The New York Times Is a Lousy Investor

The Wall Street Journal is keen to point out the Times Co.’s lousy track-record as an investor. It appears that the Times was on...

Snowy Wednesday Reads

Here are today’s favorite reads: • ‘The stock market is for suckers’ (Macleans) • In Norway, Start-ups Say Ja to Socialism...

We don’t need US wage inflation to have a problem

In the continued debate over inflation/deflation, there are some who believe the US will only experience worrisome price inflation if...

No deviation on QE2

The FOMC comments on the economy was about the same as in the Dec meeting and they remain dovish on inflation as while they acknowledge...

What Is President Obama’s Sputnik Moment and What Is His...

Bill Black is the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of...

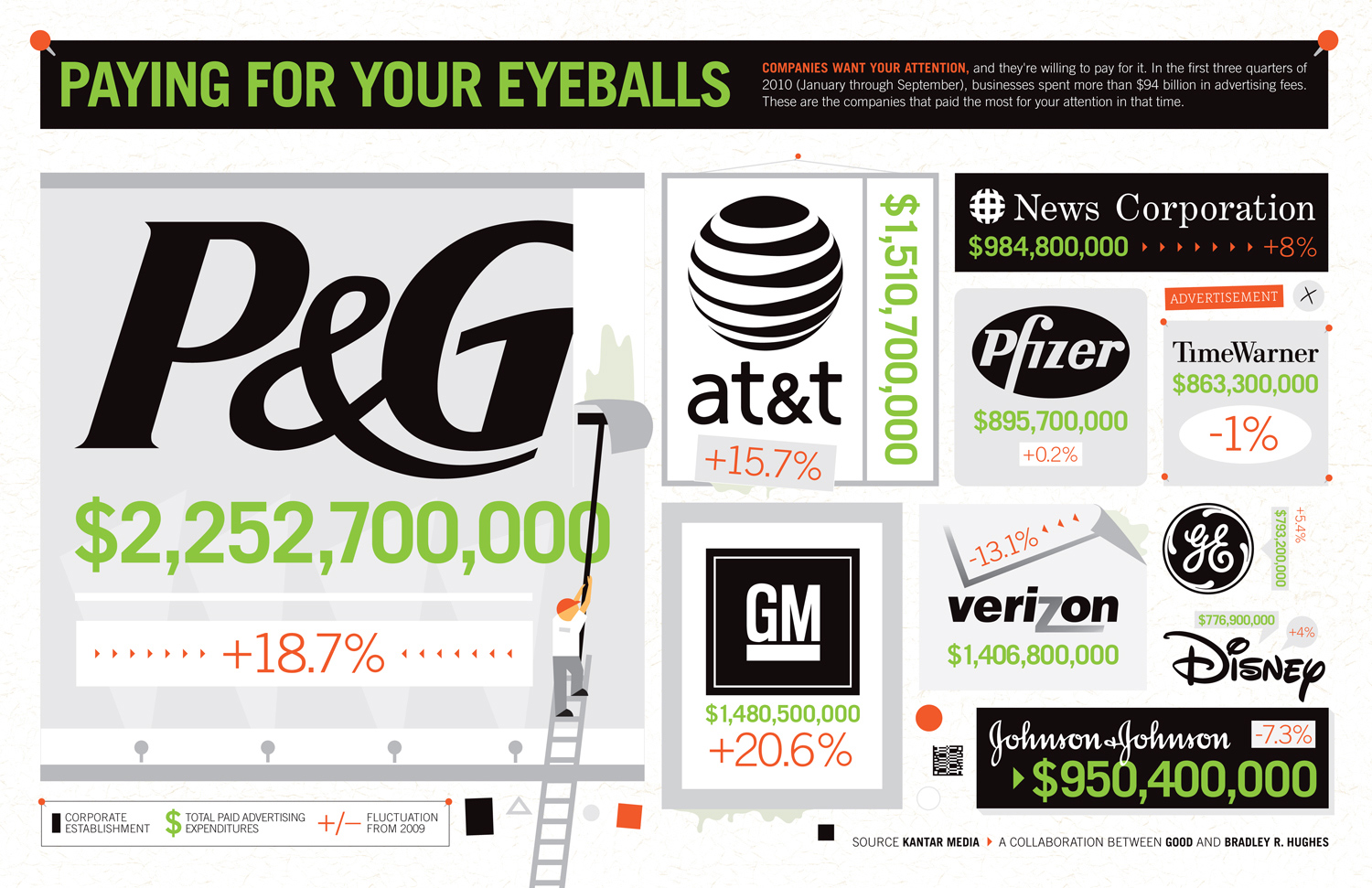

Which Companies Spend the Most on Advertising?

Via Good, comes this piece of chart porn: In the first three quarters of 2010, businesses spent more than $94 billion on advertising;...

Via Good, comes this piece of chart porn: In the first three quarters of 2010, businesses spent more than $94 billion on advertising;...

No Change in QE2, Interest Rates

FOMC Minutes Information received since the Federal Open Market Committee met in December confirms that the economic recovery is...

5 year auction solid

The 5 year auction was very good as the yield was 1-2 bps below the when issued and the bid to cover of 2.97 is above the 12 month avg of...

Tom Keene Interviews Roubini, Lyons

New York University Professor Nouriel Roubini talks about the global economy and U.S. fiscal policy. Standard Chartered Chief Economist...

New York University Professor Nouriel Roubini talks about the global economy and U.S. fiscal policy. Standard Chartered Chief Economist...