Economy: From Egypt to America

Part I Does the Egyptian chaos have any impact on the U.S. stock market and the economy? Insight with Barry Ritholtz, Fusion IQ; Jim...

> Back on the Kudlow Report at 7:00 pm this evening with Doug kass. We will be discussing the Markets, Egypt, Kevin Marsh’s...

> Back on the Kudlow Report at 7:00 pm this evening with Doug kass. We will be discussing the Markets, Egypt, Kevin Marsh’s...

February 9th marks the 50th Anniversary of The Beatles’ first performance. Fans are gathering in Liverpool to celebrate one of the most...

February 9th marks the 50th Anniversary of The Beatles’ first performance. Fans are gathering in Liverpool to celebrate one of the most...

> The recent a merger chatter between the NYSE and the Deutsche Börse got us wondering: How might life at the NYSE change under their...

> The recent a merger chatter between the NYSE and the Deutsche Börse got us wondering: How might life at the NYSE change under their...

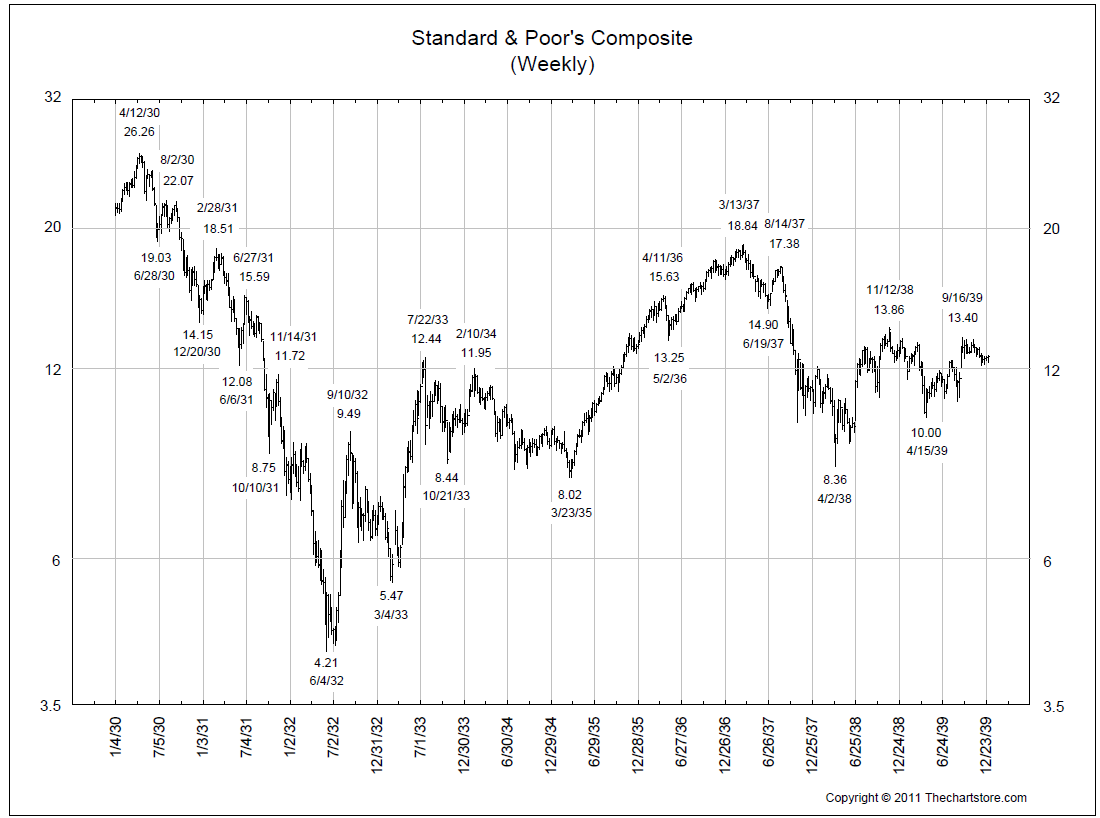

I love this chart from Ron Griess of the Chart Store: $30 to 4 to 20 to 12! The volatility back then was amazing! > 1929-39 S&P90

I love this chart from Ron Griess of the Chart Store: $30 to 4 to 20 to 12! The volatility back then was amazing! > 1929-39 S&P90

Get subscriber-only insights and news delivered by Barry every two weeks.