New Home Sales totaled 329k, 29k higher than expected and up from a revised 280k in Nov (revised lower by 10k). It’s the best sales...

Read More

One of the stranger aspects of human nature — or is it just people with intense affiliations with ideologies? — is the...

Read More

Assuming little surprise in today’s FOMC statement with respect to their comments on a continued recovery in growth with caveats...

Read More

The head of a large private equity firm once told me that he spends Davos in the lobby of his hotel with back-to-back appointments booked...

Read More

Bill Black is the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of...

Read More

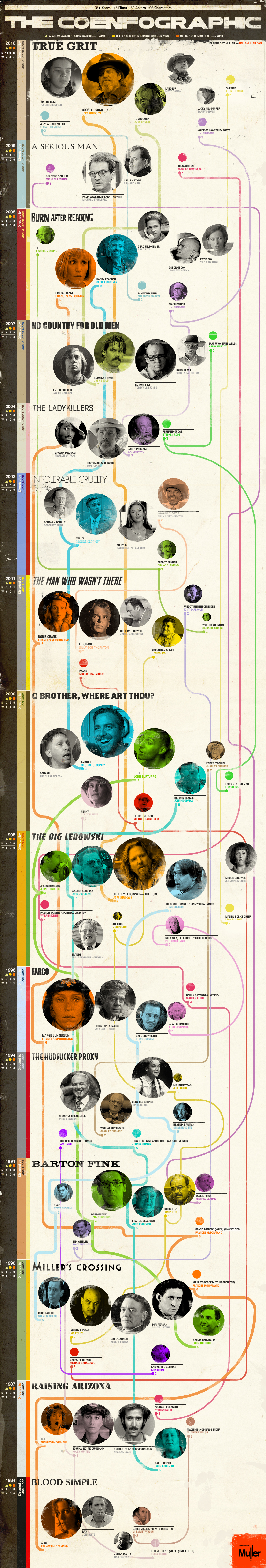

From Hello Muller, the Coenfographic: > click for ginormous graphic

From Hello Muller, the Coenfographic: > click for ginormous graphic

Read More

Back in 2009, I published a list of causal factors of the financial crisis: Who is to Blame, 1-25. It was culled from Chapter 19 of...

Read More

This video, created by Eloqua and JESS3, looks at the future of revenue: Revenue Performance Management, or RPM. The “School House...

Read More

Actor in a Leading Role Javier Bardem in “Biutiful” Jeff Bridges in “True Grit” Jesse Eisenberg in “The Social Network” Colin...

Actor in a Leading Role Javier Bardem in “Biutiful” Jeff Bridges in “True Grit” Jesse Eisenberg in “The Social Network” Colin...

Read More

So far, only the New York Times has the story — nothing from the WSJ or Bloomberg yet: The FCIC found that the crisis was caused by...

Read More

Actor in a Leading Role Javier Bardem in “Biutiful” Jeff Bridges in “True Grit” Jesse Eisenberg in “The Social Network” Colin...

Actor in a Leading Role Javier Bardem in “Biutiful” Jeff Bridges in “True Grit” Jesse Eisenberg in “The Social Network” Colin...