Kepler Exoplanet Candidates

This is a visualization of the 1236 exoplanet candidates observed by Kepler. As you can see, the vast majority of these planets orbit...

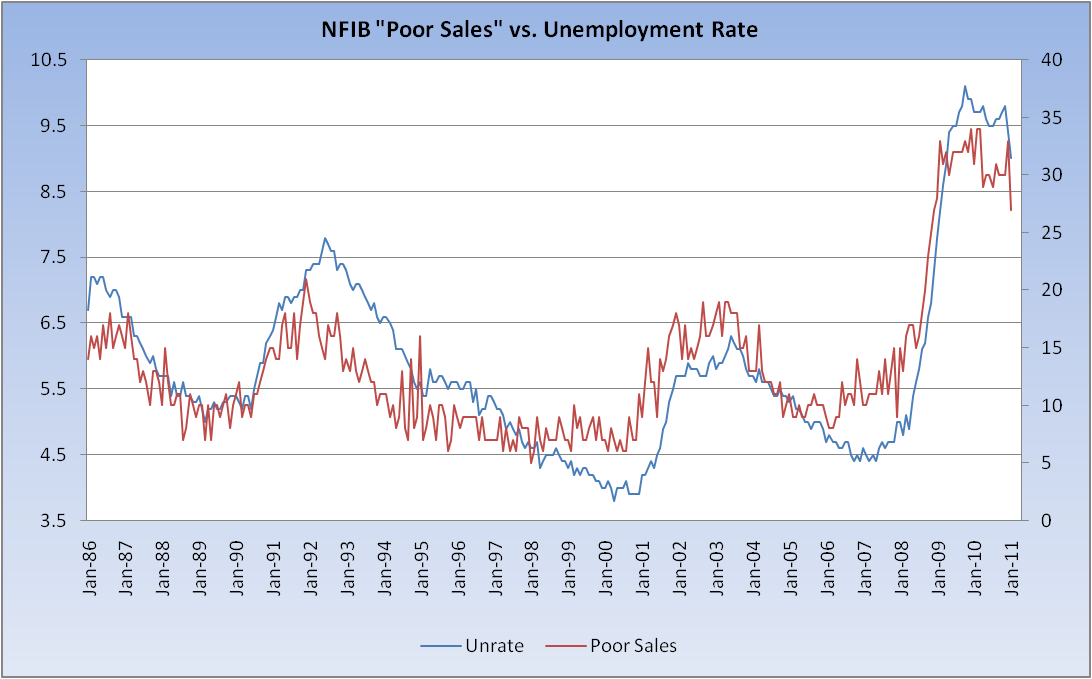

The interesting — and high (0.86) — correlation between the “Poor Sales” component of the NFIB’s SBET and...

The interesting — and high (0.86) — correlation between the “Poor Sales” component of the NFIB’s SBET and...

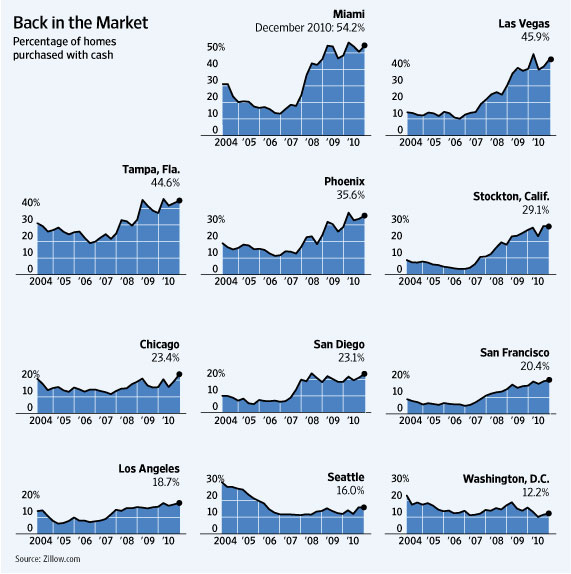

“The rates are great but the underwriting is brutal. They hang these people upside down and shake them till they see what falls out...

“The rates are great but the underwriting is brutal. They hang these people upside down and shake them till they see what falls out...

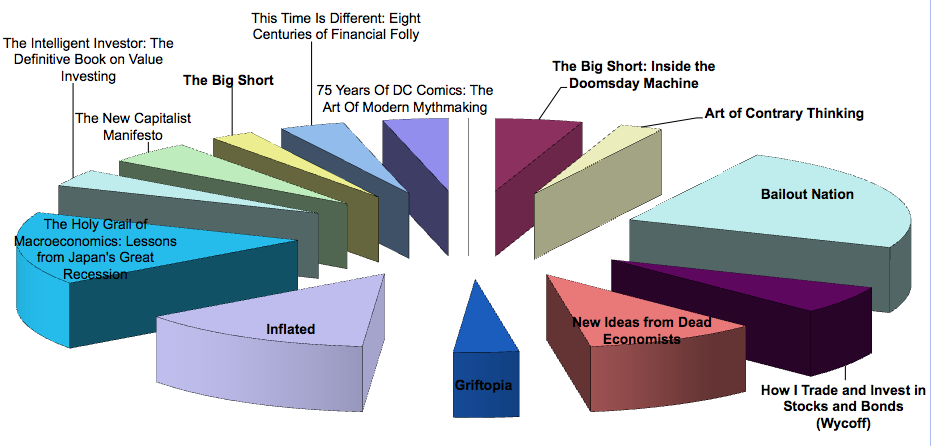

> Here are a bakers dozen of the biggest selling books purchased by TBP readers: The Big Short: Inside the Doomsday Machine Art of...

> Here are a bakers dozen of the biggest selling books purchased by TBP readers: The Big Short: Inside the Doomsday Machine Art of...

Get subscriber-only insights and news delivered by Barry every two weeks.