Khamsin

Khamsin February, 17, 2011 David R. Kotok > “This is not just a warm wind, but a dust-laden, suffocating hot wind! It blows in...

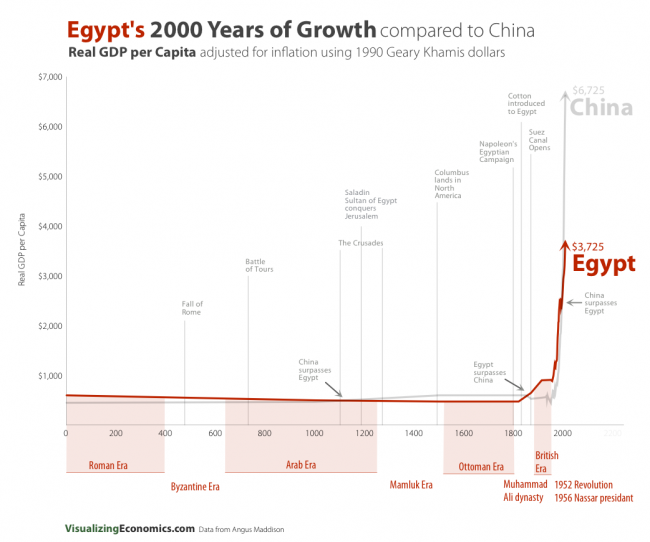

Long-term growth of both Egypt and China, via Visualizing Economics, charted over the past 20 centuries: > click for ginormous version

Long-term growth of both Egypt and China, via Visualizing Economics, charted over the past 20 centuries: > click for ginormous version

Richard Vetstein is a nationally recognized real estate attorney, frequently quoted in the media. He was recently named one of Inman...

Richard Vetstein is a nationally recognized real estate attorney, frequently quoted in the media. He was recently named one of Inman...

Get subscriber-only insights and news delivered by Barry every two weeks.