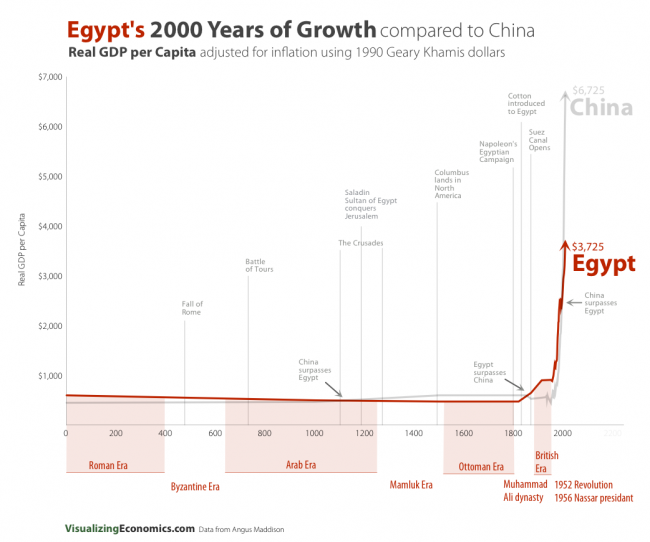

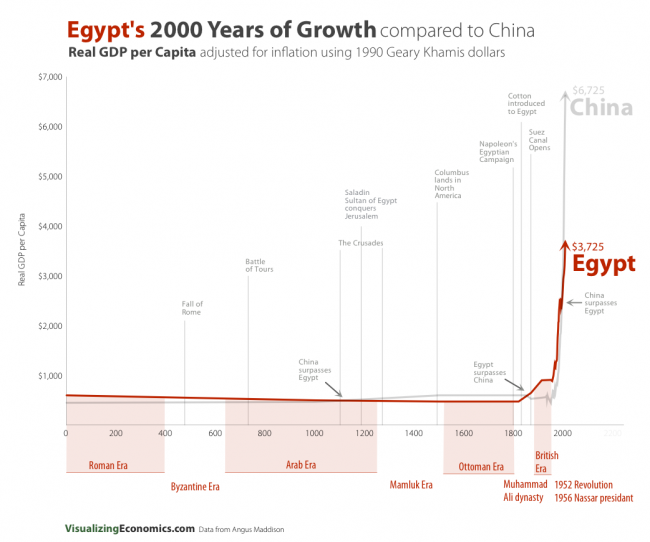

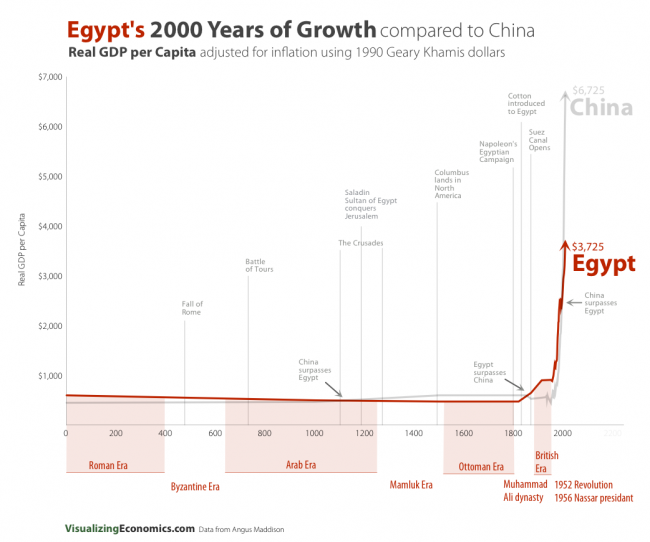

Long-term growth of both Egypt and China, via Visualizing Economics, charted over the past 20 centuries: > click for ginormous version

Long-term growth of both Egypt and China, via Visualizing Economics, charted over the past 20 centuries: > click for ginormous version

Read More

Jan CPI rose .4% m/o/m headline, .2% m/o/m core, both above expectations of up .3% and .1%. The .4% gain is for a 2nd straight month and...

Read More

“Beginning in 2006, NAR’s sales numbers began to look even more inflated relative to data collected by CoreLogic, the...

Read More

Richard Vetstein is a nationally recognized real estate attorney, frequently quoted in the media. He was recently named one of Inman...

Richard Vetstein is a nationally recognized real estate attorney, frequently quoted in the media. He was recently named one of Inman...

Read More

Mortgage Electronic Registration Systems, aka MERS, finds itself in a bit of a pickle. The bank owned entity created to facilitate mass...

