Muniland and Pensions

Muniland and Pensions February 15, 2011 David R. Kotok www.cumber.com > “In December, projections by Meredith Whitney, the banking...

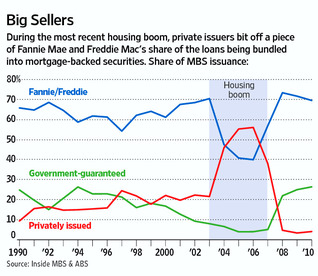

You may have missed Matt Phillips massive read Friday afternoon on the GSEs in the WSJ blog Marketbeat. The entire piece is definitely...

You may have missed Matt Phillips massive read Friday afternoon on the GSEs in the WSJ blog Marketbeat. The entire piece is definitely...

As this graph from The Chart Store shows, the markets are not quite overbought yet. > > But Ron Griess has some advice to those...

As this graph from The Chart Store shows, the markets are not quite overbought yet. > > But Ron Griess has some advice to those...

Get subscriber-only insights and news delivered by Barry every two weeks.