A year ago, when I was shopping for flat panels for then bedroom, this was one of the finalists on my short list (we ended up with a Sony...

A year ago, when I was shopping for flat panels for then bedroom, this was one of the finalists on my short list (we ended up with a Sony...

Read More

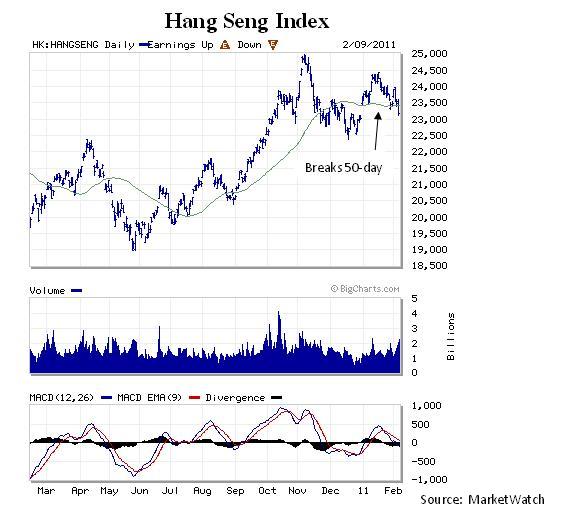

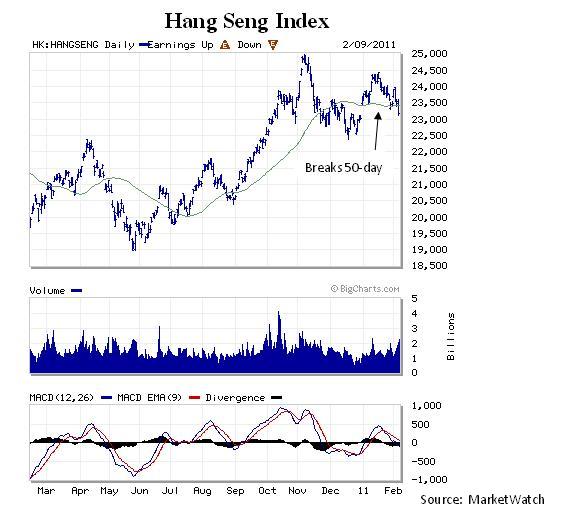

You know our schtick by now that we view the Hang Seng Index as the indicator species for global risk appetite and a signal as to whether...

You know our schtick by now that we view the Hang Seng Index as the indicator species for global risk appetite and a signal as to whether...

Read More

• Has the Nearly 2-Yr-Old Bull Market Topped Out? (Barron’s) • Steve Ballmer’s change of heart is touching, but...

Read More

> As seen in the chart above the Hang Sang Index failed to make new highs on its recent rally attempt last week by stalling at...

> As seen in the chart above the Hang Sang Index failed to make new highs on its recent rally attempt last week by stalling at...

