~~~ Source: THE PERFECT BAILOUT: Fannie And Freddie Now Send Taxpayer Cash Directly To Wall Street Henry Blodget Tech Ticker Feb 02, 2011...

Read More

There really isn’t a person who comes out of print–or television news, for that mattter–who doesn’t want to see...

There really isn’t a person who comes out of print–or television news, for that mattter–who doesn’t want to see...

Read More

We are again approaching a key spot in the 10 yr benchmark note. The yield at 3.49% is at the highest level since Dec 15th on a closing...

Read More

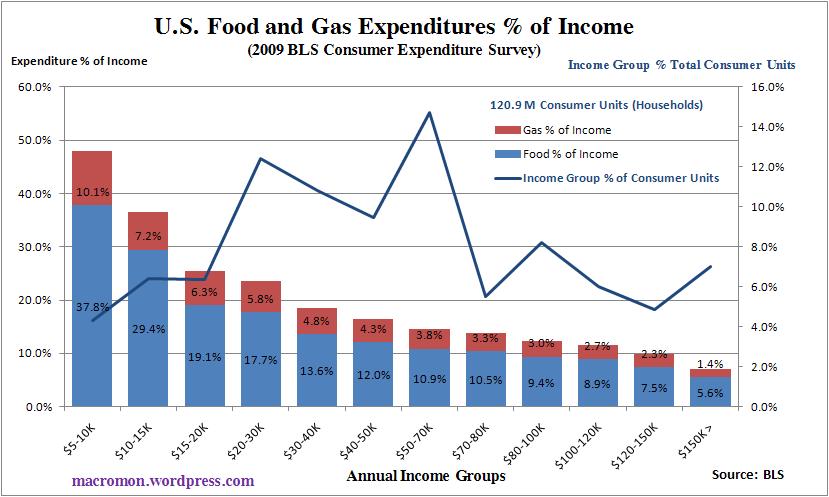

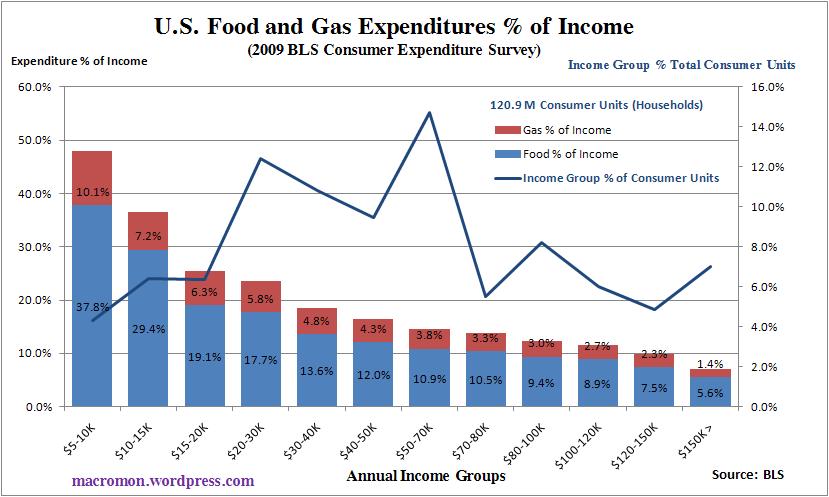

> Take a look at the chart above constructed from the Bureau of Labor and Statistics 2009 Consumer Expenditure Survey. It conveys a...

> Take a look at the chart above constructed from the Bureau of Labor and Statistics 2009 Consumer Expenditure Survey. It conveys a...

Read More

The post was originally published at The Financial Philosopher. It’s quite true what philosophy says, that life must be understood...

Read More

ADP said 187k private sector jobs were added in Jan, above expectations of 140k but Dec was revised down by 50k from the outlier report...

Read More

So, this weekend, Mrs. Big Picture tells me that I got a 1099 from Google for $3000. (She handles that stuff, it is not my forté)....

Read More

Bill Black is the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of...

Read More

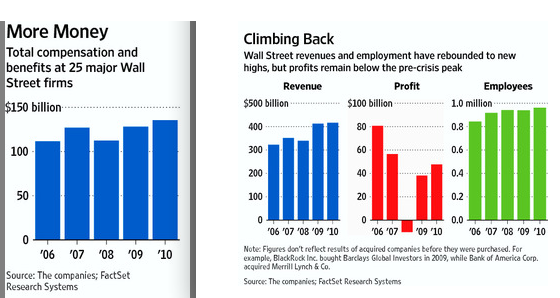

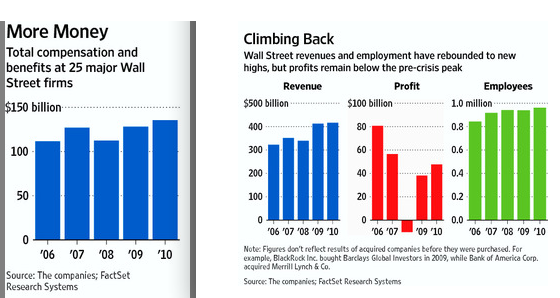

The Finance sector is back to record revenue, and of course, record bonuses and pay. I was surprised to see how much greater the...

The Finance sector is back to record revenue, and of course, record bonuses and pay. I was surprised to see how much greater the...

Read More