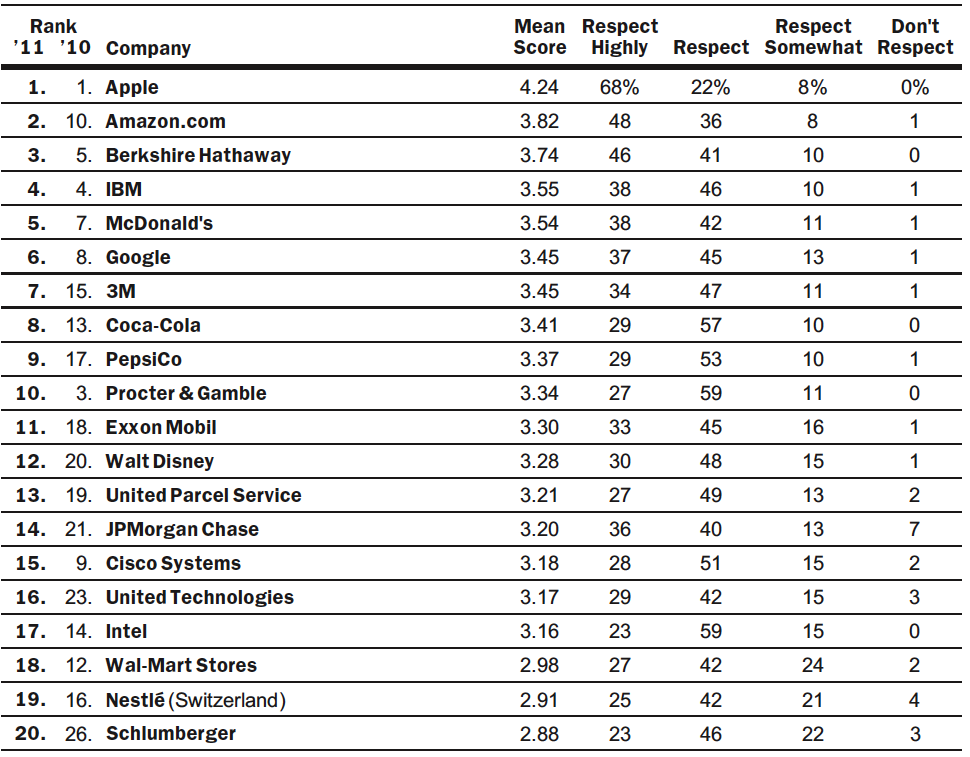

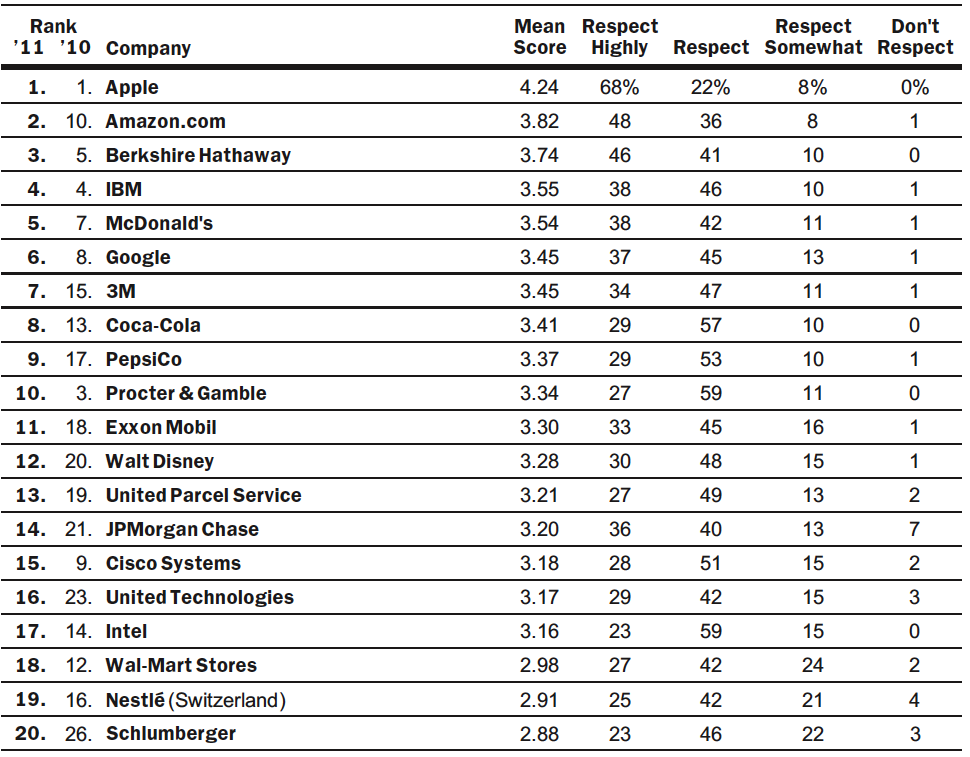

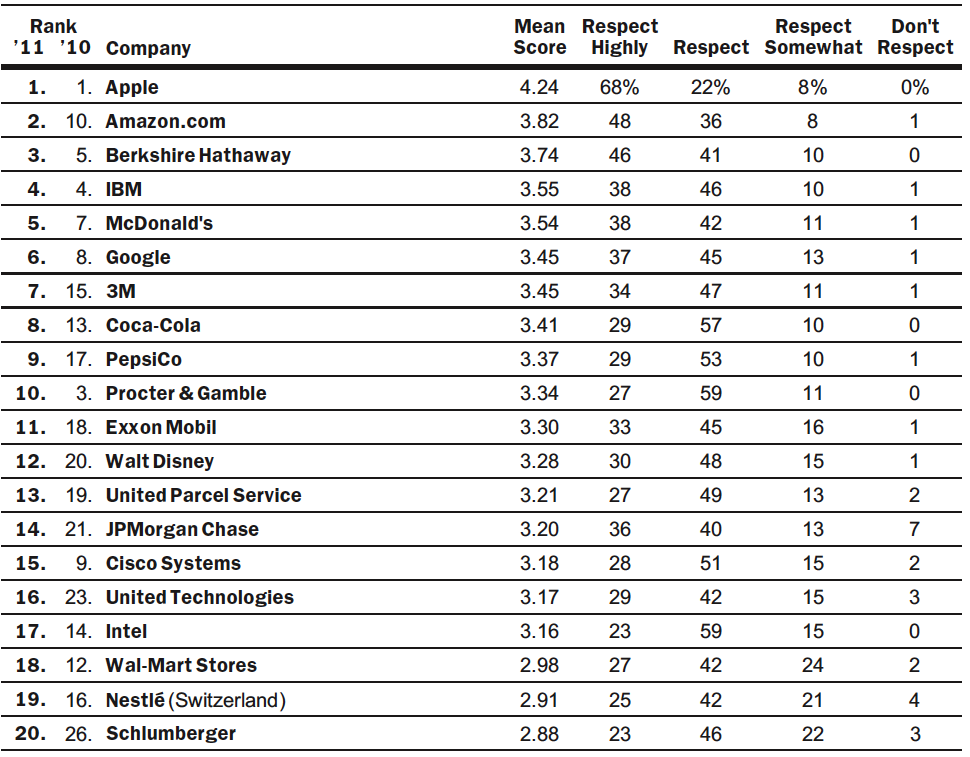

From Barron’s, comes their annual list of the most respected global companies — but for JPM (14), there are no US financials...

From Barron’s, comes their annual list of the most respected global companies — but for JPM (14), there are no US financials...

Read More

It is obvious that America has long supported dictators, instead of democracies, in developing countries. Why? Is it simply – as...

Read More

Interesting quote of the from Bob Lefsetz: EGYPT: “We were there first, music fans already revolted. They killed not only the...

Read More

Smug Hipster puppies, auto-corrected texts of Dads who say “divorce” when they mean “Disney” (oops) , and Asian...

Read More

40 insane photos of the great blizzard 1. A car landed vertically in a snowbank in an accident involving several vehicles on Interstate...

40 insane photos of the great blizzard 1. A car landed vertically in a snowbank in an accident involving several vehicles on Interstate...

Read More

Why politics and investing don’t mix Washington Post, February 6, 2011 Washington, I’m here to tell you,...

Why politics and investing don’t mix Washington Post, February 6, 2011 Washington, I’m here to tell you,...

Read More

Time’s Man of the Year. Now the new Moses? The guy who’s invisible connectivity community helped bring down the Pharaoh of...

Time’s Man of the Year. Now the new Moses? The guy who’s invisible connectivity community helped bring down the Pharaoh of...

Read More

> Why politics and investing don’t mix Washington Post Sunday, February 6, 2011; G06 Barry Ritholtz > Washington, I’m...

> Why politics and investing don’t mix Washington Post Sunday, February 6, 2011; G06 Barry Ritholtz > Washington, I’m...

Read More

Invictus here. I have been reviewing a variety of assorted miscellaneous items: Likely flat-earther/creationist Peter Wallison continues...

Invictus here. I have been reviewing a variety of assorted miscellaneous items: Likely flat-earther/creationist Peter Wallison continues...

Read More

Q: Why do Burger King Franchisees care about derivatives reform? A: huh ? > NPR discusses what a Bloomberg reporter found: Last...

Read More

From Barron’s, comes their annual list of the most respected global companies — but for JPM (14), there are no US financials...

From Barron’s, comes their annual list of the most respected global companies — but for JPM (14), there are no US financials...

From Barron’s, comes their annual list of the most respected global companies — but for JPM (14), there are no US financials...

From Barron’s, comes their annual list of the most respected global companies — but for JPM (14), there are no US financials...