Facebook and Twitter Are Changing the Middle East

In an interview with WSJ’s Alan Murray, social media expert Clay Shirky discusses the effect of Facebook, Twitter and other social...

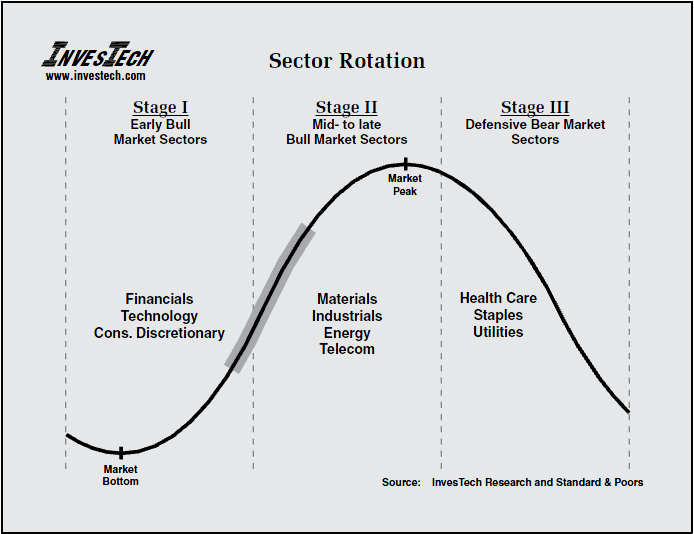

Here is another one of our favorite charts, courtesy of Jim Stack and Investech Research. It shows how leadership shifts over three...

Here is another one of our favorite charts, courtesy of Jim Stack and Investech Research. It shows how leadership shifts over three...

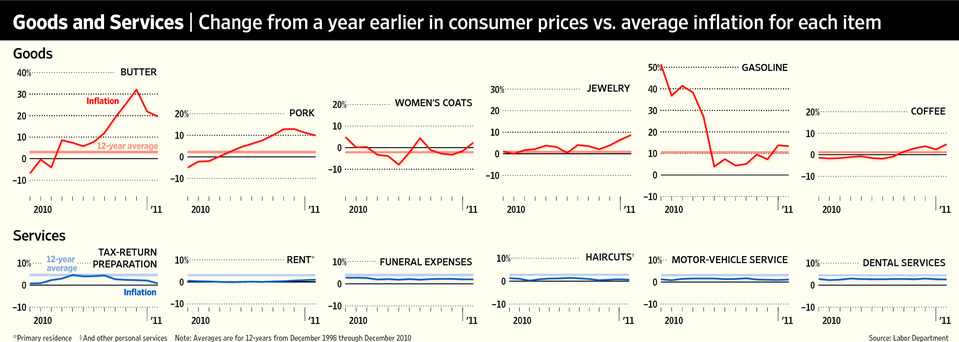

Today’s must read MSM piece is the WSJ discussion of Inflation: “The pace of consumer price increases in the U.S. is...

Today’s must read MSM piece is the WSJ discussion of Inflation: “The pace of consumer price increases in the U.S. is...

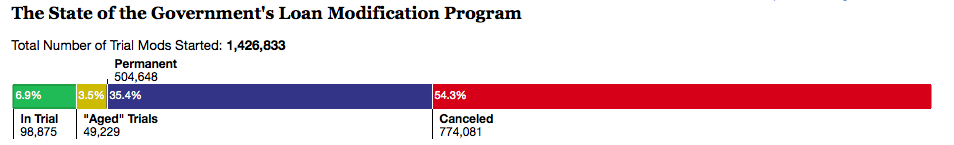

> Short answer: Not very well. According to numbers crunched by ProPublica, more than half of the 1,426,833 mortgage mods —...

> Short answer: Not very well. According to numbers crunched by ProPublica, more than half of the 1,426,833 mortgage mods —...

Get subscriber-only insights and news delivered by Barry every two weeks.