Best SuperBowl Commercials

These were my favorite Superbowl commercials: > Audi Big Game Commercial 2011 – Release the Hounds A surprisingly witty spot...

Bill Black is an Associate Professor of Economics and Law at the University of Missouri-Kansas City. He is also a white-collar...

Bill Black is an Associate Professor of Economics and Law at the University of Missouri-Kansas City. He is also a white-collar...

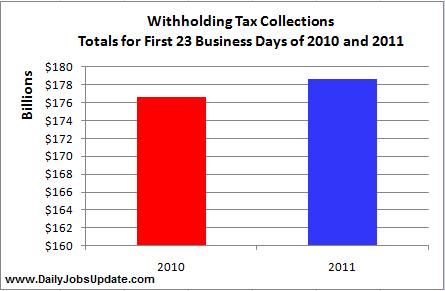

The January employment data as reported by BLS was pretty punk — only 36k new jobs created, and half a million people leaving the...

The January employment data as reported by BLS was pretty punk — only 36k new jobs created, and half a million people leaving the...

> I had a column published in Sunday’s Washington Post Business Section. Its titled “Why politics and investing...

> I had a column published in Sunday’s Washington Post Business Section. Its titled “Why politics and investing...

All the Devils Are Here: The Hidden History of the Financial Crisis by Bethany McLean and Joe Nocera > “Hell is empty, and all...

All the Devils Are Here: The Hidden History of the Financial Crisis by Bethany McLean and Joe Nocera > “Hell is empty, and all...

Get subscriber-only insights and news delivered by Barry every two weeks.