Wayne Rooney Goal (Bicycle Kick)

Manchester Derby February 12, 2011 Amazing Goal of Wayne Rooney vs Manchester City in Barclays Premier League. ManU – ManCity: 2-1...

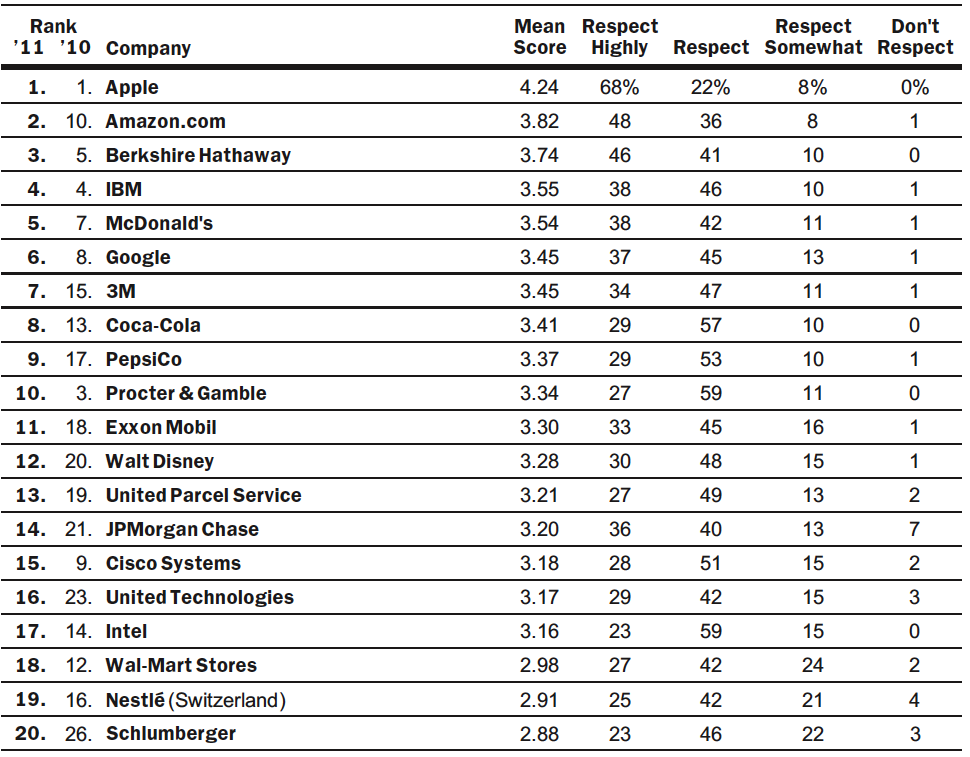

From Barron’s, comes their annual list of the most respected global companies — but for JPM (14), there are no US financials...

From Barron’s, comes their annual list of the most respected global companies — but for JPM (14), there are no US financials...

40 insane photos of the great blizzard 1. A car landed vertically in a snowbank in an accident involving several vehicles on Interstate...

40 insane photos of the great blizzard 1. A car landed vertically in a snowbank in an accident involving several vehicles on Interstate...

Why politics and investing don’t mix Washington Post, February 6, 2011 Washington, I’m here to tell you,...

Why politics and investing don’t mix Washington Post, February 6, 2011 Washington, I’m here to tell you,...

Time’s Man of the Year. Now the new Moses? The guy who’s invisible connectivity community helped bring down the Pharaoh of...

Time’s Man of the Year. Now the new Moses? The guy who’s invisible connectivity community helped bring down the Pharaoh of...

> Why politics and investing don’t mix Washington Post Sunday, February 6, 2011; G06 Barry Ritholtz > Washington, I’m...

> Why politics and investing don’t mix Washington Post Sunday, February 6, 2011; G06 Barry Ritholtz > Washington, I’m...

Get subscriber-only insights and news delivered by Barry every two weeks.