Read More

See if you can spot the theme: • Matt Taibbi: Why Isn’t Wall Street in Jail? (Rolling Stone) • Michael Lewis: All You Need to...

Read More

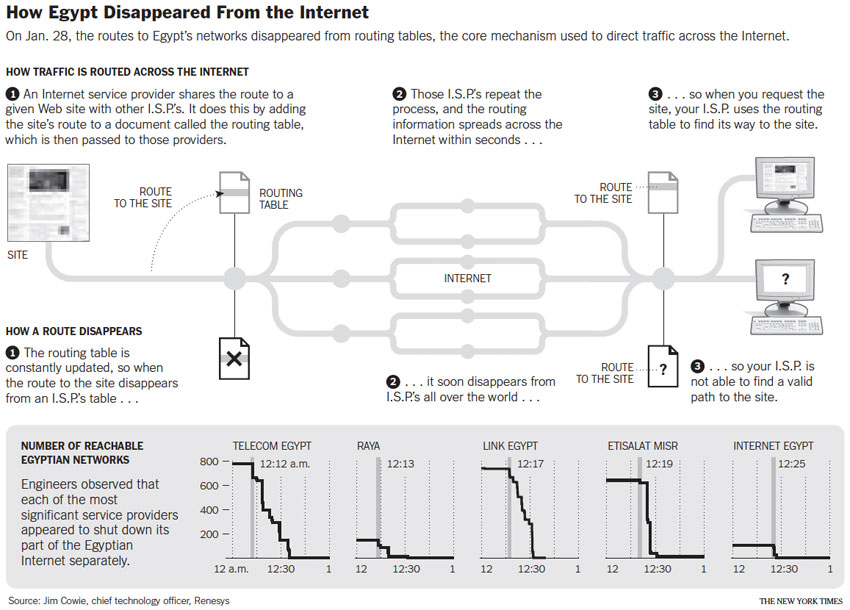

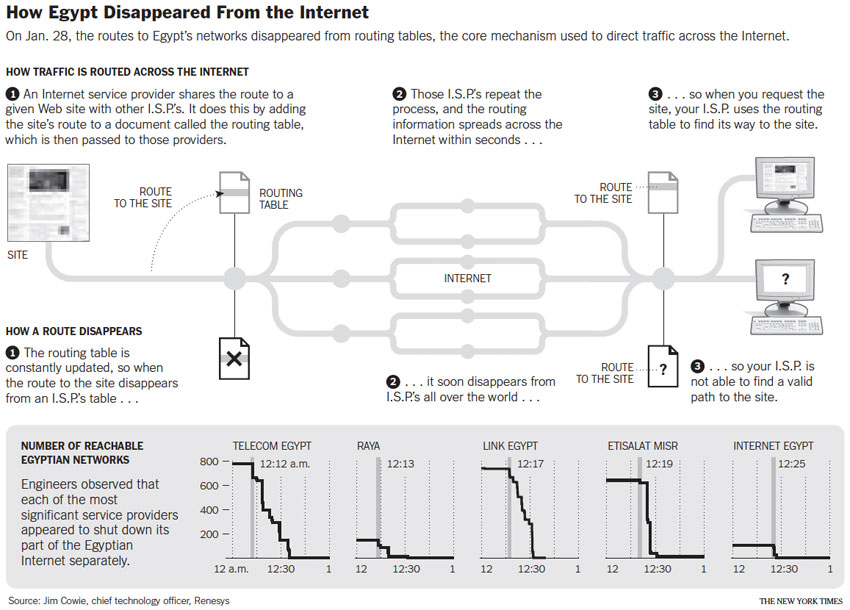

How Egypt Disappeared From the Internet > click for larger graphic > Source: Egypt Leaders Found ‘Off’ Switch for Internet...

How Egypt Disappeared From the Internet > click for larger graphic > Source: Egypt Leaders Found ‘Off’ Switch for Internet...

Read More

Fed Worries about “Fewer People Looking for Work” February 16, 2011 David R. Kotok > “Following the loss of about 8-3/4 million...

Read More

Long-term growth of both Egypt and China, via Visualizing Economics, charted over the past 20 centuries: > click for ginormous version

Long-term growth of both Egypt and China, via Visualizing Economics, charted over the past 20 centuries: > click for ginormous version

Long-term growth of both Egypt and China, via Visualizing Economics, charted over the past 20 centuries: > click for ginormous version

Long-term growth of both Egypt and China, via Visualizing Economics, charted over the past 20 centuries: > click for ginormous version