“They had to know. But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ” -Bernie Madoff...

“They had to know. But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ” -Bernie Madoff...

Read More

Source: Bernanke’s Off the Hook: Emerging Markets Are Really to Blame for Rising Food Prices, Says Bremmer Stacy Curtin Yahoo Tech...

Read More

• Great Inflation Debate: Big Week for Inflationistas (Marketbeat) • Bubblemania: Is It Time to be Skeptical of the Skeptics?...

Read More

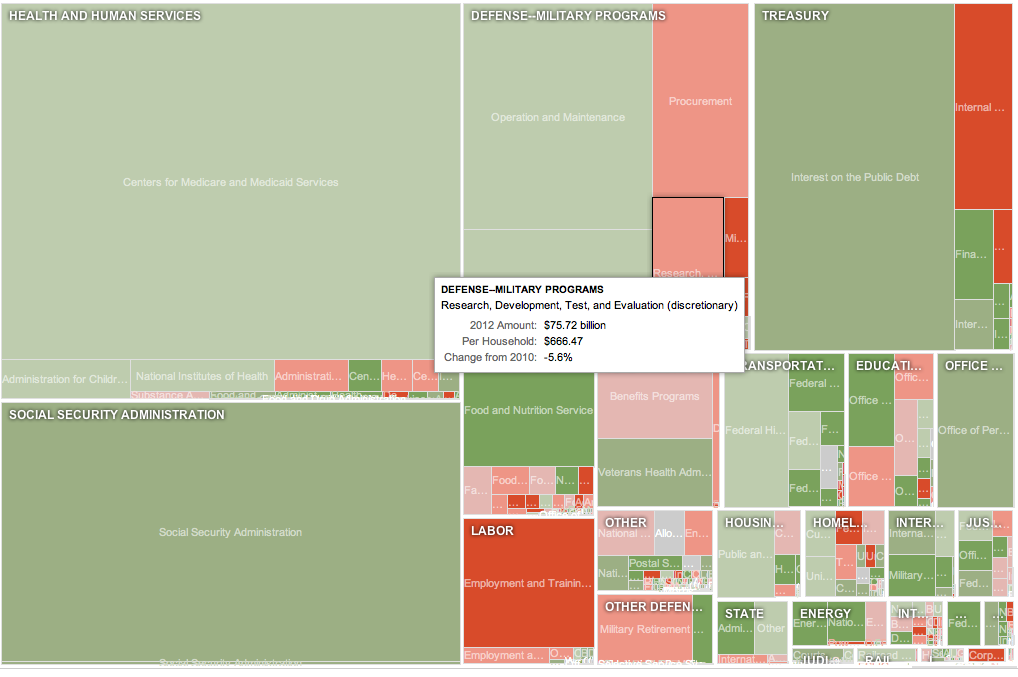

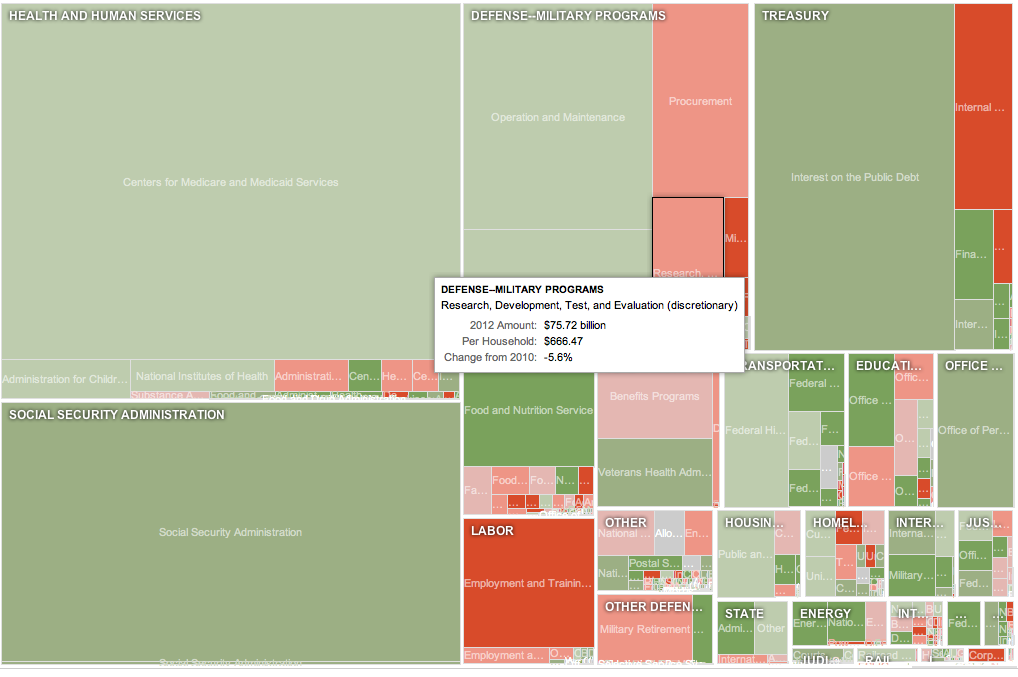

Interactive graphic from the NYT showing how the 2012 is allocated: > click for interactive graphic

Interactive graphic from the NYT showing how the 2012 is allocated: > click for interactive graphic

Read More

> The Bloomberg chart above compares year-to-year percentage changes in labor costs and consumer prices — from 1950 to...

> The Bloomberg chart above compares year-to-year percentage changes in labor costs and consumer prices — from 1950 to...

Read More

Melena Ryzik gets a rare behind-the-scenes look at the Pixar Studios complex in California. Source: Animation Advocacy, Pixar Style...

Read More

