Trading Rules, Aphorisms & Books

Expat writes: I am interested in your opinion and advice. I traded oil for eighteen years before retiring to the south of France where I...

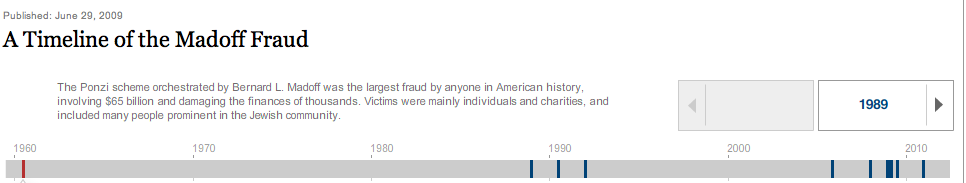

“They had to know. But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ” -Bernie Madoff...

“They had to know. But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ” -Bernie Madoff...

> The Bloomberg chart above compares year-to-year percentage changes in labor costs and consumer prices — from 1950 to...

> The Bloomberg chart above compares year-to-year percentage changes in labor costs and consumer prices — from 1950 to...

> What a stock market! Just 29 days (11.5 percent of the year) of trading into the year and the S&P500 is already up 5.94...

> What a stock market! Just 29 days (11.5 percent of the year) of trading into the year and the S&P500 is already up 5.94...

Get subscriber-only insights and news delivered by Barry every two weeks.