Inflation Rates vs Your Birth Year

This is fun: Enter the year if your Birth, and see what various items cost vs today: > click for interactive graphic Here’s mine:

This is fun: Enter the year if your Birth, and see what various items cost vs today: > click for interactive graphic Here’s mine:

Why is Al Jazeera Blacked Out in US ?

WTF? Huff Po: Canadian television viewers looking for the most thorough and in-depth coverage of the uprising in Egypt have the option of...

EGPT trading again

FYI, and a key thing to watch now of course, the Egypt etf has reopened, EGPT, and is up almost 5% after last week’s 13.7% drop and...

Dimon Interview on Regulation, U.S. Fiscal Discipline

Jamie Dimon of JPMorgan Chase & Co. is pretty slick . . . Jan. 28 (Bloomberg)

High Unemployment after the Recession: Mostly Cyclical, but...

Murat Tasci is a research economist in the Research Department of the Federal Reserve Bank of Cleveland. He is primarily interested in...

Murat Tasci is a research economist in the Research Department of the Federal Reserve Bank of Cleveland. He is primarily interested in...

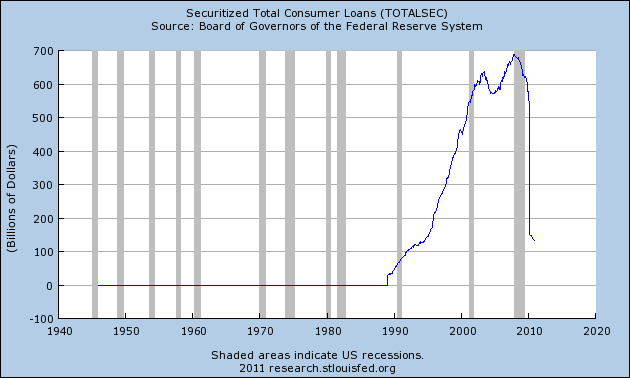

So, How’d That Securitization Thing Work Out?

Discuss. UPDATING: In the deep, dark recesses of my mind, I knew this chart was the result of accounting changes. But I more or less...

Discuss. UPDATING: In the deep, dark recesses of my mind, I knew this chart was the result of accounting changes. But I more or less...

Chicago PMI impressive but with inflation pressures

The Jan Chicago PMI was a solid 68.8 vs expectations of 64.5 and up from 66.8 in Dec. It’s the highest since 1988 but measures the...

For markets here, all eyes on oil prices

As if there wasn’t enough global government event risk that world markets have to focus on, whether Chinese and other Asian central...