> What a stock market! Just 29 days (11.5 percent of the year) of trading into the year and the S&P500 is already up 5.94...

> What a stock market! Just 29 days (11.5 percent of the year) of trading into the year and the S&P500 is already up 5.94...

Read More

The NAHB home builder sentiment survey was unch at 16, in line with expectations and flat for a 4th straight month. Present conditions...

Read More

This week Max Keiser and co-host Stacy Herbert talk about the Shoe Throwing Index, Saudi oil reserves and haircuts on investors. In the...

Read More

SENIOR SOFTWARE ENGINEER / ARCHITECT Skills Required Java/J2EE, MySQL, PHP, Servlets, Apache, JSP, Linux, Financial Algorithms What you...

Read More

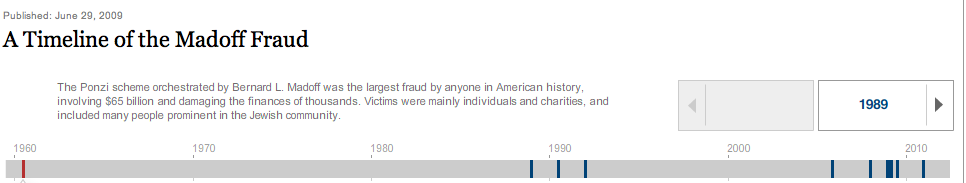

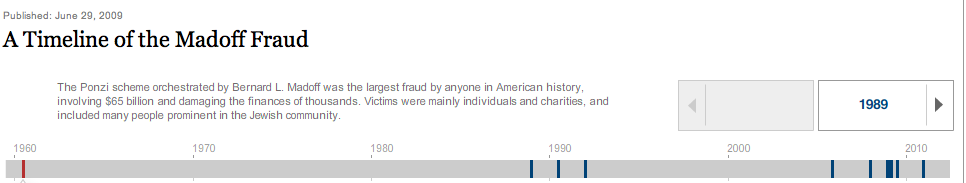

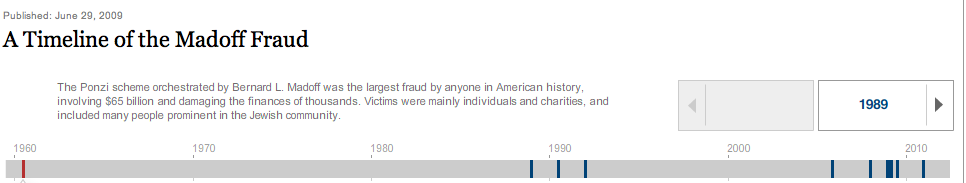

“They had to know. But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ” -Bernie Madoff...

“They had to know. But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ” -Bernie Madoff...

“They had to know. But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ” -Bernie Madoff...

“They had to know. But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ” -Bernie Madoff...