FDIC Bank Closings

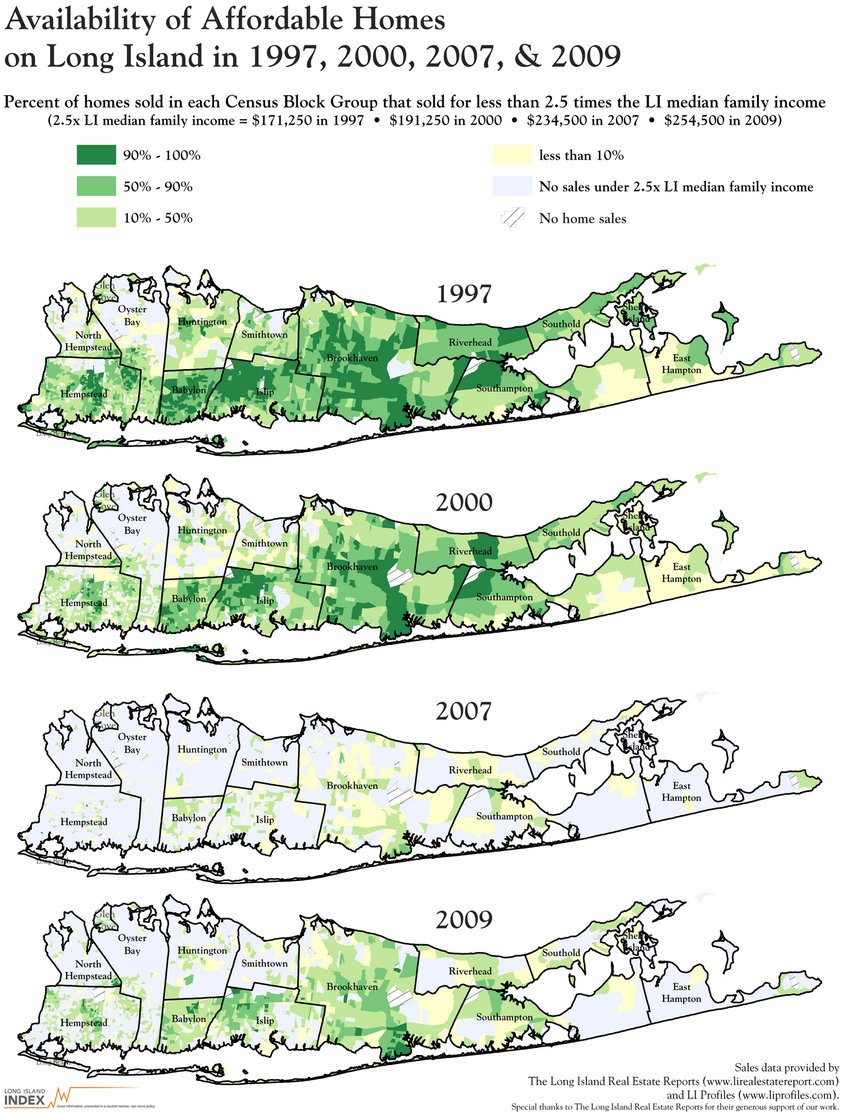

LI Home Affordability: Bad, and Getting Worse

A report prepared by the Regional Plan Association confirms that local house prices on Long Island are increasingly elevated relative to...

A report prepared by the Regional Plan Association confirms that local house prices on Long Island are increasingly elevated relative to...

Egypt: Breaking News Sources

Some links to help you follow the situation in Egypt: Al Jazeera live feeds NPR: A Primer On Following Egyptian Protests On Twitter...

One More Time, With Feeling

Picked up a copy of the FCIC report on my way the evening before its official release (took a shot that a local Barnes & Noble...

How Large is the Universe?

The mind-blowing answer comes from a theory describing the birth of the universe in the first instant of time. The universe has long...

A Bubble in Complacency

John Mauldin January 29, 2011 > The Recent GDP Numbers – A Real Statistical Recovery Consumer Spending Rose? Where Was the Income? A...

John Mauldin January 29, 2011 > The Recent GDP Numbers – A Real Statistical Recovery Consumer Spending Rose? Where Was the Income? A...

Limerick: FOMC January Meeting

From Limericks Économiques, a brief thought on the recent Fed meeting: > “With jobs disappointingly slow, Home prices...

Paying (both meanings) for War

My friend (and Washington State money manager) Carl writes about our three trillion dollar war post: The biggest reason the U.S. is...