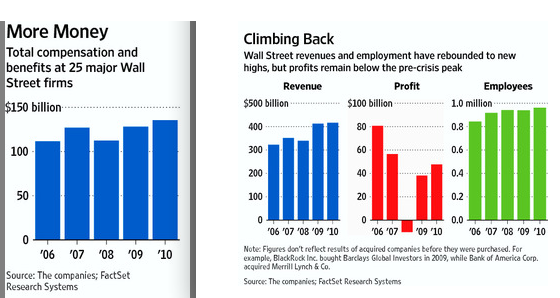

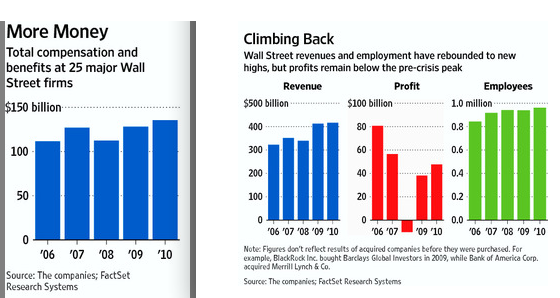

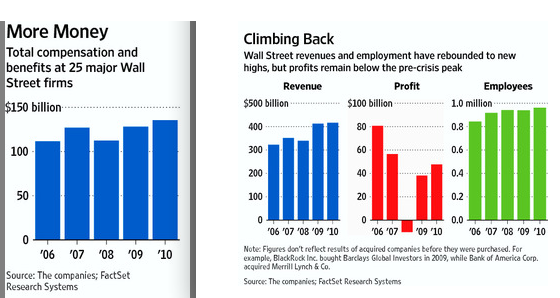

The Finance sector is back to record revenue, and of course, record bonuses and pay. I was surprised to see how much greater the...

The Finance sector is back to record revenue, and of course, record bonuses and pay. I was surprised to see how much greater the...

Read More

Source: Dow 12,000: Rally Hits New Heights But Ritholtz Sees Correction Coming Aaron Task Yahoo Tech Ticker Feb 01, 2011 04:16pm...

Read More

Taco Bell fights back against a beef lawsuit, and the Akron Aeros serve the “Nice 2 Meat You” burger: The Daily Show With Jon...

Read More

Tonight’s Open Thread: Who are the biggest recipients of Corporate Welfare? Let’s start with: Big Oil: $4B (see this)...

Read More

Today’s reads. hot off the press Instapaper: • Home-Ownership Falls back to PreBoom levels (WSJ) • What to do about Fannie...

Read More

If you missed Lou Gerstner’s Op-Ed in the Wall Street Journal yesterday, go look for it online. Gerstner makes some very good...

Read More

Boulder boasts the most software engineers per capita of any state, with CNBC’s Carl Quintanilla. Airtime: Tues. Feb. 1 2011 | 6:15...

Read More

I don’t know what to make of this bizarre headline from Diana Olick, who made the claim that “Nearly 11 Percent of US Houses...

I don’t know what to make of this bizarre headline from Diana Olick, who made the claim that “Nearly 11 Percent of US Houses...

Read More

The Jan ISM mfr’g index was 60.8, above expectations of 58, up from 58.5 in Dec and its the best since May ’04. New Orders...

Read More

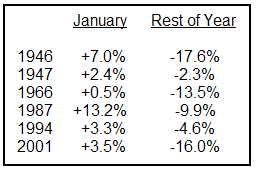

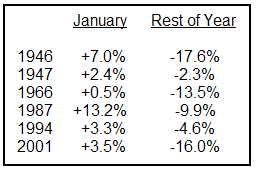

What we call the All-January Barometer* has had six false positives since 1940, where January was up, but the rest of the year was down....

What we call the All-January Barometer* has had six false positives since 1940, where January was up, but the rest of the year was down....

Read More

The Finance sector is back to record revenue, and of course, record bonuses and pay. I was surprised to see how much greater the...

The Finance sector is back to record revenue, and of course, record bonuses and pay. I was surprised to see how much greater the...

The Finance sector is back to record revenue, and of course, record bonuses and pay. I was surprised to see how much greater the...

The Finance sector is back to record revenue, and of course, record bonuses and pay. I was surprised to see how much greater the...