Read More

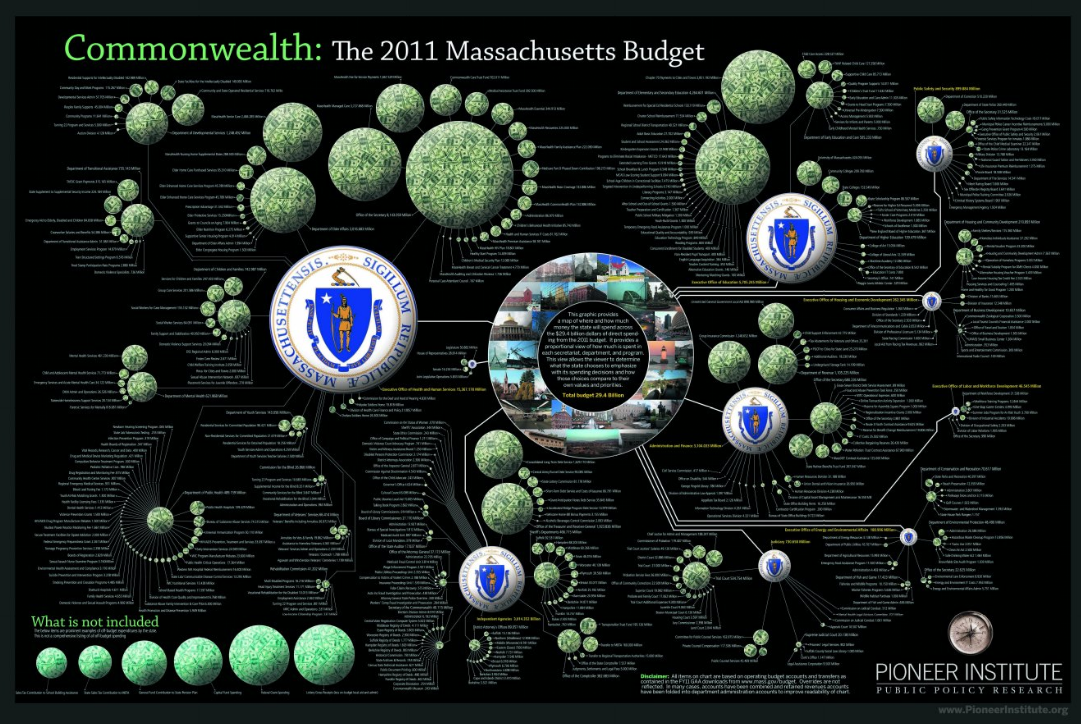

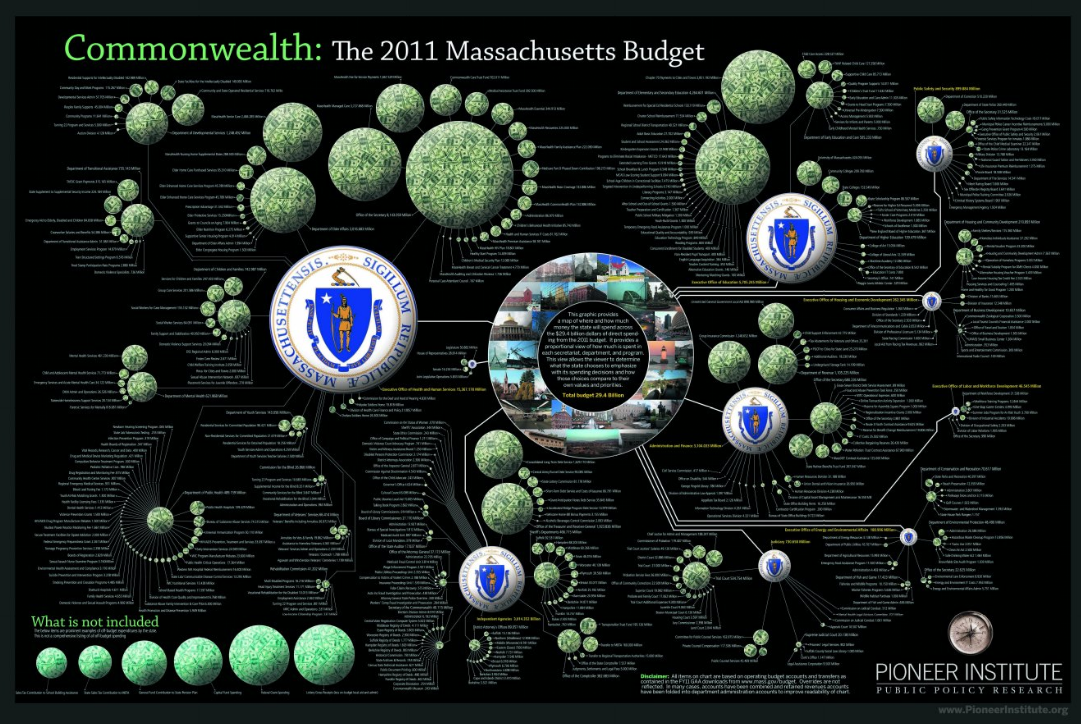

Jess Bachman (of Bailout Nation and Death & Taxes fame) does the most largest, most detailed visualization of a state budget ever....

Jess Bachman (of Bailout Nation and Death & Taxes fame) does the most largest, most detailed visualization of a state budget ever....

Read More

The benchmark 10 yr note auction was very strong as the yield of 3.665% was well below the when issued of 3.70-3.71% and the bid to cover...

Read More

The new iPad will be thinner and lighter than the first model, more memory, more powerful graphics processor, and a front facing camera...

Read More

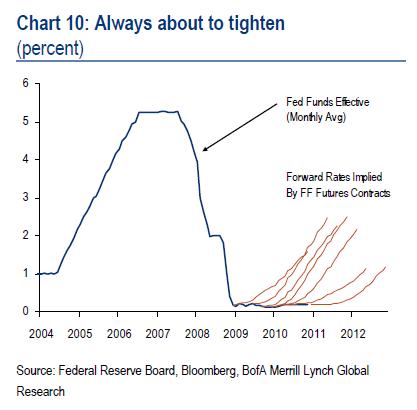

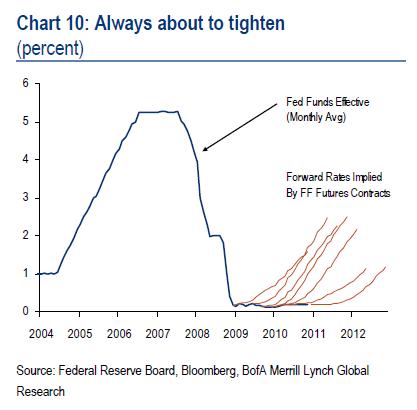

Bernanke is getting grilled on Capitol Hill, and the prospects of future inflation is what some of the armchair economists fear. Just...

Bernanke is getting grilled on Capitol Hill, and the prospects of future inflation is what some of the armchair economists fear. Just...

Read More

The Limits of Monetary Policy: ‘Monetary Policy Responsibility Cannot Substitute for Government Irresponsibility’ Richard W. Fisher...

Read More

Dennis P. Lockhart President and Chief Executive Officer Federal Reserve Bank of Atlanta Calhoun County Chamber of Commerce Anniston,...

Read More

A year ago, when I was shopping for flat panels for then bedroom, this was one of the finalists on my short list (we ended up with a Sony...

A year ago, when I was shopping for flat panels for then bedroom, this was one of the finalists on my short list (we ended up with a Sony...

A year ago, when I was shopping for flat panels for then bedroom, this was one of the finalists on my short list (we ended up with a Sony...

A year ago, when I was shopping for flat panels for then bedroom, this was one of the finalists on my short list (we ended up with a Sony...