எந்திரன் (Enthiran aka The Robot)

One part Matrix, one part Terminator, one part Transformers: The film’s story revolves around a scientist’s struggle to...

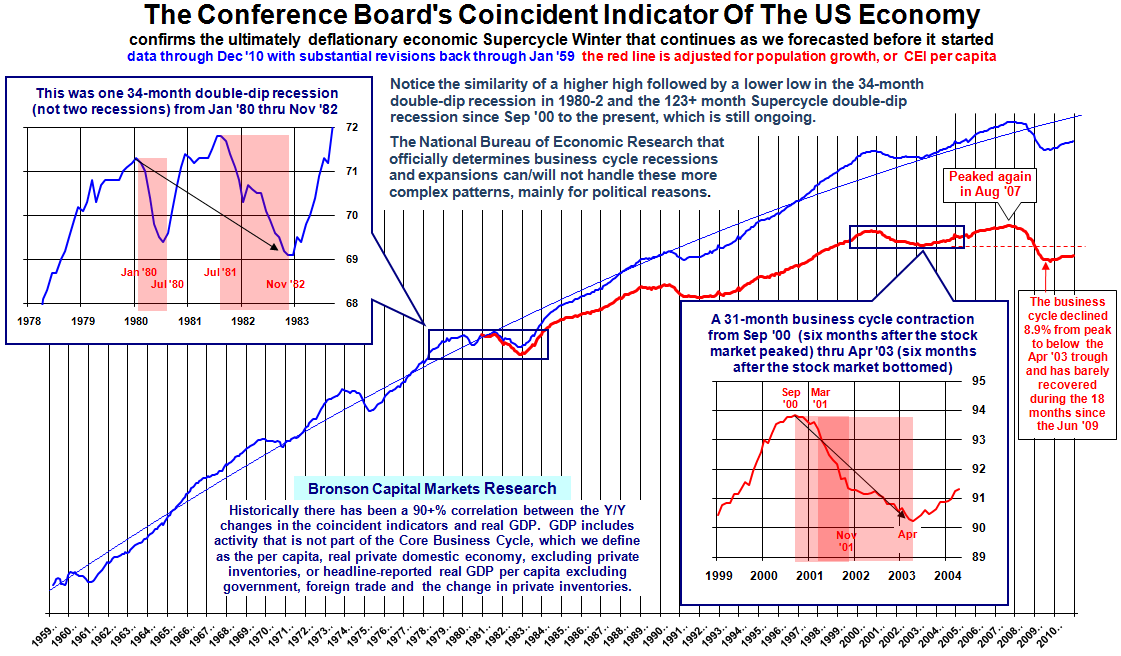

Bob Bronson of Bronson Capital Markets Research looks at the year over year Coincident Indicators as highly correlated with Real GDP...

Bob Bronson of Bronson Capital Markets Research looks at the year over year Coincident Indicators as highly correlated with Real GDP...

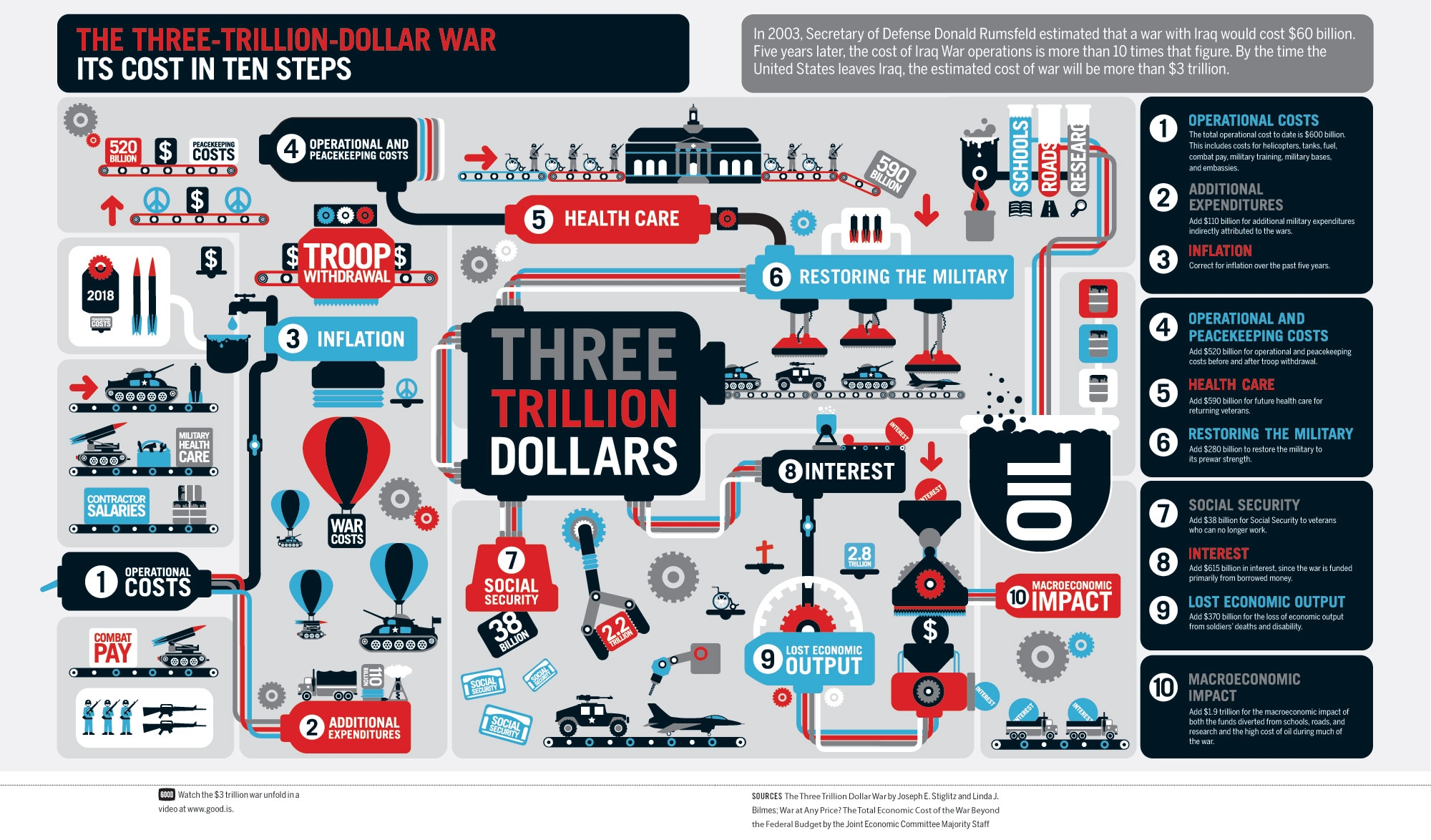

Speaking of costly wastes of money: This colorful graphic via Perceptual Edge, shows the outrageous costs of war in Iraq: > click for...

Speaking of costly wastes of money: This colorful graphic via Perceptual Edge, shows the outrageous costs of war in Iraq: > click for...

Courtesy of Chris Kimble, check out the potential breakout — or is it fakeout? — of the Dow Industrials, below: > click...

Courtesy of Chris Kimble, check out the potential breakout — or is it fakeout? — of the Dow Industrials, below: > click...

Get subscriber-only insights and news delivered by Barry every two weeks.