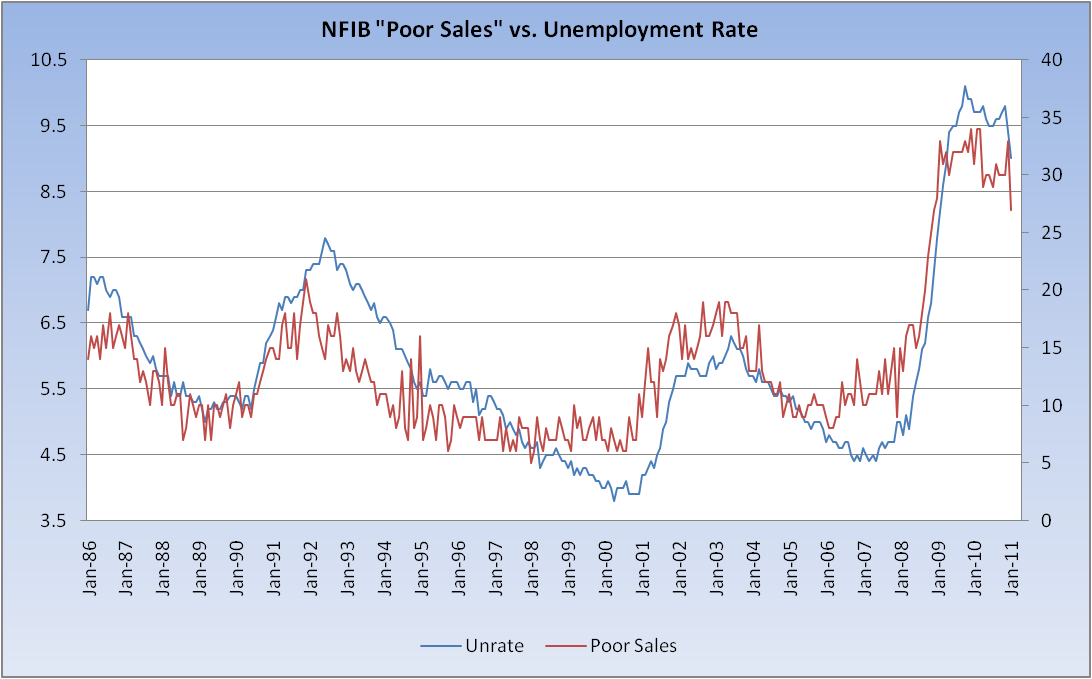

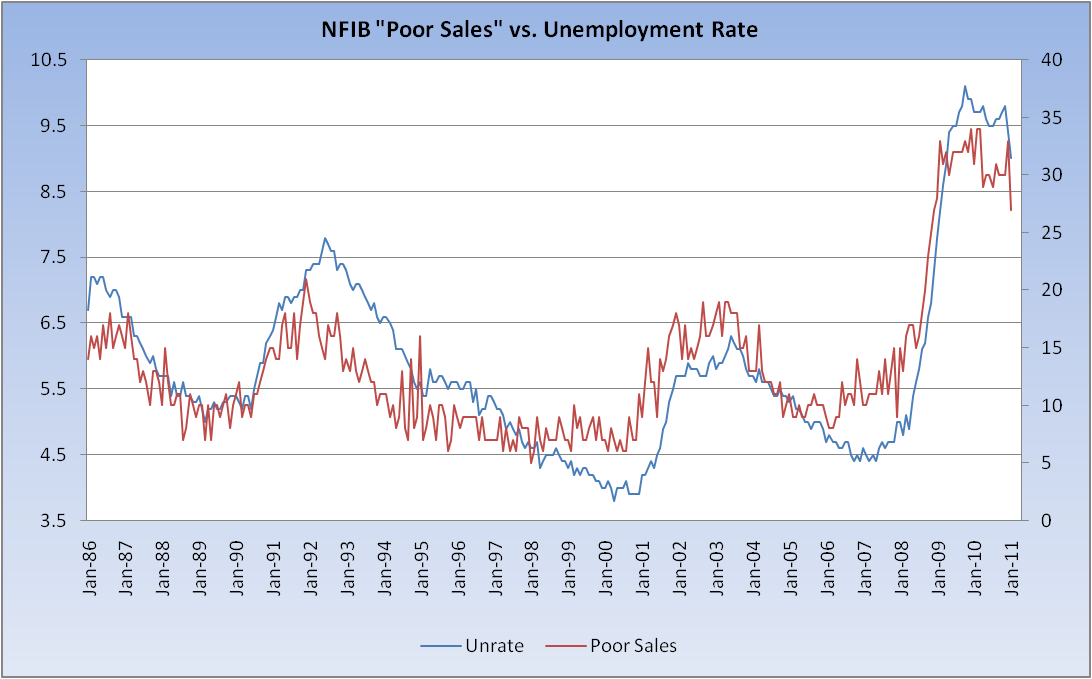

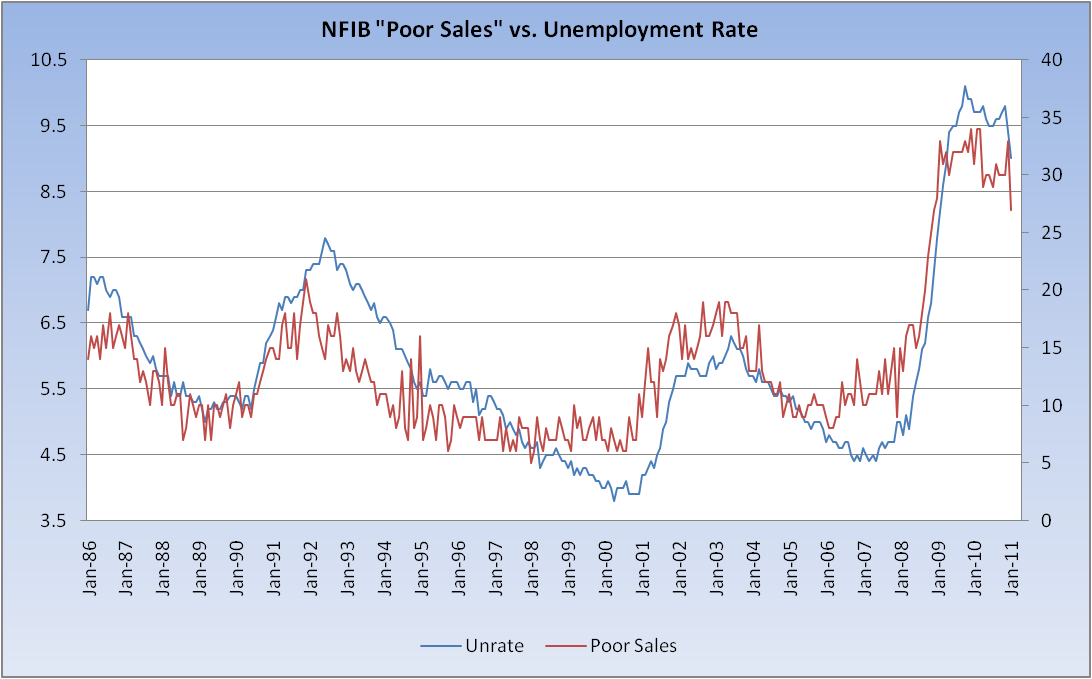

The interesting — and high (0.86) — correlation between the “Poor Sales” component of the NFIB’s SBET and...

The interesting — and high (0.86) — correlation between the “Poor Sales” component of the NFIB’s SBET and...

Read More

Bloomberg.com – S&P 500 Beating Estimates for Sales by Most Since 2006 “More U.S. companies are exceeding sales forecasts...

Read More

It’s day two of the $315 million AOL-Huffington Post deal and the non-news just keeps on coming. On the same day that there was $16...

Read More

Altucher’s new book is The Wall Street Journal Guide to Investing in the Apocalypse. ~~~ Source: The World Isn’t Ending But...

Read More

The morning’s mood in both stocks and commodities changed at 5:30am when China raised both its lending rate and deposit rate by 25...

