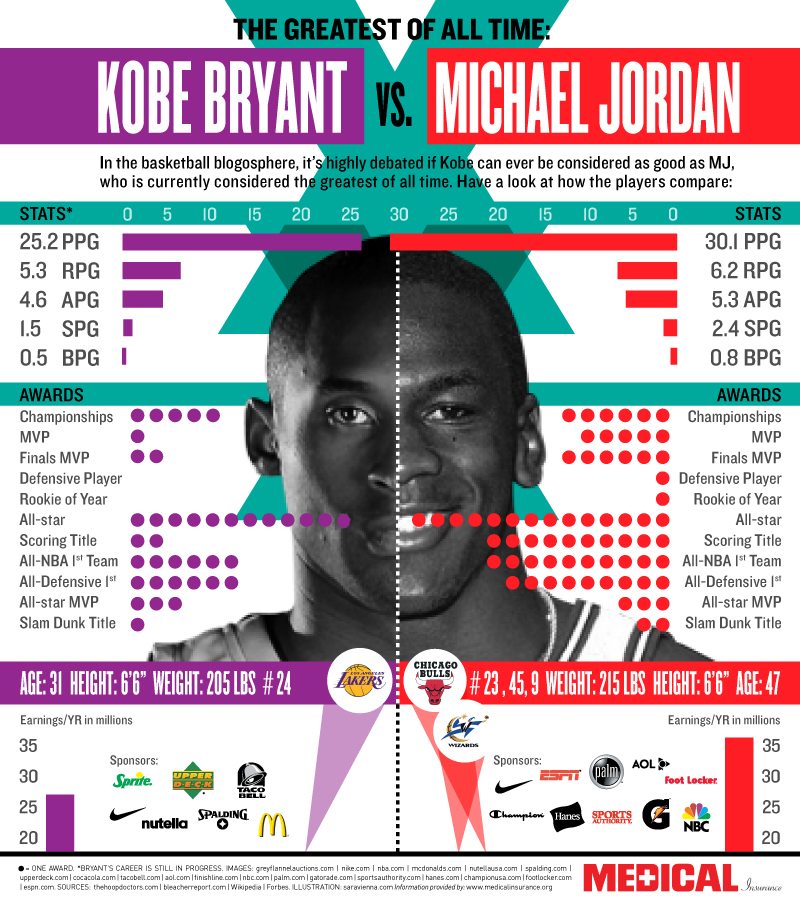

I’ve really enjoyed watching the Lakers over the past few years, but there really isn’t a contest (via Daily Infographic)...

I’ve really enjoyed watching the Lakers over the past few years, but there really isn’t a contest (via Daily Infographic)...

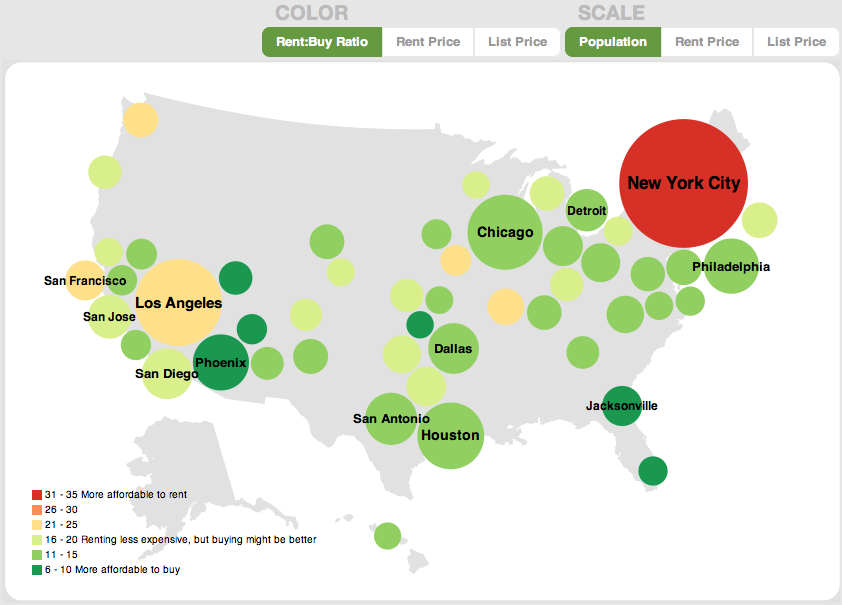

By the time Case Shiller drops today at 9am, I will be very busy (lounging on the beach). Expections are for the biggest drop in home...

By the time Case Shiller drops today at 9am, I will be very busy (lounging on the beach). Expections are for the biggest drop in home...

Probable Outcomes by Ed Easterling. ~~~ Crestmont Research’s Ed Easterling is a fellow traveler — a student of long term...

Probable Outcomes by Ed Easterling. ~~~ Crestmont Research’s Ed Easterling is a fellow traveler — a student of long term...

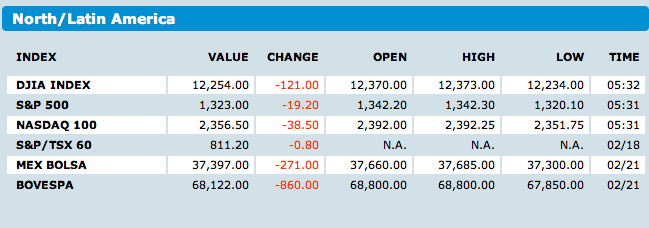

click for updated futures > As prophesied on Sunday, my travel plans have once again caused a dislocation in the global balance of...

click for updated futures > As prophesied on Sunday, my travel plans have once again caused a dislocation in the global balance of...

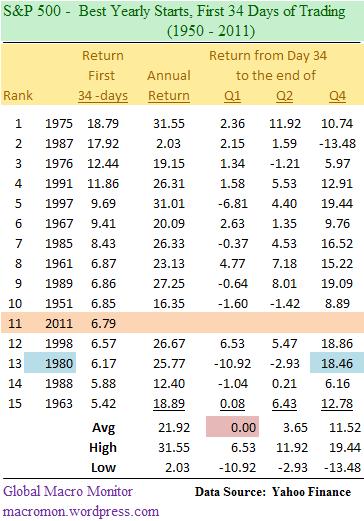

The S&P 500 is off to its best start of the year since 1997 and ranks 11th with respect to the highest return for the first 34 days...

The S&P 500 is off to its best start of the year since 1997 and ranks 11th with respect to the highest return for the first 34 days...

Via The Chart Store, this chart shows trough to peak gains in the Bush and Obama rallies. Discuss: >

Via The Chart Store, this chart shows trough to peak gains in the Bush and Obama rallies. Discuss: >

Get subscriber-only insights and news delivered by Barry every two weeks.