Read More

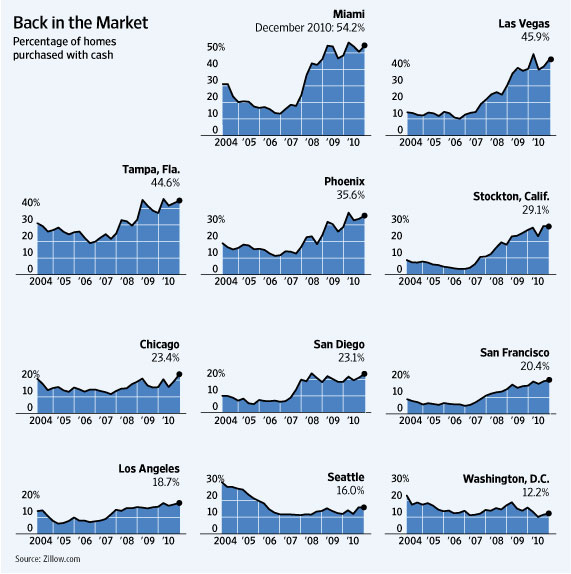

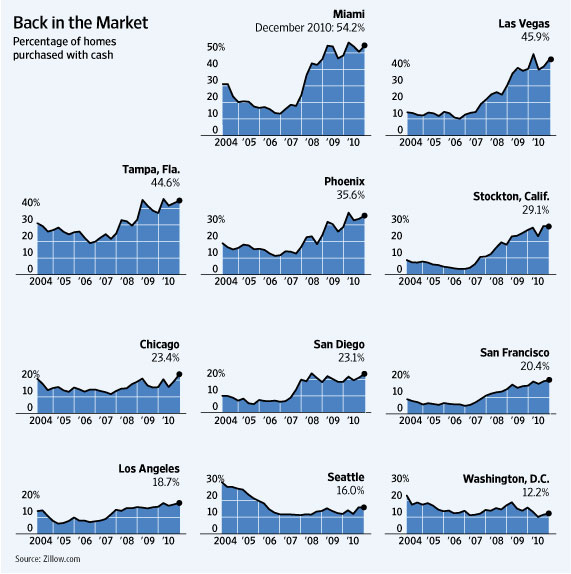

“The rates are great but the underwriting is brutal. They hang these people upside down and shake them till they see what falls out...

“The rates are great but the underwriting is brutal. They hang these people upside down and shake them till they see what falls out...

Read More

One of the knocks on last year’s earnings was that it was cost cutting was driving profitibility — not organic revenue...

Read More

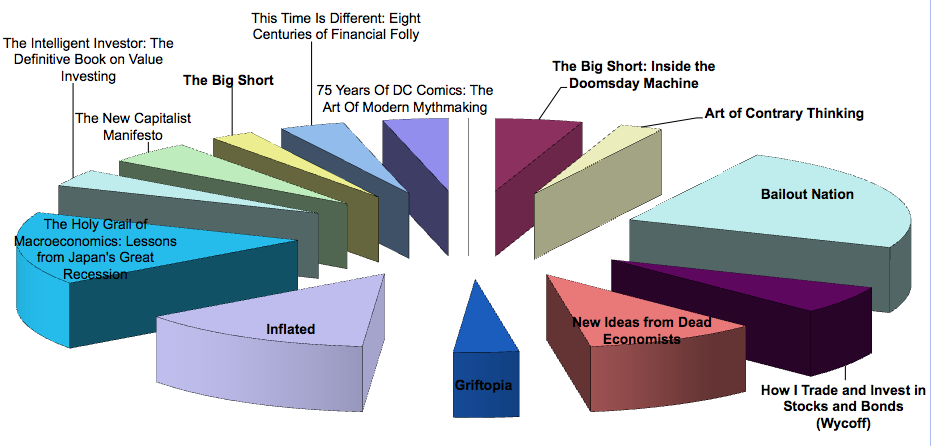

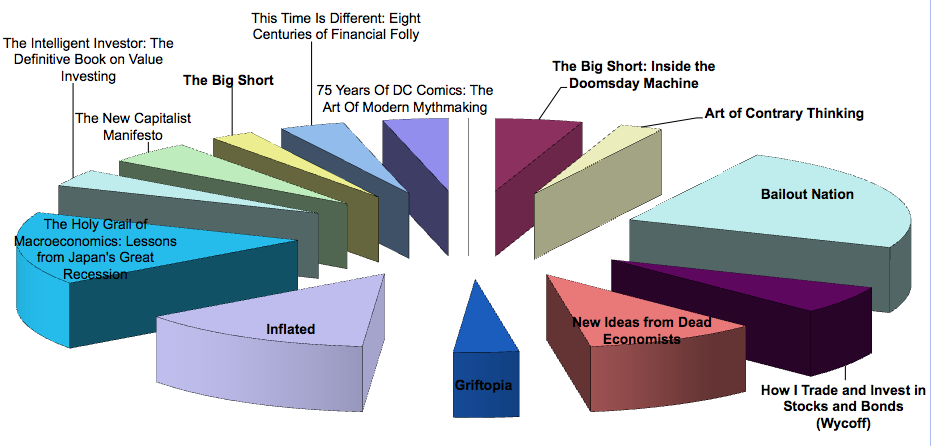

> Here are a bakers dozen of the biggest selling books purchased by TBP readers: The Big Short: Inside the Doomsday Machine Art of...

> Here are a bakers dozen of the biggest selling books purchased by TBP readers: The Big Short: Inside the Doomsday Machine Art of...

Read More

For the 1st time since Sept ’08, the level of revolving credit outstanding (mostly credit card debt) in Dec went up m/o/m, higher...

Read More

• Bond Market Flashes Inflation Warning (WSJ) • Apple’s modern success story began with four investments made 10 years ago...

Read More

The interesting — and high (0.86) — correlation between the “Poor Sales” component of the NFIB’s SBET and...

The interesting — and high (0.86) — correlation between the “Poor Sales” component of the NFIB’s SBET and...

The interesting — and high (0.86) — correlation between the “Poor Sales” component of the NFIB’s SBET and...

The interesting — and high (0.86) — correlation between the “Poor Sales” component of the NFIB’s SBET and...